AI (artificial intelligence) has been a game-changer for everything from speech recognition to language translation and … accounting? Yes, AI in accounting continues to transform the process of bookkeeping. How so?

Many accounting software platforms use AI to streamline tedious accounting tasks like data entry and bank statement reconciliation. Want to learn more about it? Read on for your starter guide to artificial intelligence in accounting.

What is AI in accounting?

First and foremost, what exactly is AI? According to Britannica, artificial intelligence is:

The ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings … such as the ability to reason, discover meaning, generalize, or learn from past experience.”

Both accountants and businesses use artificial intelligence systems to streamline mundane and repetitive tasks. Although AI isn’t a substitute for accounting tasks that require complete accuracy or professional advice, it can act as a supporting tool to save time.

Machine learning in accounting

Artificial intelligence in accounting software often comes in the form of machine learning, which is a type of AI. Machine learning is the process of giving machines data so they can learn from the data and make suggestions based on it.

Let’s look at an example. When you purchase something online, you may receive recommendations for other items based on your purchase. The system uses machine learning to make suggestions based on what other people with “similar interests” have bought.

In accounting software, machine learning can make labeling and grouping suggestions based on what other users have done.

Benefits of artificial intelligence in accounting software

As a business owner, you may be wondering how AI in accounting can help you. If you use accounting software, your system may have AI to help you:

- Categorize transactions in the right accounts

- Reconcile accounts (e.g., bank statement reconciliation)

- Spot data entry errors

- Automatically match data

- Identify security threats

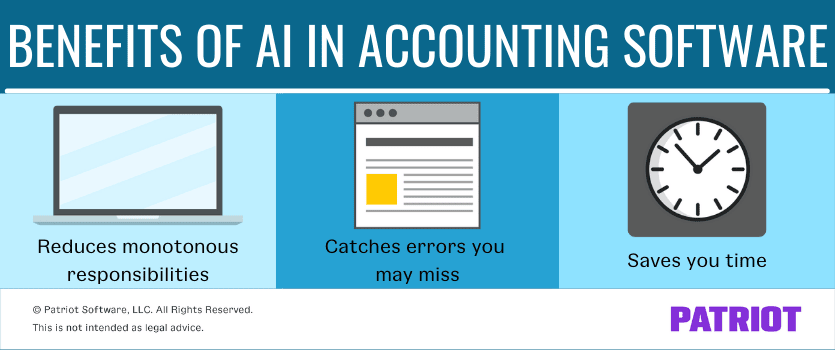

In short, AI can handle and streamline a number of accounting tasks. Take a closer look at three main benefits of AI accounting.

1. Reduces monotonous responsibilities

Let’s face it: Data entry is time-consuming. It can suck up time that you could better spend growing your business.

For example, Patriot Software’s Smart Suggestion streamlines the process of categorizing transactions during bank imports. You must categorize each transaction under the correct accounts. But with Smart Suggestion, you don’t have to manually select accounts. The machine learning feature makes account categorization suggestions based on the same or similar transactions other users have had. Your responsibility? Simply accept or dismiss the suggestions.

Other smart features in accounting software that can reduce monotonous responsibilities include:

- Automatic bank transaction imports

- Recurring invoices

- Automatic invoice payment reminders

Keep in mind that artificial intelligence accounting doesn’t remove you from the equation. Generally, you need to approve or decline suggestions and categorizations, so be ready to still carve out some time for your responsibilities.

2. Catches errors you may miss

Something out of the ordinary? AI in accounting can help spot irregularities you may have otherwise missed.

Not only can this help you catch harmless data entry errors, but it can also alert you to security threats.

3. Saves you time

At the end of the day, one of the biggest benefits of machine learning in accounting is time savings.

Smart features can streamline the process of reconciling and categorizing accounts so you can focus on what matters most: your business.

This is not intended as legal advice; for more information, please click here.