Without sales, your business’s bottom line would be in the negatives. But if a customer issues a chargeback after you make a sale, you might have to pay up. Chargeback fraud is a hassle nobody wants to deal with, but it could happen when you own an eCommerce business.

What is a credit card chargeback?

Imagine you’re a customer ordering from an online business you’ve never heard of. You purchase something and the business charges your credit card, but you never receive the item. You were scammed. After contacting your bank, you have a sense of hope. The bank will issue a chargeback, getting your money back from the business.

A chargeback is when a bank or credit card provider demands that a merchant refund money to a credit card holder.

The original purpose of a credit card chargeback was to protect customers against fraudulent businesses, hackers, and other fraudsters who would use credit card information to make illegal purchases. Consumers can issue a chargeback if they were charged the wrong amount of money, never received their package, or had someone illegally order with their credit card.

Credit card chargeback process

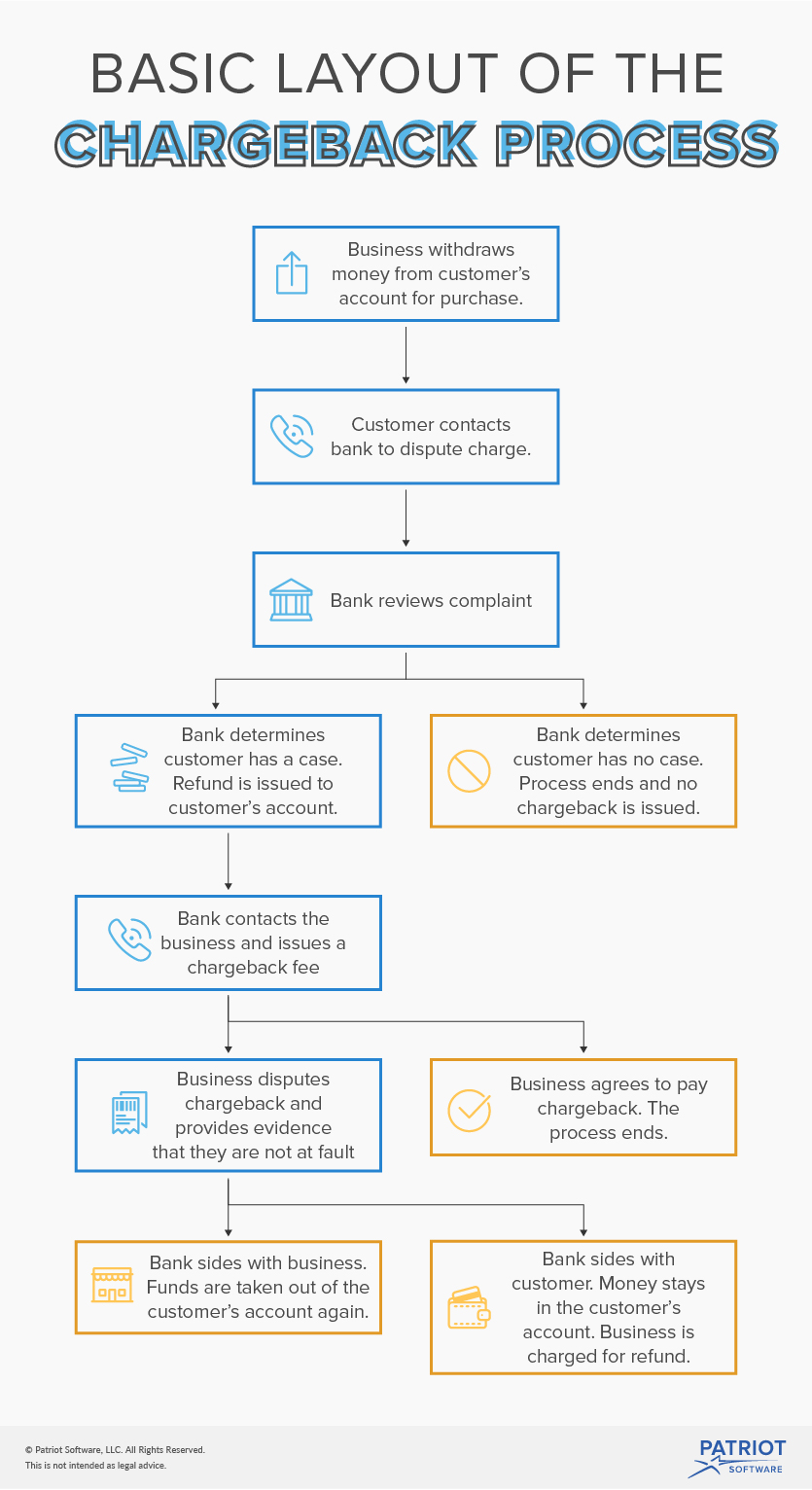

The cardholder can dispute a charge by contacting their bank. The bank reviews the complaint and determines whether or not to issue the chargeback. If they decide against the customer, the chargeback process ends. If a cardholder’s bank agrees that they were wronged, the customer immediately receives their refund.

Once the customer is refunded, the bank works to retrieve the money from the business. The bank contacts the business. The business must pay a chargeback fee in addition to the chargeback amount, which can range from $20 – $100. The business can either agree or they can issue a chargeback dispute. If the business disputes the chargeback, they need to show evidence indicating they are not at fault.

If the business shows enough evidence that the charge was legitimate and the bank sides with them, the funds are again taken out of the cardholder’s account. Evidence can include shipping verification or messages exchanged between the customer and business. Even if the business wins, they typically still have to pay the chargeback fee.

Chargeback fraud

Although the chargeback process was created to protect honest consumers, fraudsters can use chargeback protection to their advantage by committing return fraud.

Chargeback fraud, or friendly fraud, is when a customer receives a product and says they never got it. That way, the customer keeps the product and gets their money back. This can be an easy type of fraud for customers because some merchants choose to forego the hassle of disputing the chargeback process and give the refund.

