The information in this article is current as of September 2, 2020, 1:37 p.m. EST.

As the coronavirus continues to rock businesses’ and individuals’ worlds nationwide, the government is scrambling to find ways to provide additional relief. To help with the negative effects of the coronavirus, the president issued multiple executive orders on August 8, 2020, with one relating to a payroll tax deferral. Read on to learn what the executive orders entail and how they can impact your business and employees.

COVID-19 payroll tax deferral executive order & more

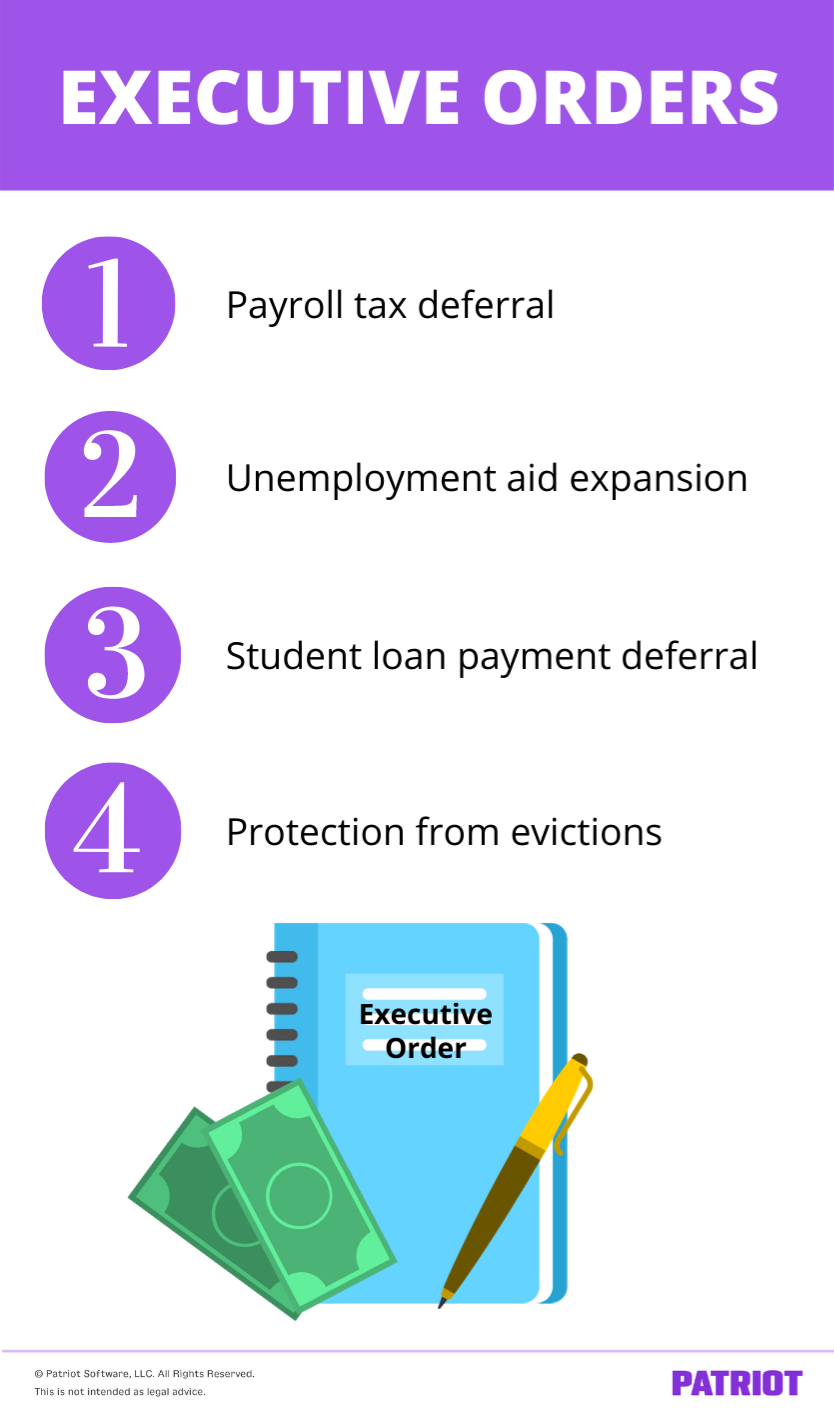

On August 8, President Trump issued four executive orders. The orders provide relief in the forms of:

- Payroll tax deferral

- Unemployment aid expansion

- Student loan payment deferral

- Protection from evictions

Check out the details of each executive order below. And, keep in mind that they are not completely set in stone (which we will get to later).

Payroll tax deferral

The first executive order issued has to do with deferring the employee portion of payroll taxes.

As an employer, you’re responsible for withholding certain payroll taxes, like Social Security tax (part of FICA tax), from employee wages.

As a brief recap, the employee portion of Social Security is 6.2%. This means employers must withhold 6.2% from employee wages for Social Security tax until the employee reaches the Social Security wage base. Social Security tax is one part of FICA tax, with the other part being 1.45% for Medicare tax (which you also must withhold from employee wages). As an employer, you have to pay a matching 6.2% for Social Security tax and 1.45% for Medicare tax.

