You’re a business owner, not an accountant. But, you probably handle some of your accounting tasks. You need to know some basic accounting terms to manage your books. An important term to understand is net profit. What is net profit? Net profit is an important figure on your income statement.

What is net profit?

Net profit reflects the money you earn after subtracting all allowable business expenses. You measure net profit over a given period of time. For example, you might find the net profit for the first quarter.

Net profit can be simple to find and track, especially if you use basic accounting software. You enter incoming and outgoing money into the software. Then, the software program calculates totals for you.

Net Profit Formula

Use this equation to find net profit:

Gross Profit – Expenses = Net Profit

Gross profit

Before you find the net profit, you need your gross profit. Gross profit is all the revenue minus the cost of goods sold (COGS).

Revenue – COGS = Gross Profit

- Revenue includes the money you earn from selling products or performing services. Revenue can also include other sources of income, such as royalties, investments, and selling assets.

- COGS are expenses that go directly into your products and services. For example, you would include raw materials in your COGS.

Expenses

What are business expenses for your company? Any money you use to buy something for your company is a business expense. After you deduct the COGS, you need to subtract all other expenses. Two common types of expenses you have are overhead expenses and operating costs.

Operating costs are usually more closely related to making products and performing services. Depending on your sales, operating costs may fluctuate. For example, shipping packages are operating costs.

Overhead expenses are the supporting costs that help you run your business. These expenses do not usually fluctuate with sales. Your rent payment is an example of an overhead expense.

Business expenses you might have at your company include:

- rent

- utilities

- employee salaries

- shipping expenses

- storage costs

- interest on loans and investments

- tax remittances

- depreciation

- one-time payments

Calculate net profit

Net profit is the amount of money left over after you deduct expenses from income. Subtract the business expenses from the gross profit. When you deduct all the business’s expenses, you reach the net profit.

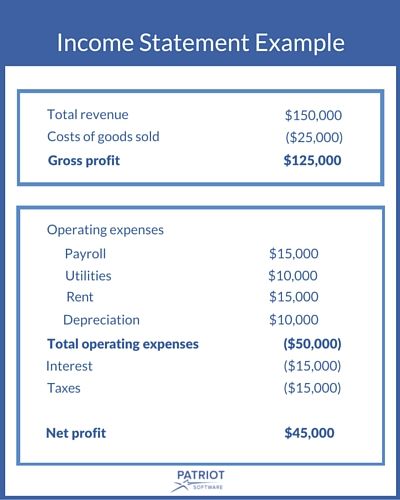

Sometimes, net profit is called the bottom line. That is because you write the net profit on the bottom line of your income statement. Take a look at this example of net profit on an income statement:

Why net profit matters to you

Now, you can answer, “What is net profit?” But, why is net profit important to you? Although there is a difference between profit and profitability, net profit reflects your company’s profitability. Knowing your profitability gives you and your business several advantages.

The net profit helps you determine your paycheck. You pay yourself after you settle business expenses. Once you determine the net profit, you can pay yourself, or put funds into a business savings account.

If your business has multiple owners, net profit helps you split the income. Partners divide the net profit by the amount of ownership each person holds in the company.

You can use the net profit to gain outside capital. You need to show the bank your net profit to get a credit line, such as a small business loan or startup business credit card. Lenders and investors look at the net profit to determine if you will be able to pay future debts.

You need net profit to fill out government forms and legal documents. The net profit is a common figure found on business tax forms. For example, the IRS requires you to report net profit on your business income tax return. The IRS uses your net profit to determine your tax liability and refund amount.

Your net profit helps show your business’s financial health. Net profit reveals if you make more money than you spend. By tracking net profit over time, you can see if your profits increase or decrease each month and year.

Data about your net profit helps you decide when to grow your business, and when to cut back on expenses. Look at your net profit to create a business budget.

Do you need an easy way to track income and expenses? Patriot’s online accounting software is a simple solution to recording your business’s transactions. Try it today with free support.