If your business operates in a location that imposes sales tax, you are likely familiar with the concept of sales tax. But, have you heard of sales tax nexus?

Mastering sales tax nexus boils down to one question: What is nexus? Read on to learn the basics of sales tax nexus, including state guidelines and nexus tax laws.

What is sales tax nexus?

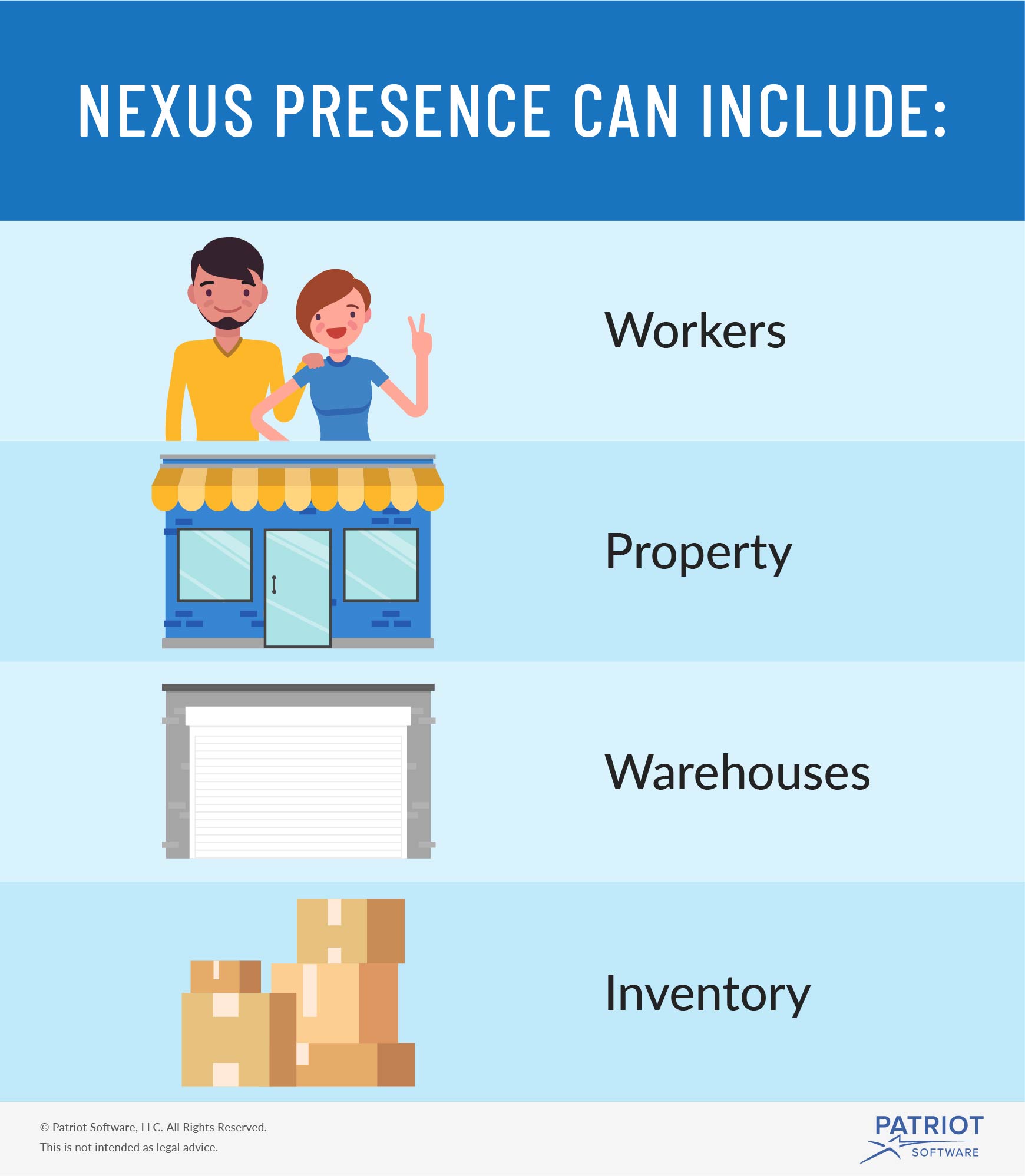

Sales tax nexus determines whether a business has a significant presence in an area to collect sales tax. Nexus presence includes your business, employees, warehouses, and inventory. Sales tax nexus requires companies doing business in a state to collect and pay sales tax in that specific state. For example, if you sell goods or services in Boston, you must file and pay Massachusetts sales taxes.

Permanent vs. temporary presence

A company’s presence can be permanent or temporary.

Permanent presence refers to a business that has a permanent physical presence or location. Owning or renting property and storing products at a location are considered permanent. When a business creates nexus in an area, the company becomes responsible for sales taxes in that city, county, or state.

Temporary presence is any place where an employee, owner, or other company representative conducts work on the business’s behalf. For example, a business may have sales representatives that travel to various states to sell products. When a worker travels for business, it may create a sales tax nexus in that area.

State guidelines for sales tax nexus

Nexus rules for sales tax purposes may depend on the state. Some states allow businesses to establish a substantial physical presence within a day. On the other hand, establishing a presence may take longer in other states.

For example, one state may determine a one-day trade show enough of a physical presence to create nexus, while another state may not.

Collecting nexus tax from different states

Collecting sales tax can get tricky. As a business owner, you need to know about each state’s nexus tax laws.

A general rule of thumb is to use the tax rate of the state where the item is delivered to (i.e., destination sales tax). However, this rule only pertains to mailing products to customers.

For sales made in person, businesses must use the location’s sales tax information. Use the current location’s sales tax rate for any in-person purchases.

Also, be aware of sales tax holidays. A sales tax holiday may include a tax-free weekend, day, or entire week, depending on the state you have nexus in.

For states that you have nexus in, you must get a sales tax permit from that state’s department of revenue. Sales tax rates vary depending on the state and locality, so be sure to collect the correct rate.

After collecting sales tax, remit the tax to the correct government agency (e.g., Department of Revenue). Check with your state to determine where to remit your sales tax.

You can review more information about nexus tax laws for sales tax on the Federation of Tax Administrators website.

Nexus sales tax for online sales

As technology evolves, regulations for nexus sales tax do, too. Accounting for online sales is even more complicated when you factor in nexus sales tax.

Your business’s nexus determines how much sales tax you collect on internet sales. Business owners must collect sales tax on internet sales if the company has nexus in the state of delivery. For example, an Ohio-based company with a customer in Ohio has nexus and must charge sales tax.

Do not collect sales tax if a state does not enforce sales tax. States that do not collect sales tax include Alaska, Delaware, Montana, New Hampshire, and Oregon.

In the past, if your business did not have nexus in a state, sales tax collection was not required. However, in 2018, the Supreme Court ruled that businesses that make online sales need to collect sales tax from customers in other states. For example, say a retailer in Michigan sells goods to a customer in Idaho. The Michigan retailer must calculate and collect Idaho sales tax.

Check with your state for nexus rules regarding e-commerce businesses. Consider checking with an accountant before collecting sales tax.

Do you need a way to track your business’s transactions? Patriot’s online accounting software is easy to use for tracking income and expenses. And, we offer free, U.S.-based support. Try it for free today!

This article has been updated from its original publication date of 1/6/2015.

This is not intended as legal advice; for more information, please click here.