When you make a sale on store credit, there is never a guarantee that the customer will pay you on time. In fact, one in three Americans is late paying their debts. Instead of banking on timely customer payments, plan for the worst. And, consider charging tardy customers a late payment fee to reclaim your losses.

If customer payments are late, you might not have enough money to pay yourself. According to one survey, 79% of small business owners cut their pay when customers don’t pay.

Sometimes when a customer won’t pay, you don’t have enough money to cover your debts, which could result in late payment charges for your business. Implementing a late payment policy can help you crawl out of the cycle by discouraging late payments and giving you an additional cash flow cushion.

What is a late payment fee?

A late payment fee is an additional charge creditors tack onto a debtor’s bill if the debtor does not pay their liability by the due date. Adding late payment interest to a customer’s bill encourages them to pay their debts on time. Late payments might be due to customers forgetting their deadline or not having enough money to cover their debt.

Businesses can charge late payment fees when they extend credit to customers. If you sell to customers on credit, you can charge late fees. And if you purchase items on credit, your vendors can charge you late fees.

How much are late payment fees?

Late payment fee amounts vary. You might charge a flat rate or percentage of the customer’s bill.

For example, you can tack on an additional $10 late fee per 30 days overdue. Or, you can charge 2% of the customer’s bill per month.

Some states restrict how much you can charge in late payment fees. Be sure to check with your state for more information.

