Spring cleaning is a staple in households for a reason. Over time, things get pretty messy—especially when you’re busy. And in business, the same thing can happen to your accounting books. Do your books need tidying up? Use our bookkeeping clean-up checklist to get started.

In this article, we’ll go over:

- Why bad bookkeeping is bad for business

- How to fix bad bookkeeping: 6 Tips

- Bookkeeping clean-up checklist

Why bad bookkeeping is bad for business

What’s the big deal if your books are a little messy, anyway? Messy, incomplete, and inaccurate bookkeeping can lead to a slew of issues that cost more than just time. Bad bookkeeping can also lead to hefty IRS penalties and (gasp!) audits.

Here are some specific issues you may have to deal with as a result of messy books:

- Trouble getting business loans or investments

- Inaccurate picture of financial health

- Overwithdrawals

- Missed opportunities (e.g., tax deductions or credits)

- Penalties for inaccurate filings

- Inability to find key records

- Wasted time

- Inconsistencies in your records

In short, bad bookkeeping puts your time and money—and maybe even your business—on the line. If you find yourself dealing with any of the above issues, it might be time to give your books some TLC.

How to fix bad bookkeeping: 6 Tips

If you struggle with disorganization in accounting, you need to know how to fix bad bookkeeping.

Take a look at the following tips on how to clean up messy bookkeeping.

1. Check for data entry errors

You need to record every business transaction. And let’s be honest, there are a lot to record. So from time to time, you may wind up with data entry errors.

A data entry error takes place when you enter inaccurate information in your books. This could be due to mistakes like:

- Flip-flopping debits and credits

- Making transposition errors (e.g., writing 24 vs. 42)

- Entering the wrong numbers

Check for data entry errors to clean up and sort out your books. You can find these types of errors by double-checking your work and preparing trial balances at the end of each reporting period.

At some point, you might do the opposite of a data entry error, too. You may forget to record a transaction, which is an error of omission. Failing to record every transaction throws off your books (aka bad bookkeeping!).

To fix bad books due to errors of omission, comb through your records (e.g., receipts). Record any omitted entries in your books for the correct accounting period.

2. Reconcile your accounts

How often do you reconcile your accounting accounts (e.g., assets)? If you don’t reconcile your books with your external account balances (e.g., bank account), you’re going to be left with bad books.

Reconciling your accounts is the process of comparing what you record in your accounting books with the transaction on your bank or credit card statement.

The transactions should match. If they don’t, adjust your records to match your bank or credit card statement to your accounting entries.

For example, you may need to adjust your books to include:

- Bank service fees

- Non-sufficient funds checks

- Interest earned

Likewise, you might have to adjust your bank statement balance for:

- Deposits in transit (i.e., increase the bank statement balance by the deposit in transit amounts)

- Outstanding checks (i.e., subtract the outstanding check amounts from the bank statement balance)

So, how often should you do bank statement reconciliation? Try to aim for reconciling your accounts each month for tidy books.

3. Make adjusting entries

Adjusting entries are key for making sure you record transactions in the right accounting period. Again, you must make them after finding data entry errors and reconciling your books.

You can also create adjusting entries to record depreciation and amortization, an allowance for doubtful accounts, and accrued revenue or expenses.

There are three adjusting entries categories:

- Accruals: Revenues or expenses that have not been recorded or received or paid

- Deferrals: Revenues or expenses that have been recorded but not yet earned or used

- Estimates: Non-cash items, like an allowance for doubtful accounts

Prepare adjusting entries like you do regular journal entries. Simply debit one account and credit the other.

4. Look for duplicates

Spring cleaning is a time for decluttering. You know, getting rid of duplicate items that you may not need.

The same goes for your bookkeeping clean-up checklist. Find and remove duplicates to get rid of unnecessary clutter and save your books from inaccuracies.

A duplicate journal entry can show you have more or less money than you have. To find duplicates, reconcile your accounts.

5. Upgrade the way you manage your books

Often, messy books are the result of a poor recordkeeping process. For spick and span books, you might consider upgrading your tried-and-true spreadsheet or paper records to software.

Accounting software can help you keep your records in one accessible space. Plus, you can get features like automatic bank transaction imports, machine learning, and the ability to accept credit card payments. And, you can quickly generate key financial statements, like your P&L and balance sheet.

Using accounting software can help tidy up your books, streamline the way you manage them, and give you financial data at your fingertips.

