If you’ve been keeping up with the news, you know that the IRS began sending out Economic Impact Payments to qualifying recipients. These stimulus checks will go out in a few rounds, so don’t panic if you aren’t included in the first send-off.

Economic Impact Payments: Q&A

An Economic Impact Payment is a government-issued stimulus check established under emergency COVID-19 legislation. There have been three rounds of COVID-19 stimulus checks thanks to the:

- CARES Act (March 2020)

- Consolidated Appropriations Act (December 2020)

- American Rescue Plan (March 2021)

The goal is to stimulate the economy by putting money directly into the pockets of individuals suffering from the effects of COVID-19.

If you’re itching to get your hands on your check, take a look at our question and answer segment below.

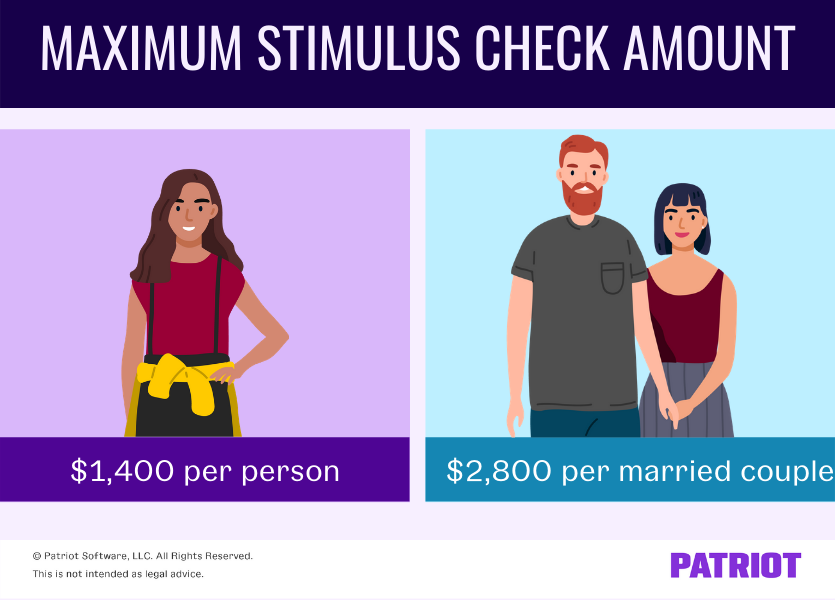

How much are the checks?

The maximum stimulus check amount is $1,400 per person or $2,800 per married couple under the American Rescue Plan.

The amount you receive depends on your adjusted gross income (AGI). Some high-earning individuals won’t receive a check at all.

Add this maximum amount ($1,400) to the maximum $600 per person stimulus under the Consolidated Appropriations Act to equal the $2,000 per person many political figures rallied to get.

Stimulus checks under the CARES Act were $1,200.

Am I eligible?

You will receive the full $1,400 if your adjusted gross income is less than:

- $75,000 (individuals)

- $112,500 (head of household)

- $150,000 (married)

If you have children and are eligible for the $1,400 amount, you are also entitled to an additional $1,400 per child who is considered a dependent.

Unlike previous Economic Impact Payment rounds, the stimulus checks under the American Rescue Plan phase out quickly.

You will receive a reduced amount if your adjusted gross income is between:

- $75,000 – $80,000 (individuals)

- $112,500 – $120,000 (head of household)

- $150,000 – $160,000 (married)

You will not receive an Economic Impact Payment if your adjusted gross income is more than:

- $80,000 (individuals)

- $120,000 (head of household)

- $160,000 (married)

And, you won’t receive a stimulus check if you can be claimed as a dependent, do not have a valid Social Security number, or are a nonresident alien. If you filed Forms 1040-NR, 1040-PR, or 1040-SS for 2019 or 2020, you also won’t receive a check.

I’m receiving unemployment benefits. Can I get it?

If you’re receiving unemployment benefits, you can absolutely qualify for the Economic Impact Payment if you meet the eligibility requirements.

I took out a PPP loan. Can I get the check?

If you received a Paycheck Protection Program loan, you are still eligible to receive a stimulus check if you meet the Economic Impact Payment eligibility requirements.

Again, the check is meant to provide spending money to individuals to help stimulate the economy. You won’t be disqualified from getting your share if you’re a business owner who took out a coronavirus loan or are claiming coronavirus payroll tax credits.

I haven’t filed my 2020 tax return. Can I get the check?

Yes, you can still receive a stimulus check if you have not yet filed your 2020 tax return. If you have not filed your 2020 return yet, the IRS will use your 2019 tax return information to determine whether or not you will receive a stimulus check.

Keep in mind that the IRS will use your most recent tax return on file to determine whether your adjusted gross income meets the stimulus check eligibility requirements.

If you have not filed for 2019 or 2020, you need to file a tax return to receive the payment (unless you are considered to be a non-filer by the IRS).

What if I moved or changed my bank account?

The IRS has the mailing address you listed on your most recent tax return (either 2019 or 2020). If you received a refund from the IRS via direct deposit, your information is on file from your most recent tax return.

Direct depositors will receive their checks via direct deposit. If you updated your bank account and haven’t yet filed your 2020 tax return, you can update it by filing a 2020 tax return.

If you do not use direct deposit when filing your tax return and do not want to submit your bank account information to the IRS, you will receive a paper check or debit card. If you moved since your most recent tax return, you can update your mailing address by filing your 2020 tax return if you haven’t yet.

I don’t file taxes. Will I get one?

If you have a filing requirement and have not filed a tax return for 2019 or 2020, you must file a tax return in order to receive a stimulus check. This includes non-filers.

According to the IRS, non-filers can file Form 1040 or 1040-SR to receive the Economic Impact Payment.

Is it taxable?

The stimulus check is not taxable. You won’t owe taxes on the payment. And, it is not considered income.

Do I have to pay it back?

No, you do not have to pay back the amount of your stimulus check.

Watch out … a word on scammers

You want your stimulus check, and so do scammers. Be on the lookout for people wanting to take advantage of the situation.

The IRS will NOT call, text, email, or reach out to you via social media. If you receive these types of communication from the “IRS,” do not provide personal or bank account information. And, do not click on any attachments or links.

This article has been updated from its original publication date of April 16, 2020.

This is not intended as legal advice; for more information, please click here.