Year-end Checklist for 2022

The end of the year is a very busy time at Patriot, and wait times can be lengthy. To save you time, we highly recommend searching our Help Center first (or clicking the “Get Help” link at the top of any page in the software) before you reach out to Support.

Payroll Year-end Checklist

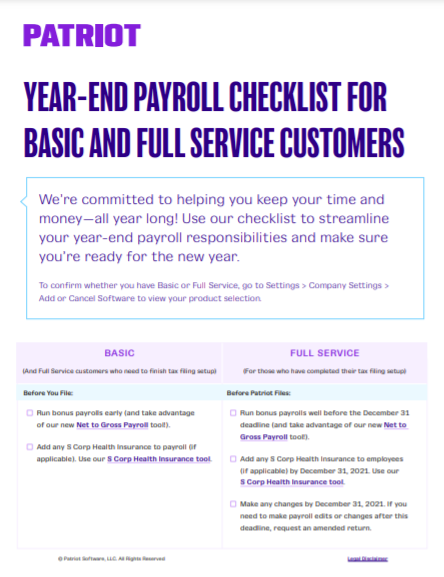

For a downloadable version of our Year-end Payroll Checklist for Basic and Full Service customers, follow these instructions:

- Click on the image of the Year-end Payroll Checklist PDF below.

- A PDF will open in a new tab.

- Right-click your mouse and “Save As” to download the PDF.

- You can email the PDF as an attachment or print it out.

Want to see the checklist without downloading it? Check out our year-end payroll checklist for Basic and Full Service Payroll customers below:

| Basic Payroll Responsibilities | Full Service Payroll Responsibilities |

|---|---|

| Run bonus payrolls early (and take advantage of our Net to Gross Payroll tool!). | Run bonus payrolls well before the December 31 deadline (and take advantage of our new Net to Gross Payroll tool!). |

| Add any S-Corp Health Insurance to payroll (if applicable). Use our S-Corp Health Insurance tool. | Add any S-Corp Health Insurance to employees (if applicable). Use our S-Corp Health Insurance tool. |

| Create and review W-2s for employees once all payrolls are in the system. Check out our help articles on how to do this. W-2s will be available for download in the software the week of January 1, 2023. You can use blank office paper (8 ½ X 11) or purchase blank W-2 forms here. Or, you can post W-2s to the employee portal if your employee gives their consent to receive W-2s electronically. Distribute W-2s to employees no later than January 31, 2023. | Make any changes by December 31, 2022. If you need to make payroll edits or changes after this deadline, request an amended return. |

| File Forms W-2 and W-3 with the SSA by January 31, 2023. Please refer to this help article on how to create a W-3 transmittal in the software. File Forms W-2 with your state (if applicable). | Create and review W-2s for employees once all payrolls are in the system. Check out our help articles on how to do this. W-2s will be available for download in the software the week of January 1, 2023. You can use blank office paper (8 ½ X 11) or purchase blank W-2 forms here. Or, you can post W-2s to the employee portal if your employee gives their consent to receive W-2s electronically. |

| File your 4th Quarter 941 and Federal Form 940 for FUTA by January 31, 2023. File state (and local, if applicable) forms. Patriot Software does not include state or local forms in the software. Please contact the government agencies for exact due dates. | Distribute W-2s to employees no later than January 31, 2023. |

| Give Forms 1099-NEC and 1099-MISC to contractors or vendors by January 31, 2023. 1099-NEC is due to the IRS and state by January 31, 2023. 1099-MISC is due to the IRS and state by February 28, 2023 (paper forms) and March 31, 2023 (electronically). File the 1099-NEC and 1099-MISC with any states that do not participate in the Combined Federal/State Filing program. Interested in e-Filing? Please read our help article on how to e-File and to get pricing. | Make sure all your 1099 payments are in the system and initiate 1099 e-Filing with the IRS and the states that participate in the Combined Federal/State Filing Program (no extra charge!). If you want to e-File both Forms 1099-NEC and 1099-MISC, you have until January 31, 2023 (Patriot will only e-File once). If you want to e-File only Forms 1099-NEC, you have until January 31, 2023. If you only have to e-File Forms 1099-MISC, you have until March 31, 2023. File the 1099-NEC and 1099-MISC with any states that do not participate in the Combined Federal/State Filing program. |

| Update your SUTA tax rate (if applicable). Update deductions and contributions (if applicable). Update workers’ compensation codes and rates (if applicable). | Distribute 1099-NEC forms to 1099 contractors no later than January 31, 2023. Distribute 1099-MISC forms to vendors no later than January 31, 2022. |

| Want us to collect, deposit, and file payroll taxes for you next year? Upgrade to our Full Service Payroll for 2022 (for just $20 more a month!). | Update your SUTA tax rate (if applicable). Update deductions and contributions (if applicable). Update workers’ compensation codes and rates (if applicable). |