As a business owner, a big part of your job is handling accounting tasks. Part of your accounting responsibilities is looking at accounting periods and analyzing reports and other financial information. Many businesses use monthly accounting periods. However, some companies may opt to take advantage of 13 accounting periods instead. So, what is this 13th period we speak of, and where the heck does it come from?

What does 13 accounting periods mean, exactly?

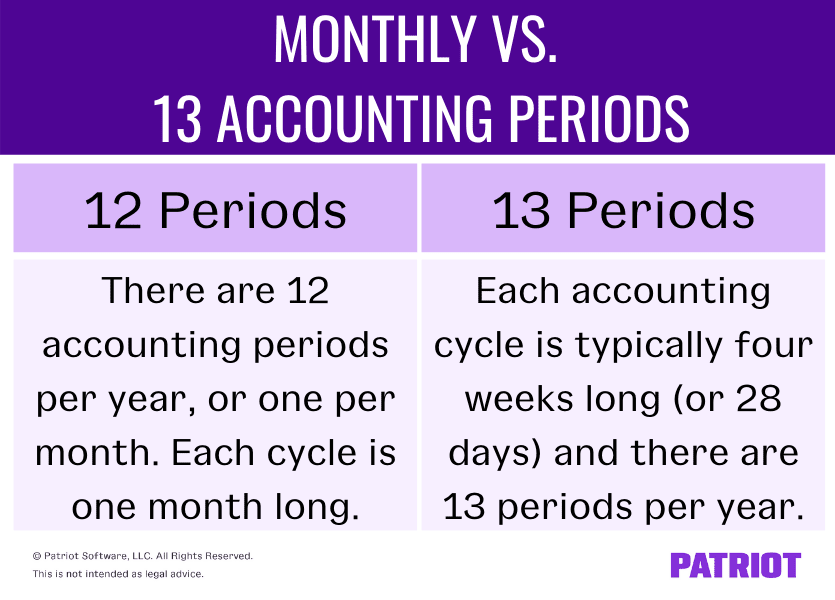

Many businesses use 12 accounting periods per year, or one per month. However, having monthly accounting periods with varying days (e.g., 30 days vs. 31 days in a month) can throw off financial reports.

Twelve-month accounting periods can be an issue in industries where the bulk of sales occurs on a weekend (e.g., restaurants and retail). This can make it challenging to compare financial results from different accounting periods.

The solution to the 12-month accounting period problem? Cue 13 accounting periods.

So, how do 13 periods in accounting work? With 13 accounting periods, each accounting cycle is typically four weeks long (or 28 days) instead of 12 calendar months. This gives you an extra accounting period each year. Basically, there are 13 four-week periods instead of 12 monthly periods. This makes it easier for certain companies to compare financials during different periods.

With 13 periods, holidays generally fall into the same week of the same period every year. And because every period has the same number of weekdays and weekends, you can compare apples to apples.

You can also use a 13th period accounting at year-end on a singular day (or another shorter period) to make adjustments. For example, you may have your accounting periods monthly. But in December, you have your 12th period from December 1 – December 30 and your 13th period just a day before you wrap up the calendar year.

13 accounting periods vs. 13-month accounting period

If you’ve heard of a 13-month accounting period, you might be thinking it’s the same as having 13 accounting periods. Although they sound similar, they are not one and the same.

With a 13-month accounting period, you create an artificial month (aka a “13th” month). During the 13th month, you account for things like bad debt, write offs, and other income. Then, these transactions flow through for year-end accounting purposes.

With 13 accounting periods, you are not adding an additional period into the mix. Instead, you are simply breaking the calendar year into 13 periods instead of 12.

Purpose and perks of having 13 accounting periods

Why take advantage of 13 accounting periods? Depending on your industry, it can be uber beneficial to your business and its books.

Again, utilizing 13 accounting periods instead of monthly periods can make it easier to compare your numbers and reports. Not to mention, it can:

- Help you spot trends

- Simplify cost monitoring

- Ensure payroll is more accurate on your P&L statement

- Make it simpler to account for payroll

- Help you better plan inventory

As you can tell, there are plenty of benefits you can reap from having a 13th accounting period. But before you make any decisions, check out…

A few downsides of having 13 accounting periods…

Keep in mind that using 13 accounting periods isn’t for everyone. Before you decide to switch your cycle, weigh the cons, too.

A few challenges of having 13 accounting periods include:

- Synchronizing with bank statements

- Coordinating the periods with other business expenses and taxes

- Having limitations with accounting software

Most bank statements are produced on a monthly basis. Talk with your bank about accommodating a 13 four-week cycle instead. Or, use online banking to gather statements.

Many business expenses are due monthly, like rent and utilities. And depending on the time of year and your business’s location, you may also have taxes (e.g., sales tax) due by the end of the month or quarter. To help keep business expenses and taxes aligned with your new periods, consider tracking them on a spreadsheet.

Some accounting software cannot accommodate 13 accounting periods. Check with your provider to find out if you can use a 13 period cycle in the software and if they are any workarounds for it.

13th period accounting example

Let’s take a look at what an accounting period with 13 periods would look like, shall we?

Here’s an example of what 13 accounting periods might look like for your business:

- 1: January 1 – January 28

- 2: January 29 – February 25

- 3: February 26 – March 25

- 4: March 26 – April 22

- 5: April 23 – May 20

- 6: May 21 – June 17

- 7: June 18 – July 15

- 8: July 16 – August 12

- 9: August 13 – September 9

- 10: September 10 – October 7

- 11: October 8 – November 4

- 12: November 5 – December 2

- 13: December 3 – December 31

Keep in mind that the dates vary year to year. If you plan on using the 13th period accounting method, map out your periods before the beginning of each calendar year. And, dates can vary depending on if it’s a leap year (i.e., extra day in February).

Regardless of if you have 12 accounting periods or 13, you need a reliable way to manage your accounting books. With Patriot’s accounting software, you can streamline the way you record transactions and save time for what matters most: your business. Try it for free today!

This is not intended as legal advice; for more information, please click here.