According to the presidential memorandum, the IRS payroll tax deferral under the executive order would allow employers to stop withholding only Social Security tax (6.2%) from employee wages from September 1, 2020 – December 31, 2020. The payroll tax deferral does not include Medicare taxes.

The Social Security tax deferral allows employers to delay employee Social Security tax payments without any penalties or interest until May of next year.

This employee payroll tax deferral would mimic a tax cut because workers would wind up with larger paychecks during the time frame where the employee portion of Social Security tax is not withheld. But because it’s a deferral and not an exemption, the payroll taxes would still be due at a later date.

The payroll tax deferral only applies to employees with biweekly pre-tax income of less than $4,000. Employees earning under $104,000 annually (roughly $4,000 every two weeks) would be able to take advantage of the payroll tax deferral. But again, these employees would need to pay back the Social Security taxes in 2021.

Depending on what legislation Congress passes and the November election, there is a chance that the deferred Social Security taxes could be forgiven.

Payroll tax deferral: opt out

Based on the guidance from the IRS, employers can choose to opt out of payroll tax deferral. If your company opts into the payroll tax deferral, you do not need to remit the deferred payroll taxes from employee wages until the period from January 1, 2021 – April 30, 2021. This is in addition to their regular payroll taxes due during this time.

Although there’s not much information about how the process will work, Treasury Secretary Steven Mnuchin said the payroll tax deferral would not be mandatory for employers to implement. And, employers can opt out of having their employees’ payroll taxes deferred.

Unemployment aid expansion

Along with a potential payroll tax deferral for the employee portion of Social Security tax, the President also issued an executive order regarding unemployment aid.

As a reminder, unemployment benefits help workers who are unemployed through no fault of their own (e.g., coronavirus). Workers who receive unemployment benefits get a percentage of the wages they would have earned if they were still employed.

With many people unemployed due to the coronavirus pandemic, the federal government set unemployment at $600 per week for eligible workers (in addition to what the state program pays) under the CARES Act. This federal funding expired at the end of July.

This order calls for federal unemployment aid to restart at a level of $400 per week. However, the federal government would only pay $300 out of the $400 unemployment benefits. States would be required to chip in the remaining $100.

With many states already low on funds, some speculate that state governors won’t sign on to this unemployment expansion plan.

Based on the order, the unemployment aid would last either through December 6, 2020, or until funding runs out.

Student loan payment deferral

Another executive order would allow individuals to delay student loan payments through the end of 2020.

The order waives all interest on federal student loans through December 31, 2020. It also allows individuals with federal student loans to defer payments until the end of this year.

Temporarily deferring student loan payments can help relieve many people of the financial burden. But, the student loan deferment does not mean individuals don’t have to pay back that student loan debt. Full payments would restart on January 1, 2021.

Protection from evictions

With so many people being unemployed due to COVID-19, many are having difficulties paying rent. And when individuals can’t pay, they could potentially get evicted.

Although this order does not ban evictions and doesn’t promise any aid to renters, it does call for officials to consider an eviction ban and find funds to help out renters.

In March, Congress passed a federal moratorium that prevented many evictions. However, it expired on July 24. The moratorium covered all renters living in places with a federally-owned mortgage.

Things to keep in mind about the executive orders…

Keep in mind that the above executive orders could change. Any changes to taxes or spending are supposed to come from Congress. Because of this, the executive orders will likely be challenged in court.

In addition to no approval from Congress, there’s no definite answer on how many states would want to participate in the expanded unemployment program. Not to mention, it’s unclear if businesses and employees would want to suspend employee payroll taxes, given workers would have to pay them back in 2021.

The American Institute of Certified Public Accountants (AICPA) also sent a letter to the IRS and Treasury Department asking for more clarification and guidance on the payroll tax deferral executive order. The letter asked for guidance on the following:

- Whether the deferral is voluntary

- Who can opt to defer the payroll taxes (e.g., employee)

- Who is considered to be an “eligible employee” for the deferral

- How the wage limit works if the employee has multiple employers

- What the payment due dates for the deferred taxes are

- How employees will pay the deferred payroll taxes

On August 28, 2020, the IRS issued guidance on the payroll tax deferral. According to the IRS notice, employers can opt to not withhold Social Security taxes from employees’ paychecks from September 1, 2020 – December 31, 2020. To pay back the deferred taxes, employers must withhold the deferred taxes from employee wages between January 1, 2021 – April 30, 2021 (in addition to other payroll taxes). Interest and penalties will begin to accrue on unpaid taxes starting May 1, 2021. It is up to the employer on whether they will opt into the payroll tax deferral.

The notice states that, if necessary, employers can “make arrangements to otherwise collect the total applicable taxes from the employee.” However, it does not provide specific details on the requirement.

Again, the deferral can only apply to employees whose biweekly paychecks are less than $4,000 ($104,000 annually).

Stay tuned for more information about the newly-issued executive orders and whether or not they will officially go into effect.

This is not intended as legal advice; for more information, please click here.