Your cash flow statement can give you an idea of your business’s current financial health. But, wouldn’t it be nice to see your company’s future cash flow? You don’t need a crystal ball to view your cash flow’s future. Instead, create a cash flow projection. Read on to learn about cash flow projection and how to project cash flow.

What is cash flow projection?

First things first, if you want to learn about cash flow projections, you need to know what cash flow is.

Cash flow is the amount of money going in and out of your business. Healthy cash flow can help lead your business on a path to success. But poor or negative cash flow can spell doom for the future of your business.

If you want to predict your business’s cash flow, create a cash flow projection. A cash flow projection estimates the money you expect to flow in and out of your business, including all of your income and expenses.

Typically, most businesses’ cash flow projections cover a 12-month period. However, your business can create a weekly, monthly, or semi-annual cash flow projection.

Advantages of projecting cash flow

Estimating anticipated cash flow projections can help boost your business’s success.

Projecting cash flows has many advantages. Some pros of creating a cash flow projection include being able to:

- Predict cash shortages and surpluses

- See and compare business expenses and income for periods

- Estimate effects of business change (e.g., hiring an employee)

- Prove to lenders your ability to repay on time

- Determine if you need to make adjustments (e.g., cutting expenses)

Cash flow projection isn’t for every business. Your projected cash flow analysis can be time-consuming and costly if done wrong.

Keep in mind that cash flow predictions will likely never be perfect. However, you can use your projected cash flow as a tool to help manage cash flow.

The bottom line is, your cash projections give you a clearer picture of where your business is headed. And, it can show you where you need to make improvements and cut costs.

How to calculate projected cash flow

If you’re ready to start calculating projected cash flow for your business, start gathering some historical accounting data.

You need to get reports detailing your business’s income and expenses from your accountant, books, or accounting software. Depending on the timeframe you want to predict, you might need to gather additional information.

Want to learn how to calculate cash flow projections? Use the projected cash flows steps below.

1. Find your business’s cash for the beginning of the period

To calculate your cash from the beginning of the period, you need to subtract the previous period’s expenses from income.

Cash at Beginning of Period = Previous Period’s Income – Previous Period’s Expenses

2. Estimate incoming cash for next period

Next, you need to predict how much cash will come into your business during the next period.

Incoming cash includes things like revenue, sales made on credit, loans, and more.

You can forecast future cash by looking at trends from previous periods. Be sure to account for any changes or factors that differ from previous periods (e.g., new products).

3. Estimate expenses for next period

Think about all the expenses you will pay next period. Consider things like raw materials, rent, utilities, insurance, and other bills.

4. Subtract estimated expenses from income

To calculate your business’s cash flow, subtract your estimated expenses from your estimated income.

Cash Flow = Estimated Income – Estimated Expenses

5. Add cash flow to opening balance

After you calculate cash flow, you need to add it to your opening balance. This will also give you your closing balance. Your closing balance will carry over to act as your starting balance for the next period.

To complete the next period’s projected cash flow, repeat the steps from above.