6. Consult an accounting professional

Sometimes, you’re too busy for an accounting clean-up. Or, you may not know what you can do to fix them. An accounting professional can help you unravel and clean up accounting records.

Hiring an accountant can help:

- Free up your time

- Improve the accuracy of your books

- Give you peace of mind

- Fix accounting mistakes

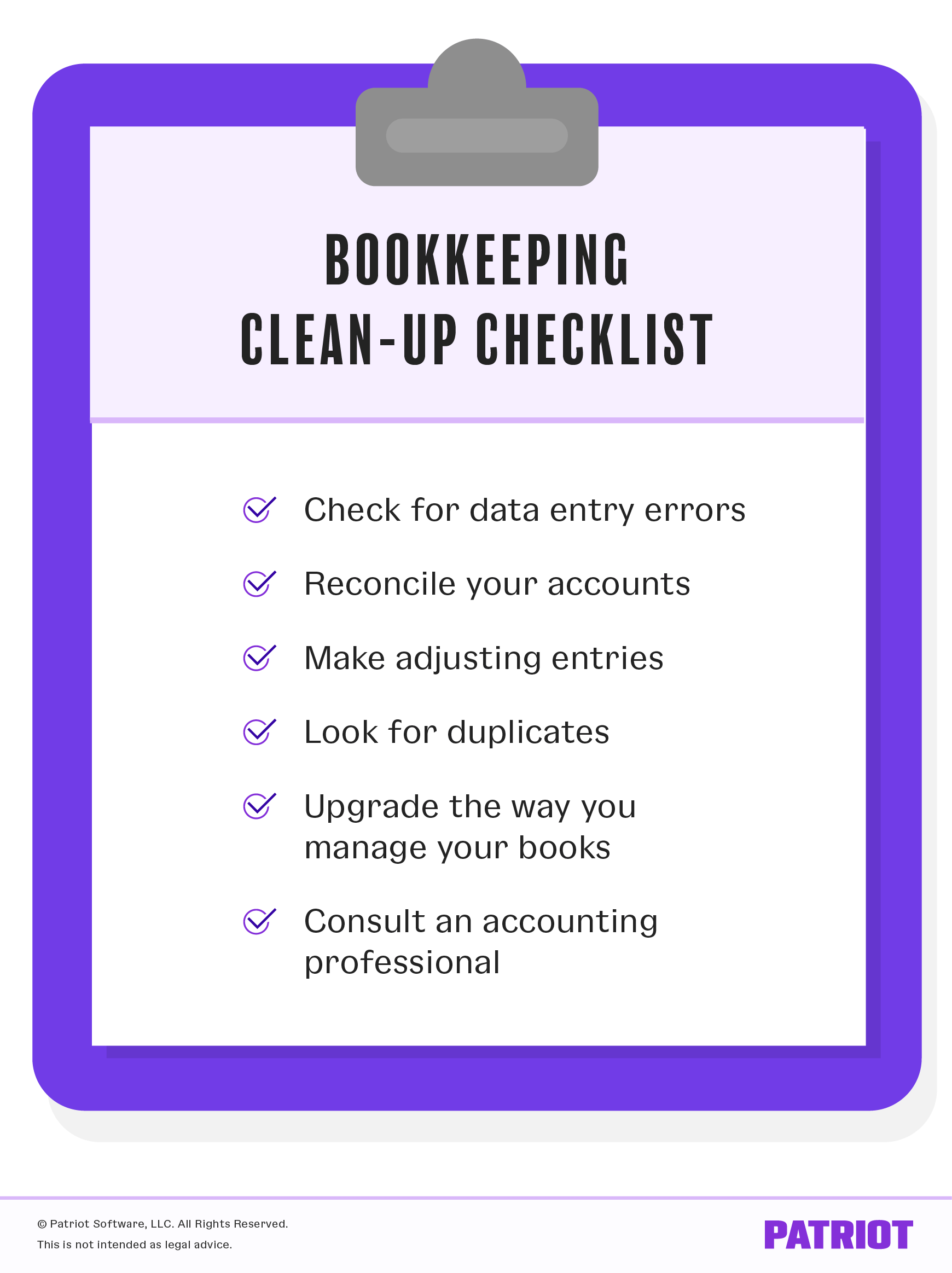

Bookkeeping clean-up checklist

When it comes to tidying up your books, create a checklist to help you track what needs done and cross items off your to-do list. To get started, use our bookkeeping clean-up checklist below.