Do you know what payroll history is? It’s important payroll information that can help you avoid errors and maintain your business records.

Learn more about payroll history and why it’s important to your business.

What is payroll history?

Every time you run payroll, you create a record of each employee’s earnings, deductions, and taxes. Your past payroll records are called payroll history.

Payroll history contains summary information about employee compensation, including:

- Earnings

- Taxes

- Timecards

- Accruals

- Payment information

Your payroll history is normally divided by employee. You might look at your paycheck history by pay period, month, or quarter.

Why is payroll history important?

Payroll history might seem like a compilation of old records, but it can be very important. You can use it to answer employee questions, update your accounting books, process payroll forms, and transfer payroll systems.

Employee questions

Employees might occasionally have questions about their previous pay. They might want to know about the taxes you’ve withheld so far, or they might want to know about their year-to-date pay. You can find answers about employees’ past paychecks by digging into your pay history.

If you set up employee self-service portals for your staff, they can look up their payroll histories themselves. They can log into their personal accounts and get all the answers they need.

Accounting errors

You might come across payroll-related errors in your accounting books. If you come across these discrepancies, you can use your payroll history to correct them.

Put your business’s payroll history and accounting books side-by-side. Make sure each total matches up. Do you have the same numbers recorded for pay and taxes? If a number doesn’t match up, you know where to start looking for the error.

Payroll forms

When you run payroll, you must fill out several forms. These include:

- Form 940 to report FUTA tax

- Form 941 or Form 944 to report federal income, Social Security, and Medicare taxes

- Form W-2 to report employee wages and taxes

You can use your business’s payroll history to verify the amounts that you must report on the forms. By referencing your payroll history, you hopefully prevent errors on the forms.

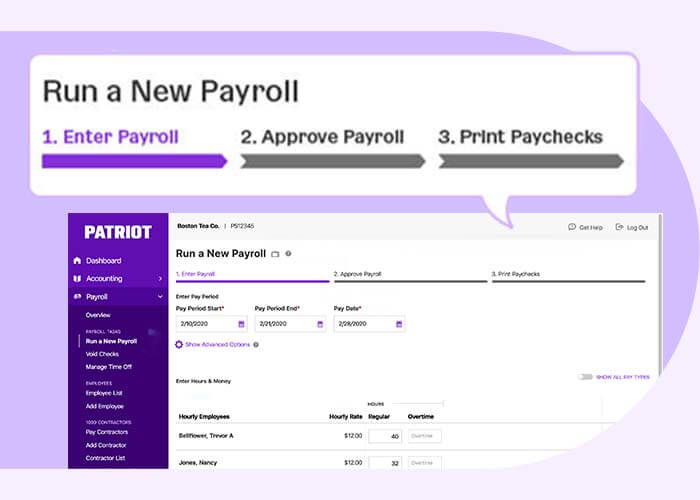

Payroll software

At some point, you might want to change how you run payroll. If you decide to start using payroll software or switch payroll software, you need your payroll history to set up your account before you can run further payrolls.

You need payroll history for each employee, including earnings, deductions, taxes, and employer contributions. You need to add information for all employees who worked for you during the year, even terminated employees.

By adding the payroll history, your new payroll software provider can accurately calculate wages and taxes. This is especially important for taxes that are dependant on employee total earnings, such as FUTA and SUTA taxes.

If you use full-service payroll software, your new payroll provider also needs your payroll tax history to fill out and file quarterly and annual forms properly.

After your payroll history is entered, you can double-check that everything is correct by cross-referencing your payroll history.

If you need to enter payroll history into Patriot Software’s payroll software, check out our help article about entering prior payroll history.

If you’re looking for payroll software that’s easy to use, check out Patriot’s online payroll software for small business. We provide free setup and support, making it easy for you to get up and running.

This article has been updated from its original publication date of August 1, 2018.

This is not intended as legal advice; for more information, please click here.