As a small business owner, you know that it’s hard to gain business capital. But, you need money to grow your business. Whether you are looking for startup or expansion funds, you usually have two options: debt financing vs. equity financing. Know the difference between equity and debt financing to choose the right one for your company.

What is debt financing?

With debt financing, you borrow money from an outside entity to fund your business. You must pay the money back, plus interest, in portions by a designated period. Banks typically issue debt financing, but private companies and friends and family are also sources you can use. You maintain all your business ownership when you use debt financing.

Lenders don’t have a say in business decisions or earn part of your profit. You only owe the loan amount, interest, and bank fees.

Types of debt financing

Though there are many types, the following are common options for debt financing.

SBA loans

The Small Business Administration offers several SBA loan programs for small business owners. The loan comes from a bank, but it is backed by the SBA. The SBA loan guarantee reduces the bank’s risk level, helping your chances of approval and getting favorable terms.

Commercial bank loans

Business bank loans can be difficult for startups to get. But, they are an option for established small businesses. To get a commercial bank loan, you need a solid business plan, a good small business credit score, and collateral. Banks offer different rates and payment terms, so you should check with several before agreeing to a loan.

Working capital loan

Working capital loans are short-term debts that help you pay for everyday business operations. You do not use a working capital loan to buy long-term assets or equipment. This debt financing option often works well for seasonal businesses, as it helps during slow cash flow months. When sales peak, business owners can pay back the debt quickly.

Equipment leasing

Equipment leasing works like a commercial loan, but it is used to fund business equipment. You pay a fixed monthly payment over a designated time period. The lease payments are less than the amount it would cost to buy the equipment. Usually, you have the option to buy the equipment at the end of the lease.

