Hiring employees can be exciting, especially if it means your business is growing. But if you’re hiring someone under 18 years old, you need to know child labor laws. Why? Because the employment of minors carries stricter regulations than adult employment. Not to mention, ignoring child labor laws can result in penalties from the federal government.

Who makes child labor laws?

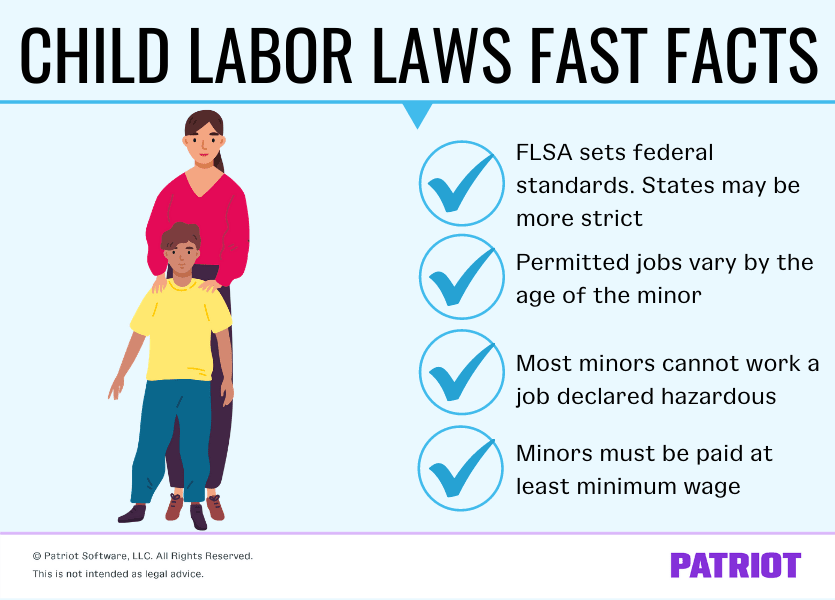

The federal government sets U.S. child labor laws under the Fair Labor Standards Act (FLSA). While the FLSA sets basic requirements, the Department of Labor (DOL) has more specific child employment laws. And, the DOL enforces the FLSA rules for teens in the workplace.

States can also establish child labor laws. If your state has its own regulations for child employment, you must follow the laws that are more protective of the minor employee.

What jobs can minors do?

How old do you have to be to work? Well, the legal working age for minors depends on the industry. And, the work the minor can perform varies based on the age of the employee. However, you may not employ minors for any work declared hazardous by the Secretary of Labor. Hazardous jobs include:

- Operating a motor vehicle

- Using power-driven machinery or tools*

- Demolition

- Roofing

- Trenching

- Mining

- Manufacturing brick, tile, and related materials

*Power-driven machinery covers a variety of tools, such as bakery machinery, balers, chainsaws, etc. Use the DOL’s resources for more information.

Minors can work in both agricultural and non-agricultural jobs. Some examples of jobs children can do include:

- Under age 14: Delivering newspapers, babysitting, acting or performing, performing non-hazardous jobs for their parents’ business, and doing non-hazardous farm work

- Ages 14 or 15: Working in retail, tutoring, delivering (by foot, bicycle, or public transportation), dishwashing, doing yard work (but cannot use power-driven mowers, cutters, etc.), and stocking items

- Ages 16 or 17: Any non-agricultural job the Secretary of Labor does not list as hazardous and any agricultural job regardless of hazard

Once an employee turns 18 years of age, they can work any job, including hazardous positions.

What hours can minors work?

Like what jobs minors can do, minors’ working hours vary based on age. And, hours can vary if school is in session.

Under FLSA child labor laws, minors 15 years old and under may only work outside of the hours that school is in session. Employees in this age range can only work:

- A maximum of three hours per school day, including Fridays

- 18 hours per week when school is in session

- Up to 40 hours when school is not in session (maximum of 8 hours per day)

- Between 7 a.m. and 7 p.m. (between 7 a.m. and 9 p.m. from June 1 through Labor Day)

Minor employees ages 16 or 17 can work unlimited hours under FLSA regulations. However, your state may have laws that are more restrictive. If your state is more strict than the FLSA regarding work hours, you must follow your state laws.

How much do you have to pay minors?

The FLSA requires that you pay minor employees at least minimum wage. The current federal minimum wage is $7.25 per hour. Your state or local minimum wage may be higher than the federal. If your state or local minimum wage is higher, you must pay that minimum wage (whichever is the highest).

Minors employed as babysitters do not have to be paid the minimum wage.

For employees 20 years old and under, the FLSA has a youth minimum wage of $4.25 per hour. During the first 90 continuous calendar days of employment, you may pay minors $4.25 rather than the federal, state, or local minimum wage. If your state has a youth minimum wage that is lower than the federal youth minimum, you must pay the higher wage. After 90 calendar days, the law states that you must pay the standard minimum wage.

Under the FLSA, the 90 calendar days of employment are consecutive. If an employee leaves before the 90 calendar days expire and returns to work after what would have been their 90th day of employment, do not reset the 90 days. Instead, pay the employee the standard minimum wage.

Some states may have laws that do not allow a youth minimum wage. If your state does not permit you to use a youth minimum wage, you must pay at least the minimum wage required by law.

How should minors be paid?

Again, minors must be paid at least minimum wage. However, you can pay minors in a variety of ways as long as the total rate equals at least the minimum wage, including:

- Hourly

- Piece rate

- Day rate

- Salary

- A combination of the other rates

How frequently must minors be paid?

The FLSA does not regulate how often a minor employee must be paid. However, you must follow state pay frequency requirements to determine how often you must pay minor employees.

What are the other requirements?

Like with all employees, you must verify that the minor is legally allowed to work in the United States. To do so, have your employee fill out Form I-9. And, have employees fill out Form W-4 and any state tax withholding forms so you know how much to withhold in income taxes from their pay.

Some states require minors to have a work permit or age certificate. The FLSA does not have laws regarding permits or certificates for minors to work. However, the FLSA can issue a work permit or age certificate to the minor employee if the employer requests documentation.

Does your state require work permits for minors? If so, you must request the permit from the minor employee before they begin their employment. Failure to obtain the work permit may result in fines or penalties for the employer.

Rest or meal breaks for minors

Like adult employees, you do not have to provide meal or rest breaks to minors under federal law. However, if you do provide breaks to your employees, you must compensate minors the same way you would for employees who are not minors. Include rest periods, typically five to 20 minutes, in compensation. You do not have to compensate for meal periods (typically 30 to 60 minutes).

If your state has stricter laws regarding rest or break periods, follow the state laws.

Hiring minor employees? Patriot’s online payroll seamlessly integrates with our HR software and time and attendance add-ons so you can store work permits and track hours all from one login. Start your free trial today!

This article is updated from its original publication date of September 16, 2015.

This is not intended as legal advice; for more information, please click here.