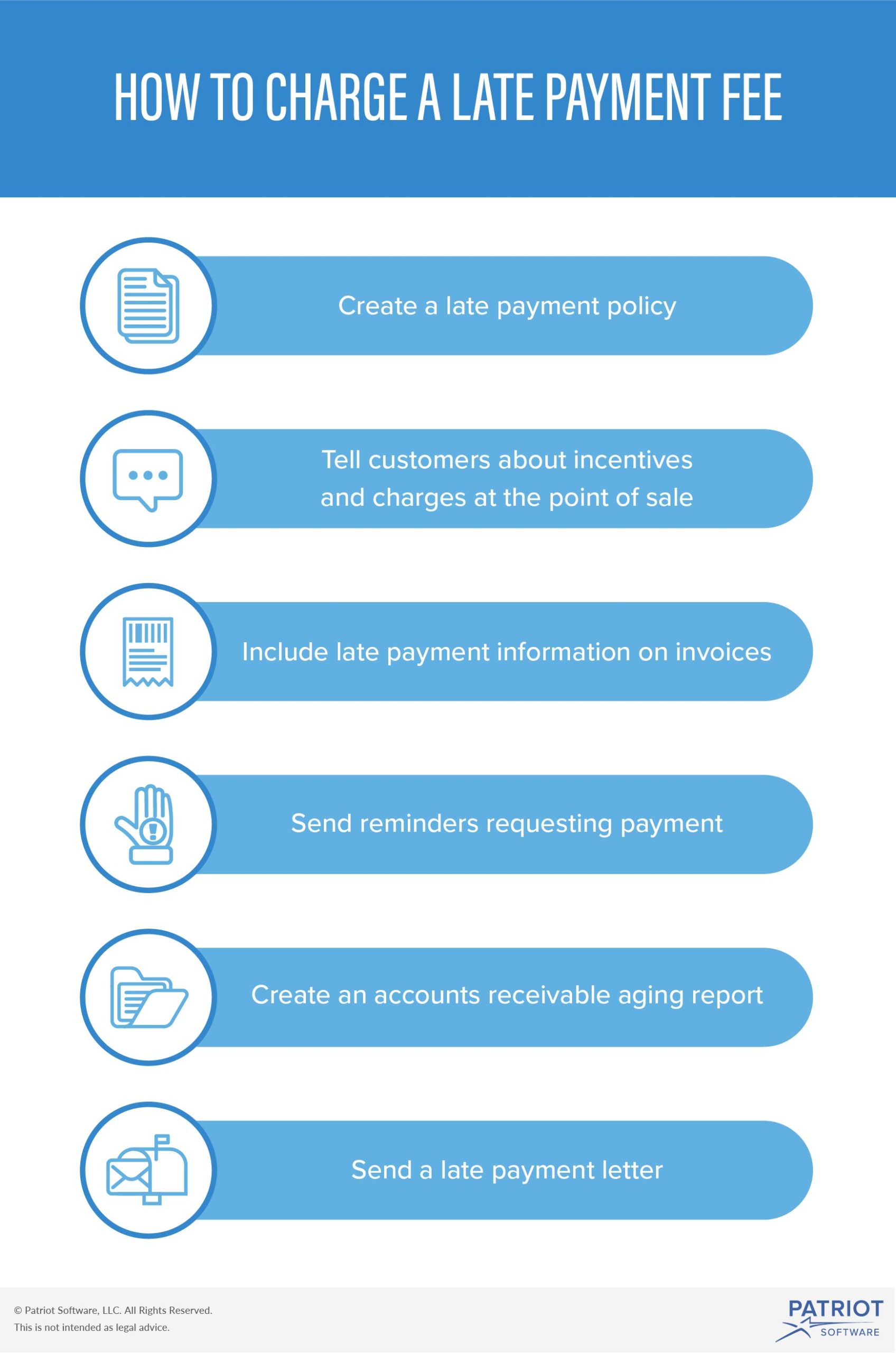

How to charge a late payment fee

Charging a late payment fee can speed up customer payments and improve small business cash flow management. But if you want to effectively charge customers for a late payment, you need to have an organized plan.

Use the following steps for charging interest on late payments of invoices.

1. Create a late payment policy

Before you can charge customers a late payment fee, you need to have a policy in place. That way, they know their obligations and deadlines.

Develop a company payment policy that discusses services or goods provided, payment due dates, acceptable forms of payment, and your early or late payment policies.

Your late payment policy should use plain language. It should tell customers what sort of action you will take if payments aren’t paid on time.

In your late payment policy, include how much late payment charges are by listing either the percentage or flat rate. Assess what you should charge by looking at industry late payment fees and consulting your state.

2. Tell customers about incentives and charges at the point of sale

Having an official late payment policy is all well and good, but you need to notify customers of it, too.

When customers make purchases on credit, review your payment terms, including any early payment incentives and late payment charges. Telling customers about your policy can help eliminate surprises and protect your business.

Offering an early payment discount, which is a price cut customers receive if they pay early, can work nicely as a late payment deterrent.

By talking about your early payment discounts and late payment fees, customers know they will pay less than their liability if they pay early and more if they pay late.

3. Include late payment information on invoices

When you invoice your customers, be sure to specify when the due date is. When including the due date on your invoice, you have two options:

- Due Date: XX/XX/XXXX

- Net # (e.g., Net 30)

Writing Due Date might make the deadline more clear to customers. This specifies the exact date the payment is due.

Net shows customers that payments are due within a certain number of days. For example, Net 30 means customers have 30 days from the invoice date to pay their debt.

4. Send reminders requesting payment

Before charging a late payment, you should remind customers of their debt.

You can send a payment reminder through email or regular mail. According to one FICO survey, 36% of customers prefer receiving late payment reminders through email.

Not only will sending payment reminders encourage customers to pay, but it will also act as proof that the customer should have known about their liability.

Payment reminders notify customers of the goods or services they received, the amount owed, and the due date. Send payment reminders after you invoice the customer and before the deadline.

For example, you may send a payment reminder one week before the due date.

