Connecticut joined the paid family leave states when employers began handling Connecticut paid family leave contributions in 2021. Time has flown by and it’s now 2022. What does that mean? Employees in Connecticut can now apply for benefits from the state’s paid family leave program.

Read on to learn about the Connecticut’s paid family leave program.

Paid family leave recap

Paid family leave is a state-mandated regulation that requires employers to let employees take paid time off for qualifying events.

Under federal law, employers with 50 or more employees must provide unpaid time off for family and medical leave. This federal law is known as the Family and Medical Leave Act of 1993 (FMLA). However, FMLA does not require employers to give paid family and medical leave.

State-mandated paid family leave is increasing in popularity. A number of states have adopted their own law, including California, D.C., Massachusetts, Washington, and Connecticut.

Don’t confuse paid sick leave with paid family and medical leave. Some states have state-mandated sick time, which lets employees take time away from work to deal with shorter-term illnesses or injuries.

Connecticut paid family leave

Connecticut’s Paid Family and Medical Leave Program (CPFML) requires that employers provide their employees with paid leave.

Read on for a Q & A on CPFML.

Do all businesses have to participate?

Yes, all businesses employing at least one employee who works in Connecticut must participate in the state’s paid family leave program.

Although all businesses must participate, there is an alternative. Employers who want to provide benefits through a private plan can apply for an exemption. However, employees must receive at least the same level of benefits through the private plan as the state-mandated program.

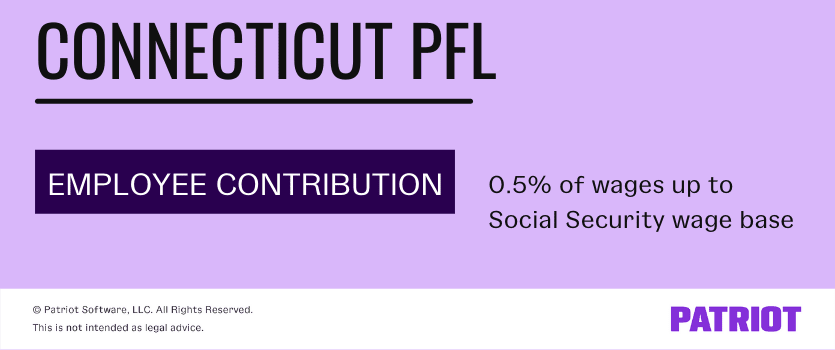

What is the contribution rate?

The paid leave program is funded through employee contributions. Employers do not contribute to the program. But, employers are responsible for withholding contributions from employee wages and remitting them to the state.

Connecticut’s paid family leave program is one-half of one percent (0.5%) of an employee’s wages. Withhold 0.5% of each employee’s gross wages until the employee earns above the Social Security wage base.

For 2022, the Social Security wage base is $147,000. Stay updated on the wage base, and stop withholding 0.5% when the employee earns above the wage base.

Let’s say an employee earns $2,000 biweekly. You would withhold $10 ($2,000 X 0.005) from their wages for CPFML and contribute it to the state.

What can employees use paid family and medical leave for?

Connecticut employees can take up to 12 weeks of paid family leave if they have a qualifying reason. Employees who need to take leave for a serious health condition during pregnancy may be able to take up to 14 weeks of paid leave.

Employees can use paid family and medical leave to:

- Deal with a serious health condition

- Care for a family member with a serious health condition

- Bond with a newly born, adopted, or fostered child

- Take more time for recovery during pregnancy or after childbirth (can apply for an additional two weeks of leave)

- Donate an organ or bone marrow

- Deal with a situation related to the military deployment of a family member

- Handle situations related to family violence

So, who is considered a family member? Connecticut defines the following as family members:

- Spouse

- Child

- Parent

- Parent-in-law

- Sibling

- Grandparent

- Grandchild

- Any individual related to the employee by blood

- Any individual who’s the equivalent of a family member

Contact the state for more information on CPFML.

Need help calculating Connecticut PFL contribution rates? You’ve come to the right place. With Patriot’s online payroll software, you don’t have to worry about computing contribution amounts or payroll taxes. Start your free trial now!

This article has been updated from its original publication date of August 19, 2019.

This is not intended as legal advice; for more information, please click here.