Filling out the Tax Authorization Form for Payroll Tax Service

Background

When you sign up for the payroll tax service as a Full-Service Payroll customer, you need to electronically sign IRS Form 8655 to authorize Patriot Software as your Reporting Agent to deposit and file your federal and state taxes (if applicable) on your behalf. You can fill out the form as a PDF on the computer. You will sign this in the setup wizard on the Tax Filing Setup step. If you have already been through the wizard, you can find this under Settings > Tax Service Settings > Federal/State Forms.

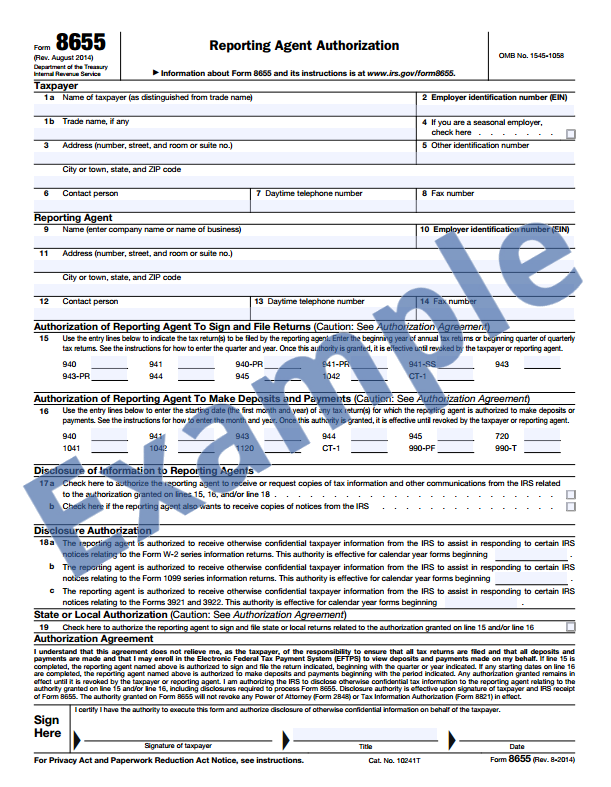

The Reporting Agent Authorization gives Patriot Software authority to file certain federal payroll tax forms and communicate with taxing authorities. Here is an example of the IRS 8655 Form:

Verifying Your Personal Identity for Electronic Signature

To confirm your personal identity, an owner or officer of the business must enter personal information including home address, date of birth, Social Security number, and government-issued ID number. Enter the required information and click “Verify Identity.”

Once the verification has passed, you can now review and electronically sign IRS Form 8655.

- Click “Preview Unsigned Form 8655” to download a PDF of the unsigned form. The form will be pre-filled with all required information. This is just for information only so you can see the form you will be electronically signing. You do not need to sign this hard copy.

- Back on the screen, check the box to certify you have the authority to electronically sign the 8655.

- Click Submit.

Once you have submitted it, you will see a message “We have received the IRS Form 8655.” You can now download the electronically signed PDF for your records. You can also upload a new file if needed. Click “Continue” once you are ready to move on.

Depending on your state, you may need to complete additional third-party administrator forms. There will be state-specific instructions for each state website login that gives Patriot Software permission to file state taxes on your behalf. Once you have followed the instructions, check the box at the bottom of the page “I have completed the above steps for Patriot Software to file on my behalf.”

At this point, your part is done, and now it’s our turn to confirm your information and process your forms. When Patriot has finished processing and approved your forms, you will receive an email notification to log back into the wizard and continue the Full Service Payroll setup process.