As a small business, you might be particularly susceptible to fraud. Small businesses experience the greatest percentage of fraud cases. According to the Association of Certified Fraud Examiners, 28.8% of general fraud cases affect small businesses with 100 or fewer employees.

Businesses face many types of return fraud. But chargeback fraud is generally unique to online businesses. Friendly fraud can be devastating to small businesses because:

- You lose the product

- You lose the sale money

- You pay an additional chargeback fee

Chargebacks can lead to inventory shrinkage and decreased profits, so it’s important to prevent and dispute fraud. If you are faced with too many chargebacks, credit card merchants might take away your ability to accept credit card payments.

Chargeback prevention

To help prevent a chargeback scheme, you need to keep accurate records of all your sales. And, make sure you receive shipping verification and insurance. You should also keep a history of your customers to help you spot dishonest individuals.

Some customers request a chargeback because they don’t fully understand your small business return policy. Make sure you are accessible to customers so they can contact you with return and refund requests instead of going straight to their bank.

Chargeback accounting

When you experience a chargeback, whether it is fraud or an honest mistake, you need to update your books. You need to reverse your original entry so your accounting books reflect the correct amount you have at your business.

Let’s say you make a sale of $150. You debit your cash account and credit your inventory account. Here is what your original journal entry would look like:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 10/6 | Cash Account Inventory |

Sale to Customer | 150 | 150 |

After sending the product, your customer’s bank notifies you that there is a chargeback. You don’t dispute the chargeback, so you need to refund the sale money. You need to debit your bad debts expense and credit your cash account. Your refund journal entry might look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 11/14 | Bad Debts Expense Cash Account |

Chargeback | 150 | 150 |

Now, your accounts are accurate. You will also need to make an additional entry for the chargeback fee. The entry might look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 11/14 | Business Expense Cash Account |

Chargeback Fee | 35 | 35 |

Updating your accounting books is essential for a healthy, legal business. But, it doesn’t have to be a hassle. Patriot’s online accounting software lets you easily track your expenses and income. Get your free trial now!

This is not intended as legal advice; for more information, please click here.