If you have employees, you need a reputable system for processing payroll, withholding taxes, and maintaining accurate records. There are a few ways you can run payroll, and each comes with its own price tag. So, what’s the cost of payroll?

Payroll pricing varies from a few dollars to thousands per month. Read on for an overview of payroll tasks, methods you can use to run payroll, and payroll services cost.

Overview of payroll tasks

Before we dive into payroll services pricing, let’s recap everything that goes into the payroll process. That way, you know what your payroll fees are going toward, after all.

When you have employees, running payroll is mandatory. And for many small business owners, payroll can cause administrative headaches.

Employers are responsible for these payroll obligations:

- Adding new hires to payroll

- Tracking employee hours worked and calculating gross pay

- Determining tax withholdings and deductions

- Paying employees

- Remitting taxes to the proper agencies

1. Adding new hires to payroll

Bring on a new employee? Great! But if you want to pay them, you need to add new hires to your payroll. And to determine how much to withhold from their wages in taxes, you must collect new employee forms.

Collect Form W-4, Employee Withholding Certificate, so you know how much to withhold in federal income tax. And, you may need to collect state W-4 forms for accurate state income tax withholding.

When you hire an employee, you also need to do new hire reporting. This is a process where you report all newly hired employees to your state.

2. Tracking employee hours worked and calculating gross pay

Each pay period (e.g., biweekly), you need to track the hours each employee works. This includes any overtime hours worked, vacation time, etc.

Use the employees’ hours worked to calculate their gross wages for the pay period. Gross pay is the base amount an employee earns before you withhold taxes and other deductions (e.g., insurance premiums). This is not the amount you pay the employee.

3. Determining tax withholdings and deductions

How much do you know about employment taxes? Typically, you must withhold the correct amount from each employee’s wages for payroll and income taxes:

- Federal income tax

- State income tax

- Local income tax

- Social Security tax

- Medicare tax

- State-specific taxes, if applicable

Keep in mind that you also must pay employer taxes, including a matching Social Security and Medicare tax portion, federal unemployment tax, and state unemployment tax.

Want to give employees popular benefits, like health insurance and retirement plan options? If so, employees typically opt into coverage, which determines how much you need to deduct from their paychecks (and contribute, if applicable).

4. Paying employees

After you determine how much the employee’s taxes and other deductions are, subtract the amounts from their gross pay. This is the employee’s take-home pay, or net pay.

To give the employee their net pay, you can choose from the following payment methods:

- Direct deposit

- Check

- Mobile wallet

- Cash

- Payroll card

5. Remitting taxes to the proper agencies

After paying employees, your responsibilities aren’t over. You must file payroll forms and deposit the withheld payroll and income tax amounts with the IRS and state and locality (if applicable). How often you file and remit taxes depends on your depositing schedule.

You also need to remit employer taxes.

Methods to run payroll

The cost of payroll (aka the cost of managing the above steps) depends on how you run payroll. So, how do employers run payroll?

There are three ways you can run payroll:

- Hire a professional

- Manage payroll by hand

- Use software

Hiring a professional

Hiring someone is the most expensive payroll service. When you hire a professional, you don’t need to worry about running payroll. Instead, you hand off your employees’ information and let the professional do the rest.

Professionals may charge a percentage of each employee’s wages. The cost of payroll services for small business with a professional depends on the number of employees you have and the services you sign up for.

When it comes to hiring a professional, you have a couple of options. You can outsource to an accountant who offers payroll services or a professional employer organization (PEO).

Managing payroll by hand

Yes, you can do your own payroll. And, running payroll on your own is the least expensive option—at first glance. You don’t need to use a payroll service, saving you significant money. But, doing payroll by hand is the most time-consuming method.

Doing your own payroll by hand can also lead to errors. Errors can mean penalties or even legal fees for your small business.

When you run payroll by hand, the direct costs you need to worry about depend on how you pay employees. If you pay employees via direct deposit, you have to pay fees. You might need to pay a transaction fee each time you transfer money into an employee’s account. This could range from $1.50 – $1.90 per transaction. Setup fees may range from $50 – $149.

If you pay employees via checks, you need to pay for the cost of check stock. If you print checks, you must also pay for the cost of ink.

Additionally, you must create a time and attendance system that lets you keep track of employee hours. And, you need to withhold and file taxes on your own, which can be time consuming.

Using software

Using software is a good middle ground between hiring a professional and managing payroll by hand. How much do payroll services cost if you use software?

The cost of payroll services for small business depends on a number of factors, such as:

- The software provider you use

- How many employees you have

- Features you want in the software

- Whether you use full-service payroll software

Some software providers charge per employee or each time you run payroll. For online payroll software, you typically pay a monthly fee. This monthly fee might include free direct deposit, which saves you from the transaction fee each time you run payroll.

Your payroll service pricing also depends on the types of features you want in your software. Full-service payroll is more expensive than basic payroll systems because the payroll does more, like filing taxes on your behalf.