Debt financing vs. equity financing: A look at debt financing

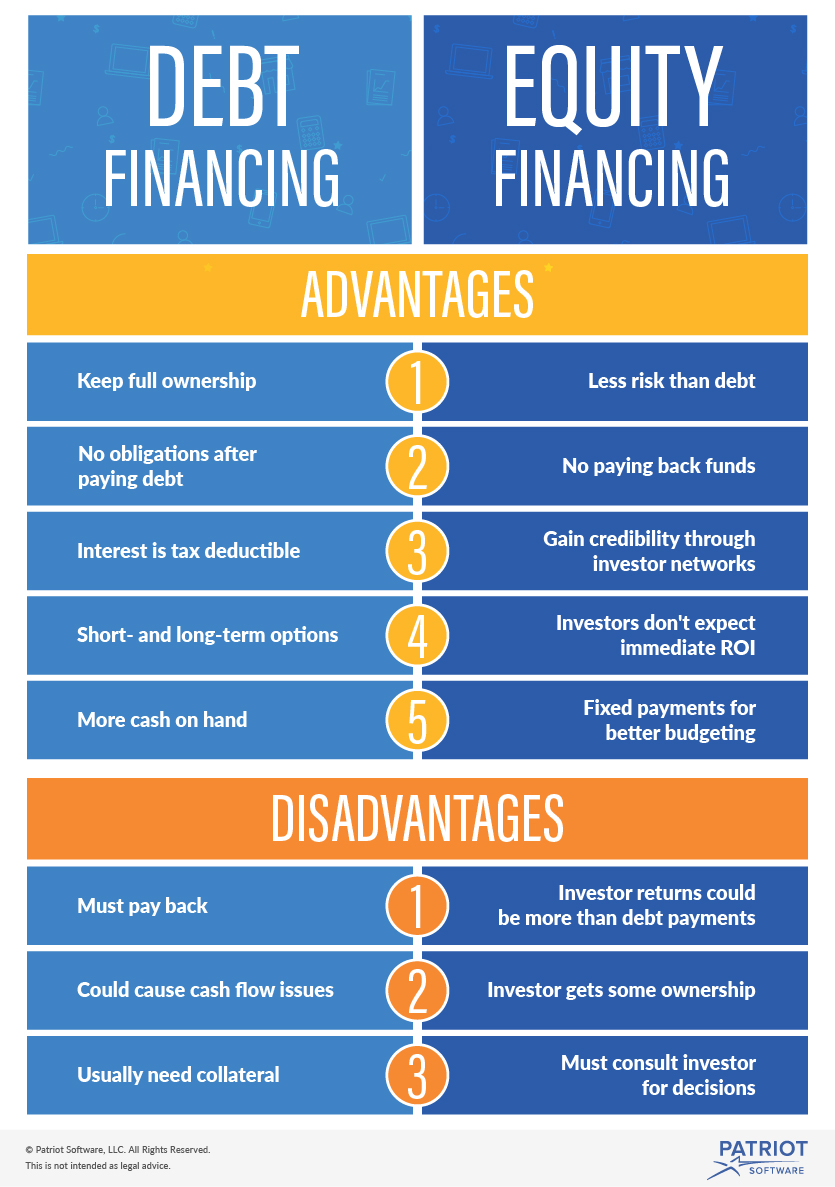

To compare your funding options for small business, you need to know the advantages and disadvantages of each. Take a look at the following pros and cons of debt financing.

Advantages of debt financing

- The bank can’t tell you how to run your business. You maintain full ownership.

- After you pay the loan off, you have no obligations to the bank.

- Interest on the loan is tax deductible.

- You can get a short-term or long-term loan.

- You know what the principal and interest cost you, so you can create a business budget.

Disadvantages of debt financing

- You have to pay back the loan within a designated time period.

- Debt financing could cause small business cash flow problems.

- You will probably need to offer business collateral.

What is equity financing?

Equity financing is money paid to your business by an outside entity. The funds come from an investor, not a lender. With equity financing, you do not have to make repayments or pay interest.

Instead of paying back a loan, you share your profits with the investor. The investor gains some ownership of your business by investing.

When you use equity financing, you issue the investor shares of equity in your business. The number of shares issued should be proportional to the amount of money invested.

The investor puts money into the business with the hope that the value of their shares will grow. Investors can also earn dividends. Dividends are regular payments made to shareholders out of a business’s profits.

Types of equity financing

The following are common types of equity financing to consider for your small business.

Private investors

A private investor is anyone who invests in your business and is not affiliated with a bank. A private investor could be an employee, local business owner, or supplier. It could even be your friends and family members. Look for private investors within your personal and professional networks.

Venture capital

Venture capitalists provide investments for new, rapidly growing companies. Venture capitalists have strict rules for investing, so their funds are not available to many small businesses. Because the companies they invest in pose higher risks, they expect to receive a larger return.

Employee stock ownership plan

An employee stock ownership plan (ESOP) is a trust that gives ownership to employees. You sell stock in the company to your employees. An ESOP gives employees a greater stake in the company’s success, but it can be expensive to maintain. You must be in business for at least three years to establish an ESOP.

Angel investors

Angel investors are wealthy groups or individuals who put money into small businesses and startups. The terms of angel investments are often more favorable than lender terms. Angel investors focus more on building up your business than their possible profits.

Debt financing vs. equity financing: A look at equity financing

You’ve already taken a look at the pros and cons of debt financing. Now, check out the advantages and disadvantages of equity financing below.

Advantages of equity financing

- You have less risk than you would with a loan.

- You don’t pay the funds back.

- Your investor’s network could help your business gain credibility.

- Investors don’t expect to see an immediate return on investment (ROI).

- You have more cash on hand without repayments.

Disadvantages of equity financing

- The returns you pay an investor could be more than bank loan repayments.

- The investor requires some ownership of your business.

- You need to consult the investor before making business decisions.

Choosing between debt and equity financing

The right funding option is different for every business owner when it comes to equity financing vs. debt financing. Often, new small businesses struggle to get equity financing, so they must take on debt. Established businesses are usually able to get a wider variety of financing options.

For lenders and investors, providing financing comes down to risk vs. reward. If you experience small business bankruptcy, debt holders have priority over equity holders for recovering funds. Investors have a greater risk, and they expect a larger reward.

You can use a mix of debt and equity financing to lessen the disadvantages of each. By using both options, you reduce the amount of debt you owe and business ownership you give to investors.

Need a simple way to keep track of all your business’s finances? Patriot’s online accounting software is easy-to-use and made for the non-accountant. We offer free, U.S.-based support. Try it for free today.