5. Create an accounts receivable aging report

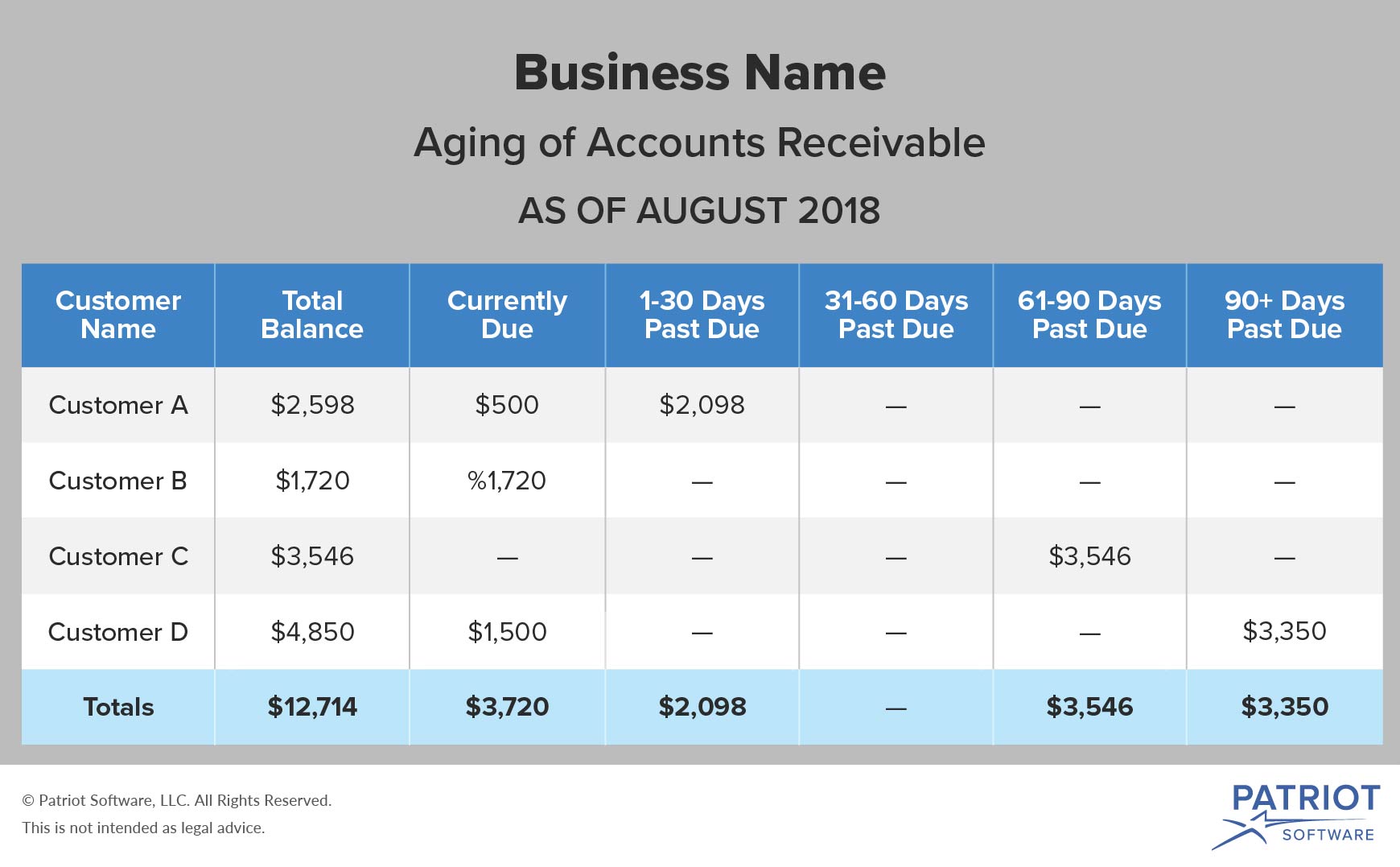

To charge a late payment fee, you need to know which customer has an overdue payment. Create an accounts receivable aging report to track unpaid customer invoices.

The accounts receivable aging report lists customers, the total amounts they owe you, overdue payments, and how much overdue balances are (e.g., 1-30 days past due). Your report also shows you the total amount of money owed to your business.

Your accounts receivable aging report should look like this:

You can use your aging of accounts receivable report to determine which customers to contact and how much of a late payment fee to charge.

6. Send a late payment letter

Once customers have missed their payment deadline, you can apply the late payment fee. Send a late payment letter notifying the customer that their payment is overdue.

In your late payment letter, explain when the due date was. List the overdue invoice charges and their new liability. Explain whether their late payment fee will increase if they do not pay within a certain number of days. You may also consider including a copy of their original invoice for reference.

Your late payment letter might also contain information on setting up a payment plan. Some customers who are unable to pay their debt might opt for a payment plan, such paying an agreed-upon dollar amount per month.

Include contact information in your late payment letter. That way, the customer can reach you to make a payment or set up a payment plan.

You might also consider reaching out to customers about their late payment fee by calling them. According to the FICO survey, 27% of respondents said they are more likely to respond to a live contact regarding a late payment.

Looking for a simple way to track unpaid invoices? Patriot’s online accounting software makes it invoice an unlimited number of customers and track your receivables. Get your free trial now!

This is not intended as legal advice; for more information, please click here.