For many employers, nothing’s more confusing than employee benefits and payroll taxes. Are there any fringe benefits that are exempt from all payroll taxes? Yes, there are, and the working condition fringe benefit (spoiler!) is one of them.

What is the working condition fringe benefit?

The working condition benefit is a type of fringe benefit employers offer employees. Working condition benefits include property and services employers provide to employees so they can perform their jobs. It also includes cash payments employers provide for specific property and services employees need to perform their jobs.

Examples of working condition fringe benefits include an employer-provided cell phone, job-related education, certain vehicles, outplacement services, and product testing.

Read on for some common questions (and answers) you may have about this fringe benefit.

Is a working condition benefit tax-exempt?

Yes! The item or service is tax-exempt up to the cost the employee would be able to deduct as a business expense or depreciation expense if they paid for it.

And, the working condition benefit tax exclusion rule also applies to qualifying cash payments. To qualify, the payment must be:

- For a specific or already arranged business activity

- Allowable as a business expense or depreciation expense deduction to the employee

Include any part of the benefit the employee uses for personal reasons in their compensation using the benefit’s fair market value.

What doesn’t qualify?

You can’t include a working condition benefit tax exclusion for the following:

- Services or property you provide under a flexible spending account (FSA) where you agree to provide a certain level of unspecified non-cash benefits with an already-determined cash value

- Physical examination programs you provide

- Items that the employee could deduct as an expense for a trade or business other than your own

Who is an “employee?”

When it comes to the working condition fringe benefit, the definition of “employee” goes a little further.

According to the IRS, the working condition tax exclusion applies to benefits you give a:

- Current employee

- Partner who performs services in a partnership

- Company director

- Contractor who performs services for you

A closer look at common working condition benefits

Knowing what you can and can’t classify as working condition benefits can be confusing. Again, these are the items/services that qualify as a working condition benefit:

- Employer-provided cell phone

- Job-related education

- Employer-provided car

- Demonstrator cars

- Outplacement services

- Product testing

Let’s take a closer look at the IRS working condition benefit rules for each.

Employer-provided cell phone

Need your employees to have a phone reserved for work purposes? You may give them a work cell phone.

An employer-provided cell phone is exempt from taxes if you provide it to employees primarily for noncompensatory business purposes. This means you can exclude the cell phone value from an employee’s income if you have business reasons for providing it.

For example, you might provide a business phone if you:

- Need to contact your employee at all times for work-related emergencies

- Require the employee to talk with clients outside of work (e.g., in different time zones)

To qualify for tax exemption, the employee doesn’t have to use the cell phone for work 100% of the time. If an employee uses their work cell phone for personal reasons, you can count the use as a de minimis benefit, which is also tax exempt.

Heads up! Keep in mind that cell phones you give employees as a bonus or method of improving morale are not working condition benefits.

Job-related education

Want an employee to further their education to perform their role? Certain types of job-related education qualify as a working condition fringe benefit. Other types fall under the (also tax-exempt, but only up to a certain limit) education assistance fringe benefit.

How do you know which is which?

There are two parts to knowing whether job-related education qualifies as a working condition fringe benefit.

Part 1: To qualify, the education must meet at least one the following:

- You or the law require that the employee complete the education to keep their current salary, status, or job

- The education maintains or improves necessary job skills

Part 2: To qualify, the education must NOT meet either of the following:

- The employee needs the education to meet the minimum educational requirements of their current position

- It’s part of a program of study that will qualify the employee for a new trade or business

If the education meets at least one part of Part 1 and neither parts of Part 2, it qualifies as a working condition fringe benefit.

Employer-provided car

Do you provide an employee with a car? Cars you provide to employees may fully or partially qualify as a working condition fringe benefit.

Partially tax-exempt: If you provide a car for an employee to use, you can exclude the amount that would be deductible if the employee paid for it. And if the employee uses the car for business and personal reasons, only exclude the business portion from taxes. You can do this by calculating the personal use of company vehicle value.

Fully tax-exempt: If you provide a qualified nonpersonal use vehicle to an employee, the entire use by an employee is a working condition benefit. A qualified nonpersonal use vehicle is one that is clearly marked or identifiable as a business vehicle with special designs (e.g., police car, delivery trucks). It can also qualify if it’s an unmarked vehicle that law enforcement officers use with official authorization.

