Most businesses must pay taxes to the IRS. And, companies report information about their income, tax deductions, and tax payments on small business tax returns, which vary based on business structure.

When nonprofit organizations apply for and gain tax-exempt status, they do not have to pay federal income taxes. So, do nonprofits file tax returns?

Do tax-exempt nonprofits file tax returns?

Nonprofit organizations can file for tax-exempt status with the IRS if they operate for the greater good and not to make a profit. There are many types of tax-exempt nonprofits, such as child care facilities, churches, and social welfare organizations. If you are applying for or have tax-exempt status, you may be wondering: Do nonprofit organizations file tax returns?

The IRS generally requires tax-exempt nonprofits to report information about their organizations by filing a nonprofit tax form. However, there are some exceptions.

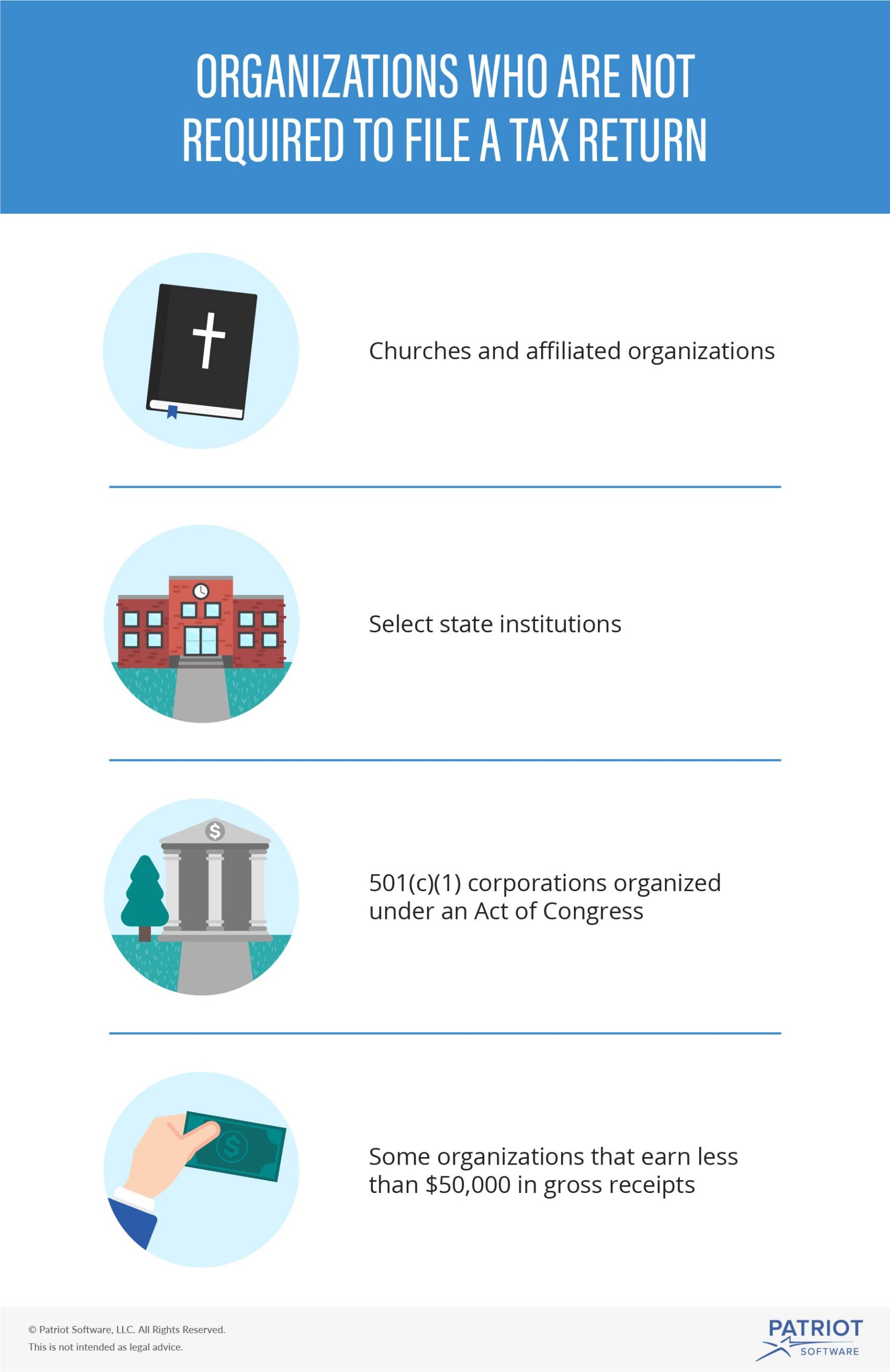

Although most tax-exempt nonprofits must file annual tax returns, some organizations who are not required to file a tax return include churches and affiliated organizations, select state institutions, 501(c)(1) corporations organized under an Act of Congress, and some organizations that earn less than $50,000 in gross receipts.

If your organization is tax-exempt and qualifies for tax return exemption, you may need to request an exemption from filing a tax return through the IRS.

Nonprofit tax returns

Tax-exempt nonprofits use a different annual tax return form than for-profit businesses. As a brief recap, here are the tax return forms businesses file, based on their structure:

- Sole proprietorships and single-member LLCs: Schedule C

- Partnerships and multi-member LLCs: Form 1065 and Schedule K-1

- Corporations and LLCs taxed as corporations: Form 1120

- S corporations: Form 1120-S

The most common tax return form for tax-exempt nonprofits are Form 990, Return of Organization Exempt from Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt from Income Tax.

About Form 990

Tax-exempt nonprofits that make $50,000 or more in gross receipts and are required to file must complete Form 990.

Form 990 asks for information such as your organization’s name, Federal Employer Identification Number (FEIN), type of tax-exempt status, revenue, and expenses.

You must file Form 990 or Form 990-EZ annually by the 15th day of the fifth month after your tax year ends.

If you need a Form 990 filing extension, you can file Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return.

Failing to file Form 990 for three consecutive years may result in the IRS revoking your tax-exempt status.

Form 990 alternatives

Some organizations may be required to file a different form than Form 990 or Form 990-EZ.

Smaller tax-exempt organizations that make less than $50,000 may be required to file Form 990-N (e-Postcard), Annual Electronic Filing Requirement for Small Exempt Organizations. There is no paper version of Form 990-N, but organizations eligible for filing Form 990-N can opt for Form 990 or Form 990-EZ. File Form 990-N annually by the 15th day of the fifth month after your tax year ends.

Other organizations have different filing responsibilities. For example, some private foundations might be required to file Form 990-PF, Return of Private Foundation.

Check with the IRS for more information on nonprofit organizations tax filing requirements.

To file your annual tax return, you need up-to-date and accurate records. Patriot’s online accounting software makes it easy to record transactions. Our software is made for the non-accountant, and we offer free, U.S.-based support if you need assistance. Get your free trial now!

This is not intended as legal advice; for more information, please click here.