When the clock strikes midnight on new year’s, bam! It’s about time to complete Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. The FUTA tax return differs from other employment tax forms in a few ways. So, how to fill out a 940 tax form also differs. Learn how to fill out Form 940 the right way to avoid penalties and fines.

FUTA tax overview

Before knowing how to fill out 940 forms, first understand what the form is. Form 940 reports federal unemployment taxes to the IRS at the beginning of each year.

Employers pay federal unemployment tax on the first $7,000 of each employee’s wages. The current tax rate is 6%, but most states receive a FUTA tax credit of 5.4%. So, many businesses only pay a 0.6% (6% – 5.4%) FUTA tax rate. However, credit reduction states do not receive the full FUTA tax credit of 5.4%.

A credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. A state with a credit reduction would receive a credit reduction rate of 0.3% for each year they don’t repay the federal loan in full. For example, a state that has not paid in full for one year would receive a tax credit of 5.1% instead of 5.4% (5.4% – 0.3%).

If a business does not receive the FUTA tax credit, the company pays up to $420 per employee (6% X $7,000). Businesses that receive the tax credit pay up to $42 per employee (0.6% X $7,000).

So, who’s responsible for paying FUTA Tax? According to the IRS, qualifying employers do at least one of the following:

- Pay wages of $1,500 or more to employees during any quarter in the calendar year.

- Have one or more employees for at least some part of a day in at least 20 different weeks during the calendar year. Include all temporary, part, and full-time employees. Do not include partners in a partnership in the employee count.

How to fill out Form 940

IRS Form 940 reports your federal unemployment tax liabilities for all employees in one document. Employers must submit the form to the IRS by January 31 of each year if they qualify.

And now, here’s how to fill out FUTA tax forms.

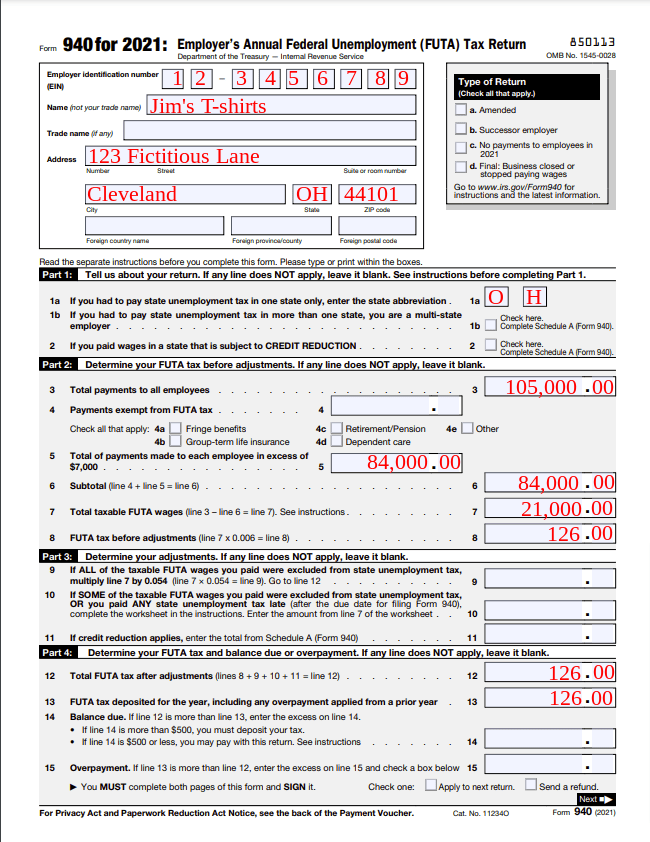

1. Complete employer information

A section for your business’s information is at the top of each 940 form. Enter your employer identification number (EIN), business name, and address. If you operate under a doing business as (DBA), include the DBA in this section. You must use a business EIN, not a Social Security number (SSN) or Taxpayer Identification number (TIN).

2. Enter state unemployment details

Part 1 of Form 940 applies to state unemployment information. There are three lines. You may need to complete more than one line:

- Line 1a: Enter the state abbreviation if you paid state unemployment in only one state.

- Line 1b: If you paid state unemployment in more than one state, check the box to identify yourself as a multi-state employer.

- Line 2: Check the box if you paid employee wages in a state with a FUTA tax credit reduction.

If you are a multi-state employer or receive the FUTA tax credit reduction (aka check Lines 1b and/or 2), complete Schedule A (Form 940), Multi-state Employer and Credit Reduction Information.

Again, the credit reduction on Form 940 includes any state that has not repaid money it borrowed from the federal government to pay unemployment benefits. Credit reduction states must pay the full 6% FUTA tax rate.

3. Determine pre-adjustment FUTA tax amounts

Part 2 of the 940 form includes six lines. Do not complete any lines that do not apply to your business or employees.

- Line 3: Enter the total payments made to all employees. Include all payments made to employees, even wages not subject to FUTA tax. Payments include compensation, fringe benefits, retirement or pension benefits, and other payments (e.g., tips).

- Line 4: Report the total amount of all payments exempt from FUTA (e.g., fringe benefits). Line 4 includes checkboxes for the type of exempt payments. Check the appropriate box or boxes for each type of payment included in the total on Line 4.

- Line 5: Enter the total amount of payments made to each employee over $7,000. The first $7,000 in wages, minus the total amount exempt from FUTA, is subject to the tax. List on Line 5 the total amount over the wage base you paid to each employee after subtracting the exempt wages.

- Line 6: Add together the amounts from Lines 4 and 5 and enter the total here.

