Running a business can be hard. You have to manage your finances, employees, timesheets, paperwork, inventory, and accounting. With so much to keep track of, things can fall through the cracks. Where did you put last pay period’s timesheets? Are your employees’ new hire information sheets stored safely? Did you add the latest payroll taxes to your general ledger? It’s a lot to handle. But, it can be easier with payroll integration. So, what is payroll integration?

Payroll integration: The basics

Plainly speaking, payroll integration is when your payroll system syncs with other software or programs. Integrated payroll lets you keep track of the information you need to successfully manage your employees and run your business.

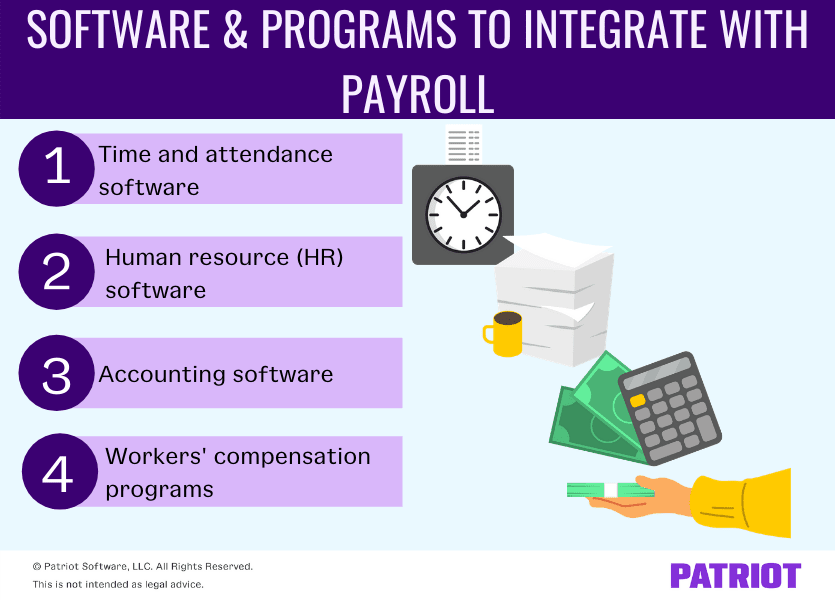

Here are some of the basic options you can integrate with your payroll.

| Don’t have payroll software yet? Worried about how much it’s going to cost? Download our FREE guide, “How Much Does Online Payroll Software Cost?” to learn more. |

1. Time and attendance

If you have employees, you need to track their time. Still using traditional paper timesheets? You may be missing an opportunity to optimize adding hours to your payroll. But if you have time and attendance software, integration can save you time. How? By simply moving hours from one software to the other without having to key in each individual employee’s hours.

The advantage of time and attendance software is that your employees can typically clock in and out from a website or app. At the end of the work period, you can approve timecards and send them directly to payroll if you integrate the software. The hours populate in the appropriate box so you can quickly scan the hours, approve, and print paychecks or stubs.

Rather than checking and double-checking the hours against employees, you can feel confident that the hours populate into the correct employee’s payroll entry. And, you’ll save money by no longer having to print timesheets for employees to manually submit.

2. Human resource software

Remember all those documents you had your employees sign when they first start working for your company? The IRS has specific laws for how long you should keep them. For example, you must keep Form I-9 for a minimum of three years after the employee’s hire date or one year after the employee leaves, whichever is later. The more employees you have, the quicker your filing cabinet drawers fill up.

Enter human resource (HR) software. With HR software, you can store that information digitally. But, why should you integrate HR software with your payroll system? Well, HR software typically allows you to store employee documentation in the employee profile. That includes all new hire paperwork, employee handbooks, and offer letters (if applicable).

Another benefit of integrating HR software with your payroll system is you can keep track of employee changes. Those changes can include new Forms W-4, changes to any employee benefits, and raises.

HR software may also let you keep track of employee anniversaries. An employee’s anniversary can be important if you schedule performance reviews for specific timeframes around anniversaries (e.g., six-month intervals from their hire date).

3. Accounting software

When you have employees, everything about payroll is key to maintaining accurate books. From taxes to benefits, you have to record it all.

Integrating your online accounting software and payroll automatically transfers payroll data to your books.

With most accounting systems, you can designate where to record payroll taxes, net wages, and any benefits. The integration removes the potential of incorrectly entering values and throwing off your general ledger or account balances. Every value transfers to where you designate.

Do you have full-service payroll software that deposits and files your taxes for you? You can set up the accounting software to show that the payroll taxes are a tax expense. Do you deposit and file taxes yourself? Choose to have payroll taxes appear on your general ledger as a payroll tax liability.

4. Workers’ compensation

If you’re in a state that does not have a state-run workers’ compensation program paid for through taxes (e.g., Washington), you might be required to purchase workers’ compensation coverage.

Your payroll system may integrate with your workers’ compensation software (e.g., AP Intego Pay-As-You-Go).

When you run payroll, the software can automatically send payroll data to your insurance provider. Your provider calculates your premiums based on the payroll information the software sends.

Benefits of an integrated payroll system

So, now that you know the types of software and programs that integrate with your payroll system, you might be asking about the benefits of an integrated payroll system. Payroll integration streamlines the entire payroll process. You can easily track employee hours and information, process payments through your general ledger, and push your payroll information to your workers’ compensation provider with a few clicks of a button.

A streamlined payroll process means that you can save time and money so you can get back to business. And, you can easily keep your information in one place to minimize the number of sites you use and passwords you have to memorize.

Remember these points to ensure you’re making the most of your payroll integration:

- Learn the ins and outs of the software you choose

- Check with your payroll software to see what integrations they offer. Your payroll software company may have time and attendance, HR, and accounting software all under one login. Or, your software may integrate with other programs or software from outside companies

- Consider the usability of the integrations before committing by taking advantage of any free trials. If it’s easy to learn, it should be easy to teach your employees how to use it

Payroll system partnerships

Your payroll software may have partnerships with other businesses that can bring you savings, such as discounted check stock, tax forms, or labor law posters.

Your payroll software company might even partner with lenders for business loans, such as the Paycheck Protection Program (PPP). Look into any partnerships your payroll software offers to determine if there are any savings you can take advantage of.

Looking for a way to seamlessly integrate your payroll software? Patriot’s payroll software integrates with our time and attendance add-on, HR add-on, and accounting software. You can approve timesheets and payroll, track employee information, and send information right to your general ledger. Start your free trial today.

This is not intended as legal advice; for more information, please click here.