Take out a business loan or have a mortgage for your brick-and-mortar? You may cringe when you see your business interest expense add up. But here’s a bit of good news—there’s a business interest expense deduction you may be eligible to claim (hooray!).

Read on to learn more about business interest expenses, including what types of interest expenses you can and can’t deduct in business.

What is a business interest expense?

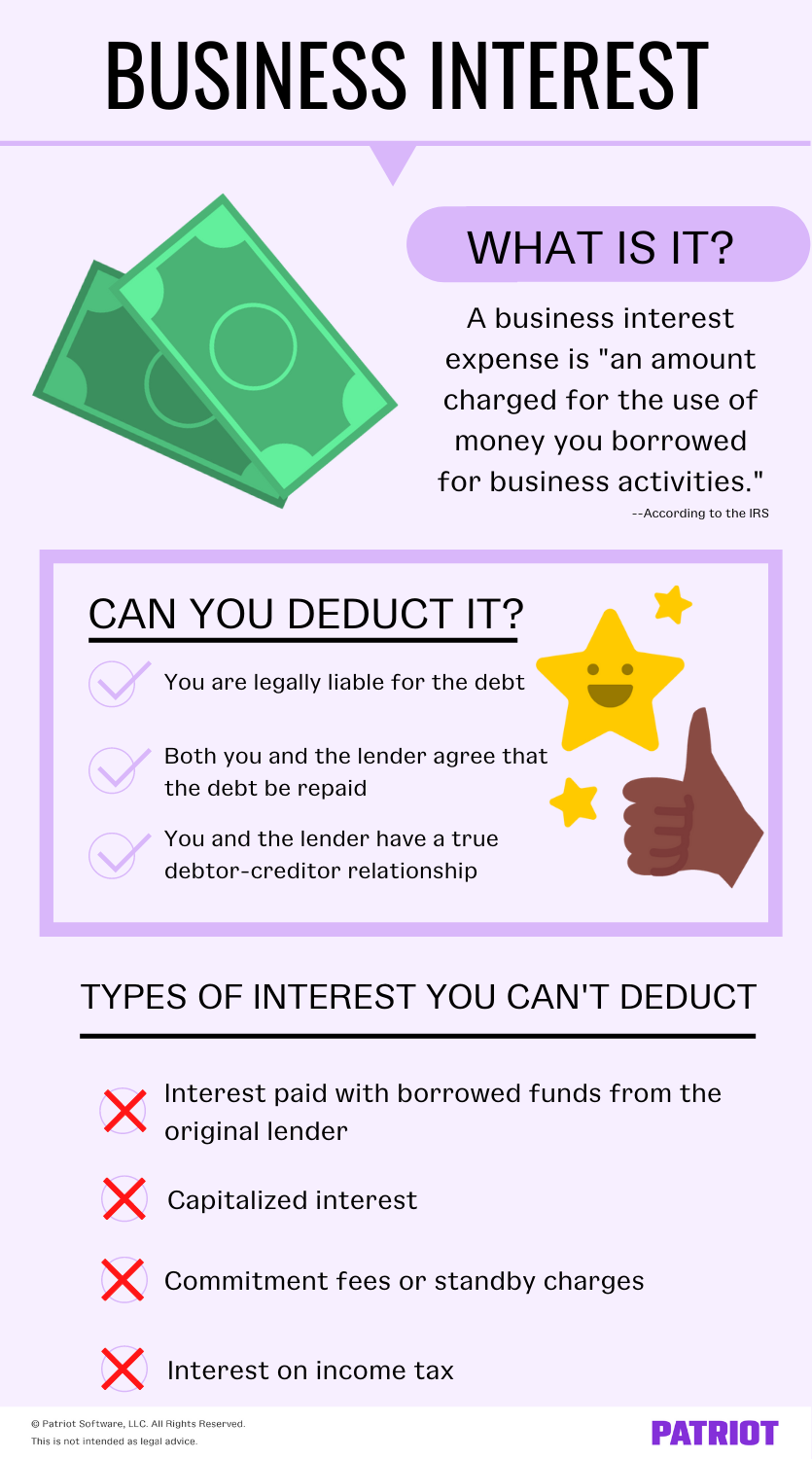

According to the IRS, a business interest expense is “an amount charged for the use of money you borrowed for business activities.” Business interest is interest that occurs on the proceeds of a loan for a trade or business expense, regardless of the type of property securing the loan.

In business, you likely accrue interest on:

- Loans

- Property mortgages

- Lines of credit

- Investment property loans

Yikes—the more loans and lines of credit you have, the more interest expenses you accrue. To help offset these high costs, businesses can claim a special interest expense deduction.

Deductible and non-deductible business interest

So, is business interest tax deductible all the time? Not quite.

Sure, the interest expense deduction is available—but only for certain types of business interest. Read on for the types of interest you can and can’t deduct.

Types of interest you can deduct

To deduct business interest on a debt, you must meet all three of the following requirements:

- You are legally liable for the debt

- Both you and the lender agree that the debt be repaid

- You and the lender have a true debtor-creditor relationship

For example, if you’re only liable for part of a business debt, you can only claim the deduction on your share of the total interest.

Here are some examples of the types of interest that are deductible:

- Mortgage interest on real estate you own

- Original issue discount (OID)

- Employment tax deficiency interest

Types of interest you can’t deduct

Again, you can’t deduct all types of interest payments—or payments you think might be interest. Generally, you can’t deduct interest that must be capitalized or personal interest.

Take a look at the following types of interest (and payments you may mistake for interest) you can’t deduct:

- Interest paid with borrowed funds from the original lender

- Capitalized interest

- Commitment fees or standby charges

- Interest on income tax

For more information on deductible and non-deductible interest, check out Publication 535, Business Expenses.

Interest expense deduction limitation

For many businesses, there is a limit to how much of an interest expense deduction you can claim. This limit is known as a section 163(j) limitation.

Qualifying small business taxpayers are not subject to the business interest expense limitation. To qualify for the limitation exemption, you must:

- Meet the IRS gross receipts test (aka you need average annual gross receipts of $26 million or less for the three prior tax years) AND

- Not be a tax shelter (as defined by the IRS)

If you are subject to the section 163(j) limitation, the maximum business interest expense deduction you can claim is limited to the sum of:

- Business interest income,

- 30% of the adjustable taxable income, AND

- Floor plan financing interest

Unable to claim the full amount of your business interest expense? Generally, you can carry the amount you don’t claim in one tax year to the following year as a disallowed business interest expense carryforward.

How to claim the business interest expense deduction

Eligible to claim the interest expense deduction? Great! Use your small business tax return to claim the deduction:

- Schedule C: Sole proprietors and single-member LLCs

- Form 1065: Partners and multi-member LLCs

- Form 1120: Corporations

If you’re claiming investment interest deductions, use Form 4952, Investment Interest Expense Deduction, to calculate the amount. Attach Form 4952 to your tax return.

Want to make it even easier to claim the deduction? Keep your books up-to-date throughout the year so you’re not scrambling at tax time to find documents.