Adding Contractor Direct Deposit Info in Patriot Software

Background

You can pay your 1099 contractors through payroll, and electronically deposit their payment into their bank account instead of paper checks. You will first need to set up your company to use direct deposit, then enter your contractor’s bank account information before you can pay them with direct deposit in payroll.

If you need to add employee bank information for direct deposit, see Adding Employee Direct Deposit Info.

How to enter a 1099 contractor bank account in Patriot Software

- Payroll > 1099 Contractors > Contractor List > Contractor Name

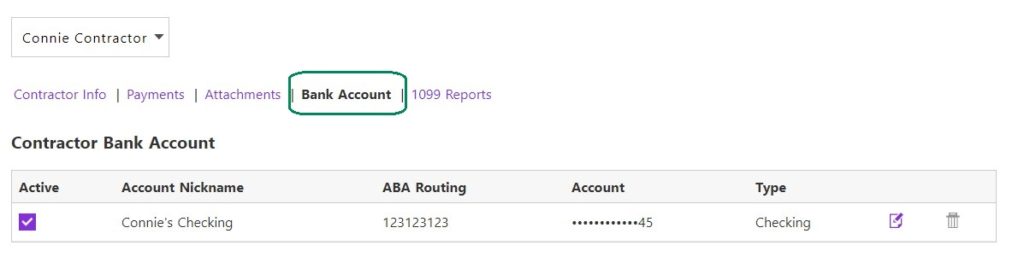

- Click the “Bank Account” tab.

- Click “Add New.” You will only be able to add one bank account to send direct deposit payments.

- Enter the ABA routing number twice

- Enter the bank account number twice

- Choose the account type, either checking or savings

- Click “Add New Account.”

The next time you pay this contractor, the payment will be electronically sent to their bank account. For more information, see How to Pay 1099 Contractors in Payroll.

If needed, you can confirm an account number you have already entered. See Verifying an Employee Bank Account Number.

You can update the contractor’s bank information by clicking the edit icon at the end of the row. Enter the updated bank information and click Save. The change will go into effect the next time you pay this vendor.

You can also inactivate the bank by unchecking the “Active” box. This will stop direct deposit and result in a live check that you’ll pay to the vendor.