If you’re an employer in Oregon (specifically in Multnomah County), listen up. There’s a new personal income tax that went into effect in 2021, and it may impact both you and your employees. What is this new tax in town, you ask? The Multnomah County Preschool for All tax.

What is the Multnomah County Preschool for All tax?

The Multnomah Preschool for All tax (PFA for short) in Oregon is funded by personal income tax to establish a tuition-free preschool program. The PFA program gives three- and four-year-old children in Multnomah County access to free, high quality, developmentally appropriate, and culturally responsive preschool experiences. It is expected to grow over time to increase the number of children and families that it covers.

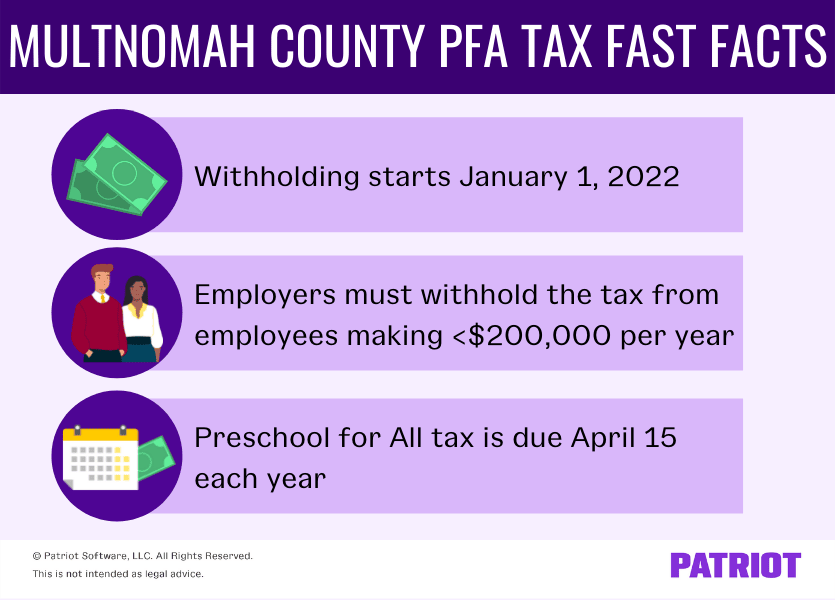

The tax went into effect on January 1, 2021, but withholding is not mandatory until January 1, 2022.

Families can begin applying for the PFA program starting in early 2022. All families in Multnomah County are eligible to apply. And, families who currently have the least access to high-quality preschool will receive priority.

Who funds the PFA tax?

High-income earning individuals in Multnomah County, Oregon fund the PFA tax with a personal income tax. Individuals subject to the tax include individuals with taxable income over $125,000 ($200,000 for joint filers). And, the tax rate increases if the individual has a taxable income over $250,000 ($400,000 for joint filers).

How much is the Oregon Preschool for All tax?

So, how much is the Multnomah County PFA tax for filers? Let’s break it down based on taxable income amounts:

- $125,000 or more for individuals: 1.5% personal income tax

- $200,000 or more for joint filers: 1.5% personal income tax

- $250,000 or more for individuals: 3% personal income tax

- $400,000 or more for joint filers: 3% personal income tax

The rate is set to increase by 0.8% in 2026.

Residents of Multnomah County have 100% of their Oregon taxable income subject to the tax thresholds. For non-residents, income sourced within the county is subject to the tax thresholds.

What are your employer responsibilities?

Multnomah County employers must withhold the PFA tax from employees making over $200,000 per year.

As an employer, you must begin withholding the tax from applicable employees once your payroll system is updated to handle the PFA tax. In 2022, withholding becomes mandatory.

Can employees opt in or out of the tax withholding?

Employees may be able to opt in or out of withholding based on their individual tax situation. If an employee wants to opt out from withholding, they must notify you and complete the METRO/MultCo OPT Form.

Likewise, employees can opt into the withholding using the form (even if they make below the threshold amount) and select the amount they want withheld.

Employees who opt out and have an annual PFA tax liability of $1,000 or more must make quarterly estimated payments.

How do you file and remit the PFA tax?

Employers who withhold the PFA tax from employee wages must file quarterly withholding returns and an annual withholding reconciliation return. Employers must also submit Forms W-2 for employees who had PFA taxes withheld. And, submit METRO/MultCo OPT Forms for employees who opted in or out with the annual withholding reconciliation return.

The City of Portland Revenue Division collects the Preschool for All personal income tax on behalf of Multnomah County. All payments and filings should be sent to the City of Portland through its Portland Revenue Online (PRO) system.

When is the tax due?

The Preschool for All Oregon tax is due April 15 each year.

Multnomah County PFA tax: Resources

Have more questions about the Multnomah County Preschool for All tax? Check out these resources:

To find out more information, employers and individuals can reach out to the tax administrator at [email protected] or by calling 503-865-4748.

This is not intended as legal advice; for more information, please click here.