From time to time, you may need to raise prices in your business to keep up with production or offset business expense increases. But what if you’re hit with a price increase? What do you do?

Whether it’s a supplier, service provider, or another vendor you work with, a price increase can be crippling in business. Not to mention, it may force you to raise prices in your business, causing a vicious cycle.

Fortunately, you don’t have to take price hikes lying down. Despite supply chain issues, you do have options, and we’re here to go over what they are.

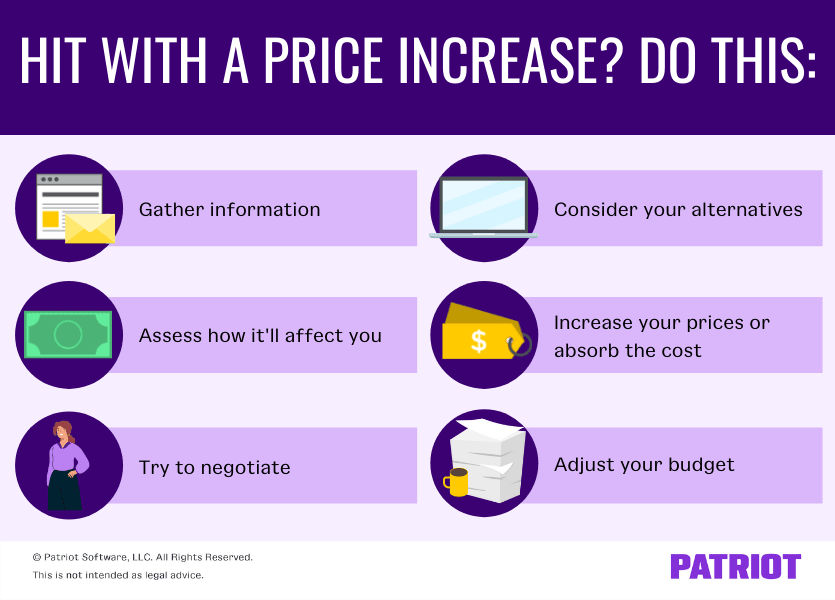

6 Steps to take if you’re hit with a price increase

If you think your business-to-business (B2B) vendors won’t charge you more now, soon, or sometime in the future, think again. The biggest indication? Consumer prices are increasing because businesses themselves are seeing rising prices in raw materials.

Here’s the rundown of consumer price increases in the 52-week period leading up to April 10, 2021:

- General merchandise: 7.1%

- Baby care: 7.0%

- Household care: 5.2%

- Grocery: 2.6%

At some point, your business might get a price raise notification from your vendors or suppliers, too. And if you do, avoid panicking or getting frustrated. Instead, follow these six steps.

1. Gather as much information as you can

Start by getting more information on why your vendor or supplier is raising prices. Are you getting additional services? More value? Are they trying to keep up with supply chain issues or low inventory?

Like any business, your vendor or supplier might issue a price hike to:

- Hire more employees

- Add value

- Keep up with industry trends

- Make a strategic change

- Deal with increased business costs

If a vendor is hitting you with a price increase because the cost of the materials is increasing, do some research. You might ask for a cost breakdown to help you determine if the hike is fair or not.

Some other information you should gather (if the vendor skimped out on details when notifying you) is:

- Whether the price increase is temporary or permanent

- When the raise takes effect

- Whether it’ll impact any existing orders you have

2. Assess how it’ll affect you

After getting all the information you need about the price hike, map out how it will impact you. That way, you know whether it will impact your business’s bottom line and if you can afford it.

Put together your:

- Current monthly total with existing pricing

- Annual total with existing pricing

- Monthly total with the new pricing

- Annual total with new pricing

If you realize there’s a significant difference in your long-term costs, you can use this information for a price negotiation with the vendor or start researching alternative products or services that better fit your expectations.

3. Try to negotiate

Prices can be negotiable. Before jumping to conclusions that the price increase is the price you have to pay, talk with your vendor or supplier. In some cases, you may be able to negotiate the price or your payment terms.

If you have a longstanding relationship with the vendor, they might be willing to work with you to keep your business. They might not be able to charge you the same price you’ve always paid, but they might meet you in the middle.

So, do you know how to negotiate with vendors and suppliers? Here are some questions you might ask:

- Having done business with you for X years, can I be grandfathered in, at least temporarily?

- Can you provide a discount on the new price?

- Is there an alternative product or service that is less expensive you can offer?

- Are you willing to provide me a discount on other products or services?

- What other value are you able to offset the costs of this price hike (e.g., free shipping)?

When negotiating, try not to get heated, even though tensions might be high. Keep the conversation respectful and fact-based to highlight your strong working relationship with the vendor or supplier.

4. Consider your alternatives

If the negotiations don’t pan out (or if you decide to skip them), it might be time to start shopping around.

When considering your alternatives, Gergo Vari, CEO at Lensa offers the following suggestion:

Find alternative vendors and obtain quotes from them on similar products or services, then compare your current supplier’s revised cost to the different bids. If a better deal can be found elsewhere, and your current vendors won’t price-match, be willing to switch suppliers.”

When considering alternative vendors, pay attention to:

- Your budget

- Your business needs

- What prospective vendors offer

- Whether you are able to lock in prices

Depending on what product or service the price increase is on, your best alternative might be to cut it out as a whole. You may be able to do business without it. For example, you might be able to get rid of certain subscriptions, memberships, or unnecessary office supplies.

5. Increase your prices or absorb the cost

Can’t find a better price out there? Aren’t able to negotiate as low of a deal as you want? In that case, your next step is deciding whether you want to increase your business’s prices (aka charge customers more) or absorb the cost.

If you opt for charging customers more, keep in mind that you could wind up losing some of them. Your customers may be upset by the price increase and either try to negotiate with you or shop around for alternatives.

On the other hand, if you absorb the cost, you could lessen your profits and wind up hurting business growth.

To help you make the best decision for your business, you should:

- Weigh the pros and cons of increasing prices and absorbing the costs

- Do research on industry trends, competitor prices, and your target market

If you decide to raise your prices, be upfront with your customers when you explain the changes. And, consider whether you can add something of value.

6. Adjust your budget

Whatever happens, your next step is to adjust your small business budget. If you decide to stay with the vendor, factor the price increase into your budget. If you choose another vendor or cut the expense as a whole, update your projected expenses.

You also need to adjust your budget to account for whether you increase your business’s prices or absorb the cost. Last but not least, remember to annotate the change so you can explain budget changes to investors or lenders, if applicable.

This is not intended as legal advice; for more information, please click here.