Demonstrator cars

Do you employ a full-time auto salesperson? If so, you may require them to use a demonstrator car in the sales area. And if you do, the demonstrator car may qualify as a working condition benefit.

To qualify, the demonstrator car must:

- Primarily facilitate the services the salesperson provides for you

- Have substantial restrictions on personal use

Outplacement services

Want to help your employees find new work? If you provide outplacement services, the amount may qualify as a working condition benefit.

To qualify, you must:

- Provide the services to the employee on the basis of need

- You get a substantial business benefit (e.g., avoiding wrongful termination suits, maintaining morale, etc.) from the services that is separate from the benefit you’d get from the payment of additional wages

- The employee is looking for a new job in the same kind of trade or business

Do not include outplacement services as a working condition fringe benefit if the employee can choose to receive cash or taxable benefits instead of the services.

Product testing

Did you just come up with a new product? If so, congratulations! But now, you want your employees to test and evaluate it outside of work. Can you exclude the value of using the product from the employee’s wages?

Generally, yes! Product testing is a working condition fringe benefit if all of the following are true:

- Testing and evaluating is an ordinary and necessary business expense

- The testing must be performed off business premises

- You provide the product to employees for the purpose of testing and evaluating and impose limits on the use of the product that could reduce its value

- You set a timeframe for testing and evaluating and require the employee returns it to you after

- Your employee submits detailed testing and evaluation reports, which you use and examine within a reasonable period of time

- You do not lease the product to employees for a fee

- The testing program is justified, and the benefits of testing and evaluation outweigh the expenses

Keep in mind that you cannot exclude product testing as a working condition benefit for independent contractors or company directors.

Other types of fringe benefits

Again, the working condition benefit isn’t the only type of fringe benefit. Other types of fringe benefits include:

- Accident and health benefits

- Achievement awards

- Adoption assistance

- Athletic facilities

- De minimis (minimal) benefits

- Dependent care assistance

- Educational assistance

- Employee discounts

- Employee stock options

- Group-term life insurance coverage

- Health savings accounts (HSAs)

- Lodging on your business premises

- Meals

- No-additional-cost services

- Retirement planning services

- Transportation (commuting) benefits

- Tuition reduction

Some fringe benefits are exempt from income, Social Security, Medicare, and FUTA taxes (e.g., de minimis benefits). Others are tax-exempt from some employment taxes, but not all (e.g., adoption assistance). Others are tax-exempt up to IRS limits (e.g., educational assistance).

Confused? You’re not alone. Fringe benefits are notoriously difficult to track in terms of employment taxes. Consult IRS Publication 15-B for more information on fringe benefits and taxation.

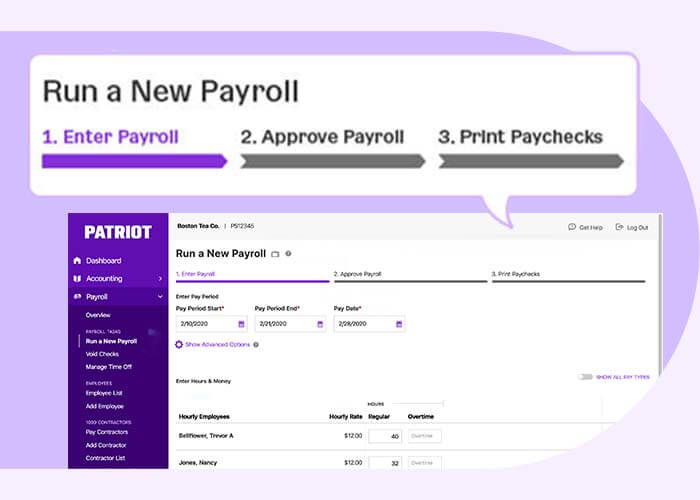

Running payroll and handling taxes is a time-consuming process … until today. Start your free trial of Patriot’s Full Service payroll and enjoy an easy three-step payroll process, guaranteed accurate payroll tax deposits and filings, free USA-based support, and so much more.

This is not intended as legal advice; for more information, please click here.