If you accept check payments from customers, you need to know that the checks might not always clear. A customer might not have enough in their bank account to cover the check amount. Learn what to do with checks that bounce.

What is a bounced check?

A bounced check is a check that cannot be processed because the check writer doesn’t have enough money in their checking account. The bank will bounce or return these checks instead of depositing the money in your business bank account. The bank may charge the payer a bounced check fee. And, the bank might also charge your business for depositing a bad check.

Bounced checks are also called non-sufficient funds checks (NSF checks).

Bounced checks are typically written by people who don’t realize that their bank accounts have insufficient money to cover the check. Rarely do people knowingly write bad checks with ill intent.

What to Do When a Check Bounces

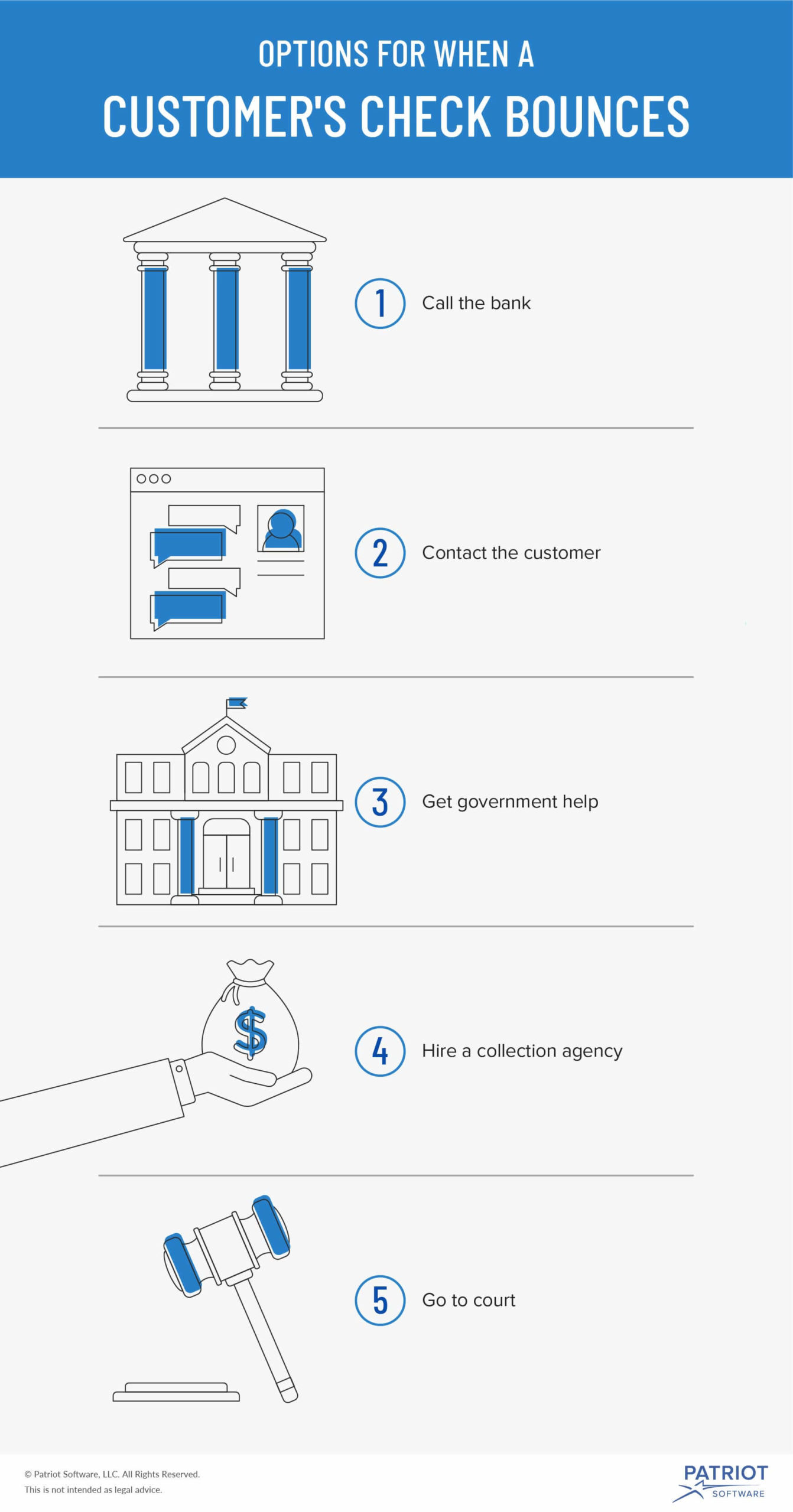

When a customer’s check bounces, you can take many actions. Discover how to collect on a bad check below.

Call the bank

After you find out that the check bounced, contact the bank. Even though the check bounced at one time, there might be sufficient funds now. Ask if the bank can try depositing the check again.

If there still aren’t sufficient funds in the customer’s account, ask the bank if they can do an enforced collection. This means the next money the customer deposits into their account goes to you. This way, the bank promises you the money from the customer’s bank account.

Contact the customer

You might be able to resolve the situation easily by contacting the customer.

Call the customer. There’s a chance you can get their phone number off their check or customer account. Explain the situation to them. Ask the customer to pay with cash or credit card.

If you can’t reach the customer by phone, you can try sending a bounced check letter to customer. Tell the customer why you are contacting them. Tell them how they can pay and when they should pay you by.

Get government help

You might get help from your local police department or district attorney. They might have services that can help you track down customers who write bad checks. And, these agencies might be able to help you collect funds from the bad checks. Customers might be more willing to pay you if there is a threat of prosecution.

Hire a collection agency

A collection agency might be able to help you with bad check collection. A collection agency can act on your behalf to get the customer to pay, but it will take a percentage of the money.

When you hire a collection agency, there’s less work for you. And, there’s an increased chance that you’ll get the money. But because the agency does take some money, it might be best to use one after you’ve tried other actions.

Go to court

You can go to small claims court to get your money back. Typically, this is only done after all other options are exhausted.

Small claims court can be expensive and time consuming. This route might not be worthwhile for small amounts. But, there is a chance you can get more than the amount of the original bounced check.

Keep track of your small business’s incoming and outgoing money with Patriot’s online accounting software. If you ever need help with the software, we provide free support. Start your free trial today!