For a small business owner, obtaining a business loan isn’t easy. But, there are steps you can take to increase your chances of securing a loan. You need to show lenders you will be able to make repayments.

Small business loan tips

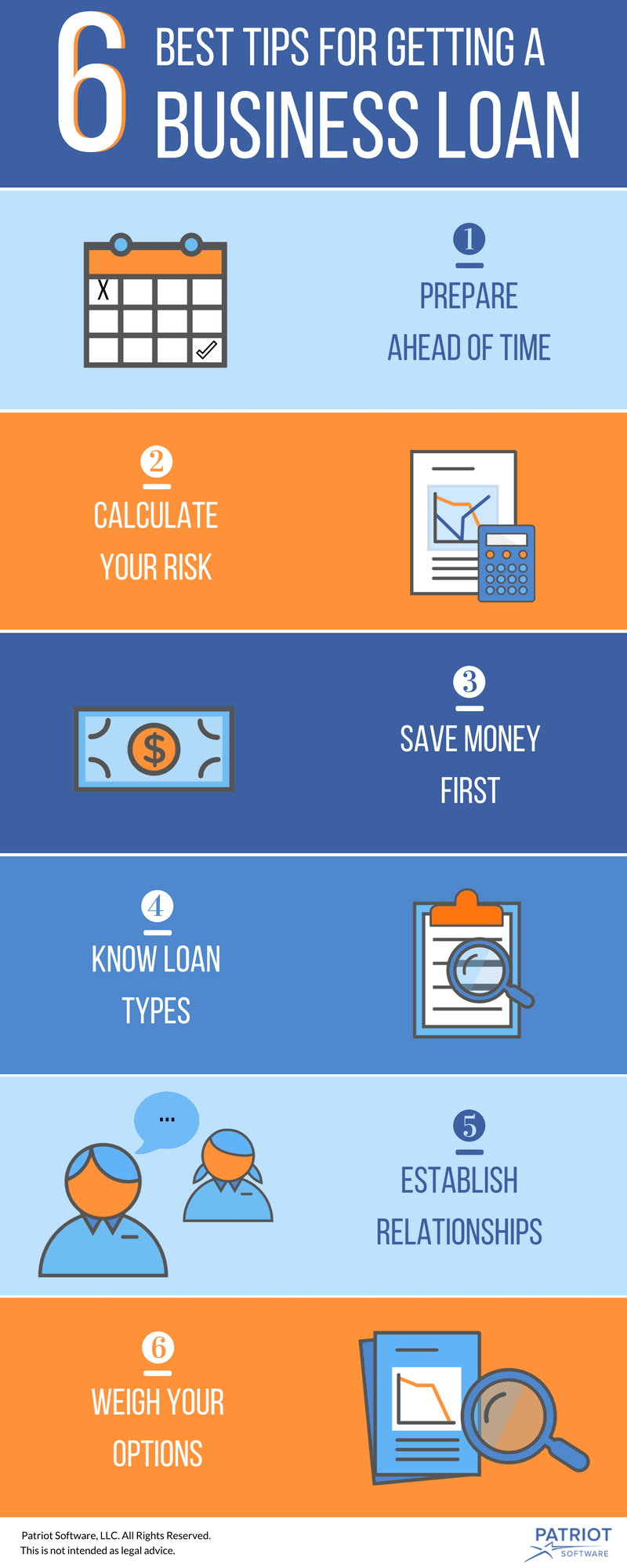

If you need financing for your small business, you might have considered a loan. But, what is the best way to get a business loan? Here are six ways you can improve your chances of getting a business loan.

1. Prepare ahead of time

Your business won’t be ready to apply for a loan overnight. When it comes to obtaining a business loan, it takes some preparation to set yourself up for success. Make sure you steer your company in the right direction from day one.

Lenders look at two things when it comes to loan applicants: personal finances and business profits. Long before you reach out to lenders, improve your credit score, pay off debts, and organize accounting records.

Get ready to show your financial history and plans for growth. Being an open book to lenders helps your business appear prepared and professional.

2. Have an honest idea of your risk

Lending money to small businesses is riskier than large corporations, which is one reason small businesses have a tough time securing loans. Here are some details that increase your risk to lenders:

- Little collateral

- Low profits

- New business

- Unorganized records

- Poor credit history

Knowing the risk your business presents to lenders will help you negotiate the loan. You can use your understanding of risk to make improvements and build a case for your business. Knowing your level of risk will also lessen the blow of lenders pointing out the weak parts of your business.

3. Save money before taking on a loan

You don’t want to get a loan and then be unable to make repayments. One of the most valuable small business loan tips to keep in mind is to keep a cash reserve for loan payments. Set some money aside in a business savings account to stay on top of payments from the start. Write a repayment plan that shows how you will use the loan and generate money for repayments.

Lenders often look at where repayments will come from before giving businesses a loan. To prove you can pay them back, you could offer non-cash collateral. But, you might lose personal assets if you can’t make repayments, such as your car or mortgage. Saving for repayments protects you from needing to use personal property as collateral.

4. Understand different loan types

When you enter a lending office, be aware of your small business loan options. The more you know about business loan types, the better chance you have of finding the one you need. The best way to get a business loan will depend on your unique situation, and the type of loan that you’re pursuing.

Here are some common loans to consider:

- Term loans are lump sums that you pay back (with interest) over a set amount of time.

- SBA loans are flexible term loans endorsed by the Small Business Administration.

- Short-term loans are like term loans, but you pay them back in a shorter amount of time.

- Long-term loans are larger amounts repaid over a long period with low interest rates.

- Business lines of credit only need to be repaid if you use the money.

- Equipment financing covers new and used equipment.

- Alternative financing includes cash advances, crowdfunding, peer-to-peer loans, and other sources of funding that are not from the bank.

5. Establish relationships

It can be difficult for new small businesses to get a startup business loan. You can’t show proof that your business will be profitable, making you a larger risk to lenders.

Forming relationships with lenders early on will increase your chances of obtaining a business loan. Take advantage of what banks can offer your company, including business bank accounts and credit cards. The more you work with your bank, the better lenders get to know you, establishing trust.

6. Don’t jump on the first opportunity

There are a lot of different small business loans available. Look at several lenders to find the one that is right for your business. Research each lender’s specializations, terms and conditions, and loan offerings.

Make a note of leaders that have lent to businesses that are similar to yours. Keep the size, industry, and age of the lender’s clients in mind during your research. Take a look at traditional banks and alternative funding options, like online lenders. Apply to three or four different lenders that best fit your needs.

Need a simple way to keep track of your small business finances? Patriot’s online accounting software is easy-to-use and made for the non-accountant. We offer free, U.S.-based support. Try it for free today.