- Line 7: Subtract Line 6 from Line 3 (Line 3 – Line 6) and enter the total here. This is your total taxable FUTA wages.

- Line 8: Multiply the amount listed on Line 7 by 0.006 and enter the total on Line 8. This amount is the FUTA tax before adjustments.

4. Calculate FUTA tax adjustments

In Part 3 of Form 940, leave any line that does not apply to your business blank. This section determines the total adjustments you must make to your FUTA taxes.

- Line 9: Complete this line if all taxable FUTA wages were excluded from state unemployment tax. Multiply Line 7 by 0.054 (the amount of the FUTA tax credit) and enter this amount.

- Line 10: If only some of the taxable FUTA wages paid were excluded from state unemployment tax OR you paid any state unemployment tax late, complete Line 10. Use Worksheet—Line 10 in the Form 940 Instructions to calculate the amount. Enter this on Line 10.

- Line 11: Use Line 11 if the FUTA credit reduction applies. Enter the amount from Schedule A (Form 940).

5. Determine FUTA tax balance due or overpayment

In Part 4, determine the total amount of FUTA tax you owed for the calendar year. Use this section to calculate if you owe FUTA tax or overpaid. Only complete applicable lines. Leave lines blank if they do not apply.

- Line 12: Add together Lines 8, 9, 10, and 11. Enter the total on Line 12.

- Line 13: Enter the amount of FUTA tax you deposited for the entire year, including any overpayments applied from the previous year.

- Line 14: If the amount on Line 12 is greater than the amount on Line 13, enter the excess amount on Line 14.

- Deposit the tax if the excess is more than $500.

- You can pay the tax with the return if the amount is less than $500. Use the instructions listed on Form 940 if paying when filing the return.

- Line 15: If Line 13 is greater than Line 12, you overpaid. Enter the excess amount on Line 15 and select the checkbox below the line. You may choose to apply the overpayment to the next return or request a refund.

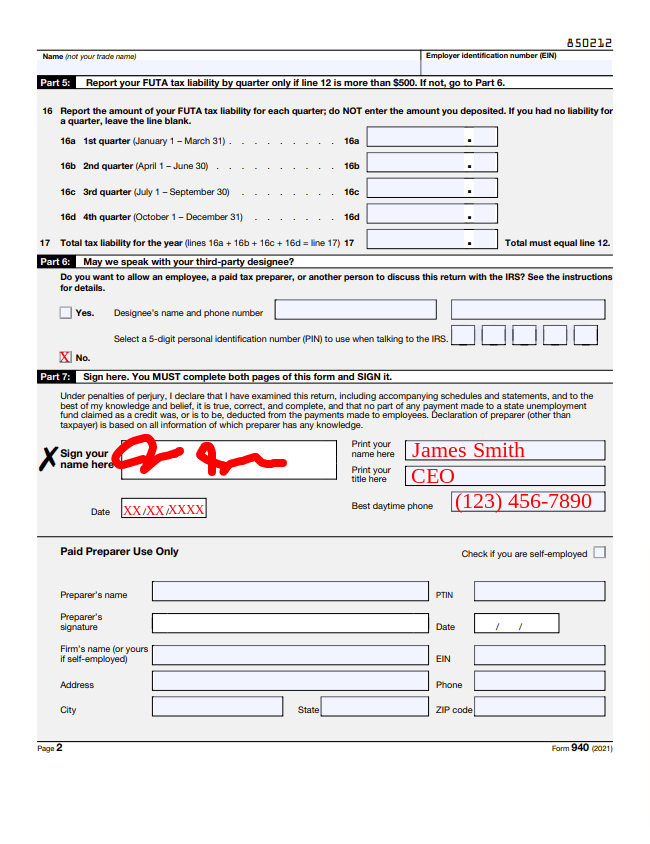

6. Report quarterly FUTA tax liabilities

Only complete Part 5 of the 940 form if Line 12 of Part 4 is more than $500. If Line 12 is less than $500, skip Part 5 and complete Part 6.

- Line 16: Enter the amount of your FUTA tax liability for each quarter. Do not enter the amount of tax you deposited. Lines 16a through 16d specify each quarter.

- Line 17: Add lines 16a through 16d together and enter the total tax liability on Line 17. The total on Line 17 must match the amount on Line 12.

Your FUTA tax liability for the quarter is the total amount of FUTA tax calculated on applicable wages for each employee up to the $7,000 wage base.

7. Choose who may speak with the IRS

Part 6 of the form allows you to choose who may speak with the IRS regarding your Form 940 tax return. If you select ‘Yes,’ enter the designated contact’s name and phone number. Then, enter a five-digit personal identification number (PIN) the contact can use when speaking to the IRS to confirm their authority.

You may also check the ‘No’ box to ensure the IRS can only speak to you regarding your return.

8. Sign the form

In Part 7, you must sign and date the form. And, print your name and title and provide a daytime phone number for the IRS to contact you.

Part 7 also includes a section for paid preparers to complete. If you are not a paid preparer, leave this section blank.

Example of 940 form filled out

Take a look at a Form 940 example. You have three employees: Bob, Sara, and Tom. Bob earned $30,000, Sara earned $35,000, and Tom earned $40,000 last year. You did not offer fringe benefits, group-term life insurance, retirement or pension plans, or dependent care.

Your state offers the maximum FUTA tax credit of 5.4%, so you only pay 0.6% for FUTA tax on each employee. You paid $126 for federal unemployment tax during the year. And, you did not have any overpayments from the previous year to apply.