Do some research and shop around before deciding on a software provider. If possible, take advantage of free trials and avoiding signing up for long-term contracts until you are positive the software is the right choice for your business.

How much does payroll cost?

Again, there is not a standard payroll services cost. Your payroll fees depend on what method you use to run payroll, after all. But, you can use research to see how much other small businesses pay.

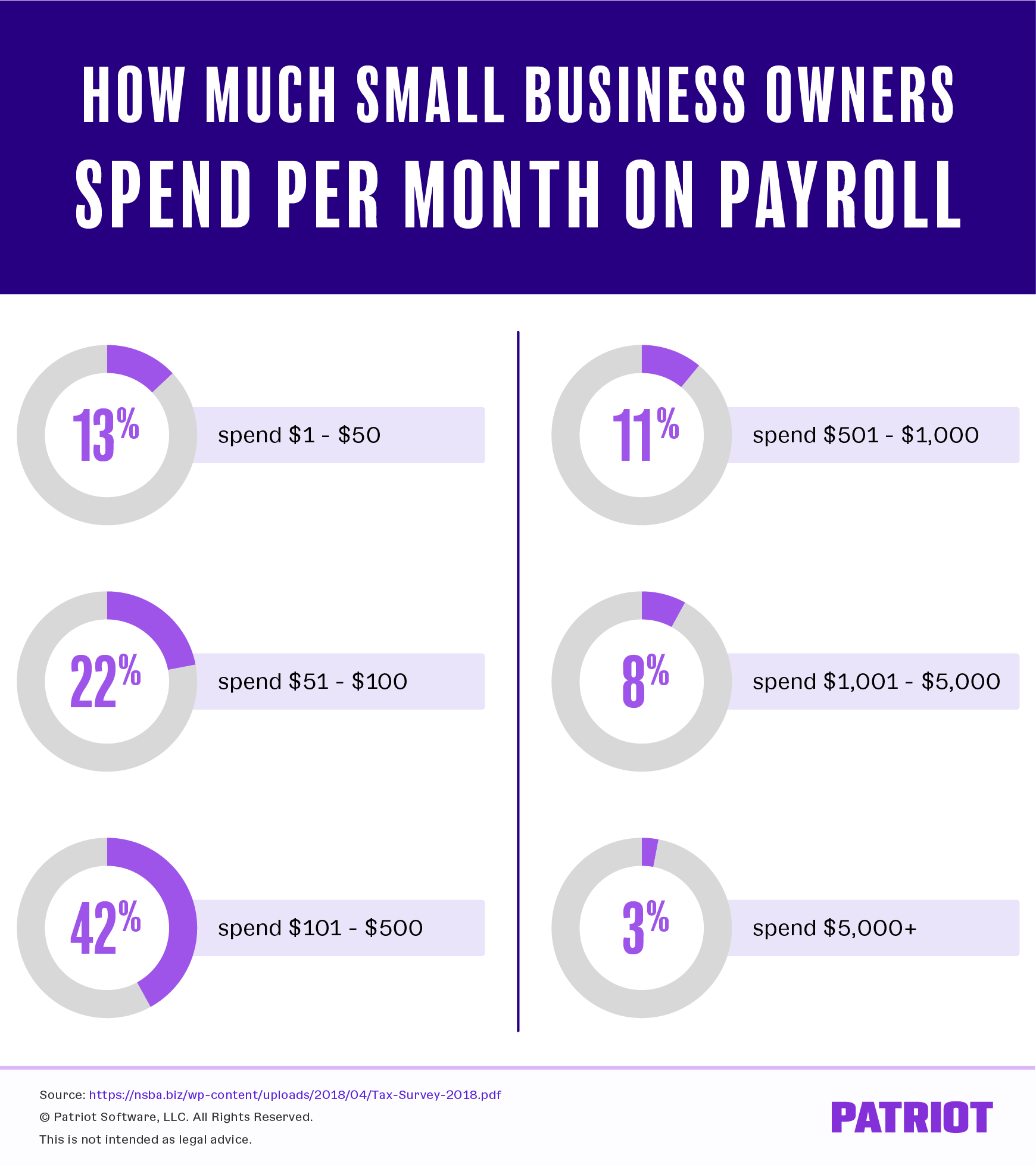

The National Small Business Association’s Small Business Taxation Survey asked small companies about the cost of payroll services. To get their results, the NSBA polled small business owners in different industries and localities.

Small business owners said they spent the following per month on payroll services:

- $1 – $50: 13%

- $51 – $100: 22%

- $101 – $500: 42%

- $501 – $1,000: 11%

- $1,001 – $5,000: 8%

- $5,000+: 3%

Assessing payroll services cost

So, how much will your payroll services for small business cost? Before determining your expenses, remember that the following affect payroll services rates:

- Type of payroll service you use

- Number of employees

- Tasks needed

Like anything, research your options before deciding on a payroll service.

This article has been updated from its original publication date of December 1, 2017.

This is not intended as legal advice; for more information, please click here.