Each state’s income taxes are different. Some states have low taxes, some have high taxes, and some states don’t have income taxes at all.

State income taxes get even more complicated when you have an employee who lives and works in different states, works from home in a state where your business isn’t located, or travels for work. Knowing how much tax to withhold and where to pay it can get confusing.

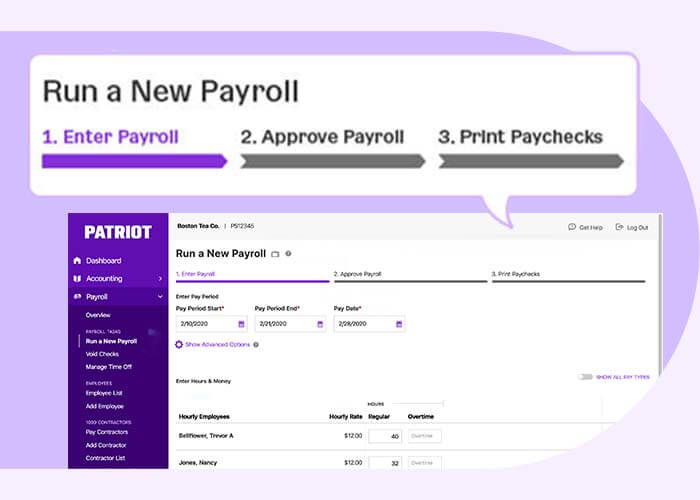

Don’t let confusion deter you from hiring out of state employees. You can learn the basics of how to handle payroll taxes for out-of-state employees. And, you can use payroll software with multi-location functionality to ensure all payroll calculations and deposits are correct.

The basics of payroll taxes for out of state employees

Generally, you must withhold state taxes for the state where the employee performed work. You must register with each state tax department where you’ll remit the withholding.

That seems pretty simple, right? Well, that’s the basic rule. There are other nuanced rules you must follow.

Employee resides and works in two different states

Let’s say you have an employee who lives in one state but works in another. The employee permanently works at your business location. They don’t work remotely or travel other places to work. For example, an employee lives in Kansas but commutes to your business in Missouri to work.

Withhold state taxes for the state where the employee works. In this case, you will withhold taxes for Missouri because the employee works at your business there.

Now, let’s say you have an employee who lives in Missouri but works exclusively in Arkansas. Even though the employee lives in the state where your business is located, you must withhold taxes for Arkansas because that is the work location.

Temporary placement

You might send an employee to different locations. They might be at the location for a long or short period of time.

Let’s say you own a local chain of small businesses in North and South Carolina. You have an employee who lives in North Carolina and works at one of your locations there. You send that employee to South Carolina for three months of management training at another store.

Again, you withhold and remit state taxes for the state where the employee works. For the three months of training, you must withhold taxes for South Carolina even though the employee lives and primarily works in North Carolina.

Now, let’s say you send your employee on short-term stents to different states. The employee lives and primarily works in one state, but meets with clients and goes to conferences in other states. Depending on the states and how long the employee is there, you might have to withhold taxes for the state where the employee is working, even if they’re only there for one day. Check the state’s rules for specific details on how long an employee must temporarily work there before you start collecting taxes for the work state.

States without withholding taxes

Seven states don’t have income taxes: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming. Another two states, New Hampshire and Tennessee, only have income taxes on dividend and interest income.

Let’s pretend your business is in Pennsylvania and you have an employee who works from home in Wyoming. Following the basic rules, you know you must withhold income taxes for Wyoming because that’s where the employee works. But, Wyoming doesn’t collect income taxes, meaning you don’t have to collect anything. You also don’t have to register with Wyoming’s tax department.

Now let’s say you have an employee who lives in a state with no taxes but commutes to work in a state with taxes. Withhold taxes for the work state, even though the home state doesn’t have taxes.

Reciprocal states

Some states have tax reciprocity. A reciprocal agreement allows you to withhold taxes for the state of residence instead of their work state for out of state employees.

Not all states have a reciprocal agreement. Only some states have state tax reciprocity agreements and only with certain states.

Generally, if an employee lives in one state and works in another, you must withhold taxes for the state they work in. But if their home and work states have a reciprocal agreement, the employee can give you a reciprocal withholding certificate to request that you withhold taxes for their home state. You are not required to act on the reciprocal agreement unless the employee gives you a certificate.

Courtesy withholding

If an employee’s home and work states don’t have a reciprocal agreement, you can do courtesy withholding. This is where you withhold taxes for the employee’s home state and work state as a courtesy. This way the employee’s taxes are already paid to both states, and they will have less of a scramble at tax time. You are not required to do courtesy withholding.

Managing payroll taxes for employees working out of state can be difficult, but it’s not impossible. Don’t be afraid to use software to make the process easier.

Dealing with taxes for multiple work locations can be confusing. Using software that handles multi-state payroll can help. Patriot’s online payroll software can handle taxes for your employees who work in different cities and states. Try the software for free.

This article has been updated from its original publication date of January 31, 2018.

This is not intended as legal advice; for more information, please click here.