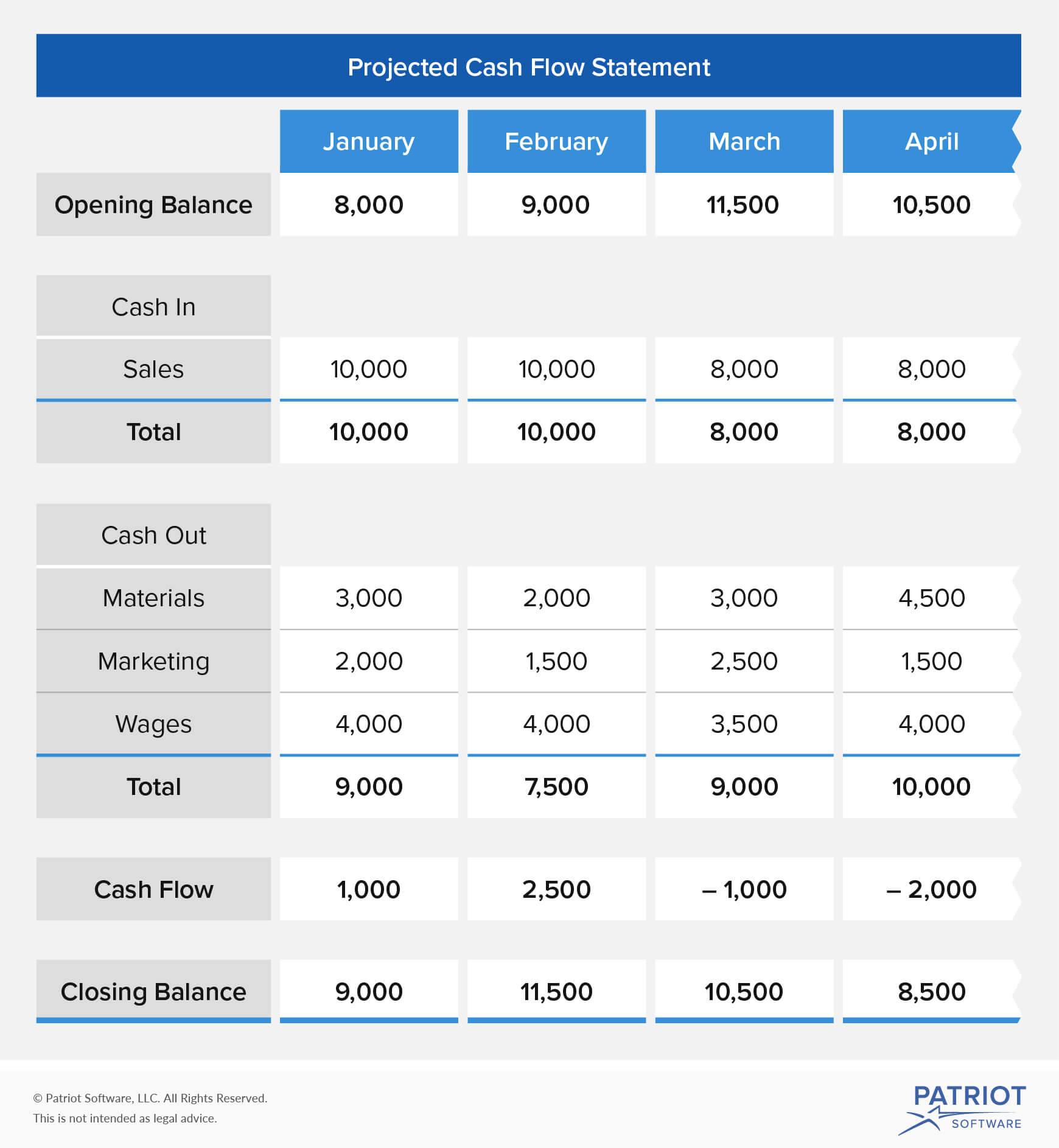

Confused? No worries! Take a look at an example of a project cash flow statement below:

Creating a projection of cash flow

If you want to create your own cash flow projection, start drafting out columns for your future periods. Or, you can take advantage of a spreadsheet to organize your cash flow statement projections.

You should include the following categories in your cash flow projection:

- Opening balance

- Cash in (e.g., sales)

- Cash out (e.g., expenses)

- Totals for cash in and cash out

- Uses of cash (e.g., materials)

- Total cash flow for the period

- Closing balance

- Periods (e.g., month of January)

After you lay out the sections on your cash flow projection report, plug in your projected cash flow calculations.

Revisiting your cash flow projection

Cash flow projections are not set in stone. Revisit your projection from time to time to see where you stand.

If you see major differences or flaws in your cash flow forecast, it may be time to crunch more numbers and do some digging. Pinpointing issues with your projection early on can prevent major inaccuracies in the future.

To ensure your projection stays as accurate as possible, consider variable expenses such as:

- Months with three paychecks

- Sales during peak seasons

- Months when premiums are due (e.g., insurance)

- Hiring additional workers

A good rule of thumb is to not project too far into the future. Too many variables can come into play with your business (e.g., dip in the economy) and affect your future cash flow.

As mentioned, a standard time period for cash flow projection is 12 months. Try to limit your cash flow projection time period to only a year in advance. That way, you can help prevent unforeseen expenses and errors impacting your projection.

If you don’t have time to track financial forecasts, consider delegating projection updates to a bookkeeper. Or, you can streamline the way you track cash flow with basic accounting software.

For an accurate cash flow projection, you need to receive and track customer payments. Patriot’s online accounting software lets you record your income and expenses to keep your finances in tip-top shape. What are you waiting for? Get started with your self-guided demo today.

We’re always ready to keep the conversation going. Give us a like on Facebook and share your thoughts on our latest articles.

This article has been updated from its original publication date of August 28, 2012.

This is not intended as legal advice; for more information, please click here.