Changes to W-2 reporting for tax year 2021? You can thank COVID-19, again. Read on to learn about reporting COVID pay on W-2 2021. And if you collected deferred employee Social Security tax, you need to know how to report that, too.

Form W-2 reporting changes

Each year, employers are responsible for reporting employees’ annual wages and withheld taxes on Form W-2. And, you might need to enter additional benefits like retirement plan earnings and third-party sick pay.

In 2020 and 2021, Congress enacted emergency pieces of legislation to financially help employers and employees. It’s your responsibility, as an employer, to report any employee wage and tax changes related to this COVID-related financial help.

So, what are the 2021 W-2 changes? You must report the following on an employee’s W-2:

- Paid COVID-19 sick or family leave

- 2020 Deferred employee Social Security tax that you’ve collected

| If you feel like things are getting more complex by the second, you’re not alone. That’s where Patriot’s online payroll comes in. We make it easy to run payroll, and when the time comes, you can post electronic W-2s for employees to view in their own portal (with employee consent) or print paper copies to distribute. Easy enough, right? |

Reporting COVID pay on W-2 2021

The Families First Coronavirus Response Act (FFCRA) and American Rescue Plan (ARP) provided paid sick and family leave to eligible employees.

Under the Families First Coronavirus Response Act, qualifying employers had to provide paid sick and family leave to eligible employees between April 1, 2020 and December 31, 2020. The Consolidated Appropriations Act extended paid sick and family leave tax credits under the FFCRA through March 31, 2021 and made providing leave optional for employers.

The American Rescue Plan again extended paid COVID leave tax credits through September 30, 2021. It also reset the paid leave limit on March 31, 2021. That way, eligible employees who hit the limit under the FFCRA could still take leave under the ARP (beginning April 1, 2021).

Confused? No worries. Here’s a breakdown of each leave extension and their timeframes:

- FFCRA paid sick and family leave: April 1, 2020 – December 31, 2020

- Employers had to report on W-2s for tax year 2020

- Extended FFCRA paid sick and family leave: January 1, 2021 – March 31, 2021

- Employers must report on W-2s for tax year 2021

- American Rescue Plan paid sick and family leave: April 1, 2021 – September 30, 2021

- Employers must report on W-2s for tax year 2021

Background

Before we go into reporting the paid leave on Form W-2, here’s a brief recap of the type of leave employees may have taken:

- Paid sick leave (self): Up to 10 days of paid sick leave at the employee’s regular rate of pay, up to a maximum daily rate of $511. Employees could use this COVID leave type if they were quarantining or isolating, receiving the vaccine, or dealing with vaccine complications.

- Paid sick leave (others): Up to 10 days of paid sick leave at two-thirds of the employee’s regular rate of pay, up to a maximum daily rate of $200. Employees could use this leave type to care for someone quarantining or isolating, receiving the vaccine, or dealing with vaccine complications.

- Paid family leave: Up to 10 weeks (FFCRA) or 12 weeks (ARP) at two-thirds of the employee’s regular rate of pay, up to a maximum daily rate of $200. Employees could use this type of leave to care for a child whose school, place of care, or childcare provider closed or was unavailable due to COVID-19.

If you doled out one or more of the above coronavirus paid sick or family wages to employees, report the amounts on Form W-2.

Keep in mind that you’ll only be reporting paid leave taken in 2021 on the 2021 Form W-2. You should have reported paid leave taken in 2020 on the 2020 Form W-2.

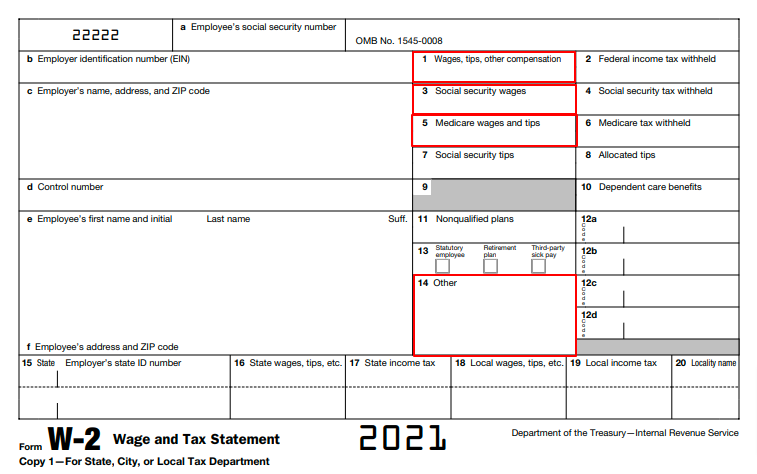

Where to report paid leave on Form W-2

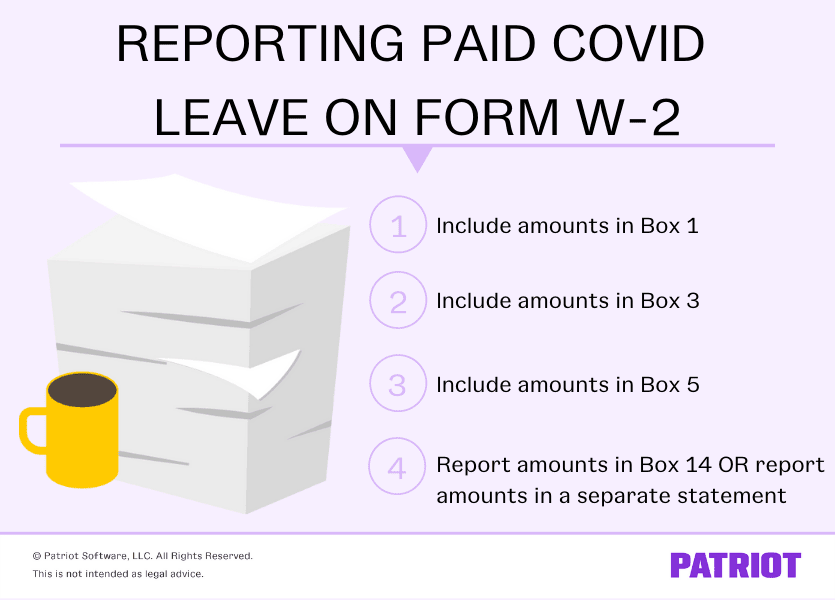

According to the IRS, you must do the following when reporting FFCRA and ARP sick pay and paid family leave:

- Include the amounts in boxes 1, 3, and 5 on Form W-2

- Report the amount in box 14 (Other) on Form W-2 OR report the amount in a separate statement and attach to Form W-2

If you choose to report the paid leave in a separate statement, send it at the same time—and in the same way (e.g., paper vs. electronic)—you send the employee their Form W-2.

Describing the paid leave amounts on Form W-2

When reporting the amount in Box 14 on Form W-2 or in a separate statement, you need to describe the type of leave. That way, the IRS knows whether it was sick leave (self), sick leave (other), or family leave. The IRS also needs to know what time frame the employee took the paid leave (aka under the extended FFCRA or ARP).

You can use the following descriptions (provided by the IRS) to describe each amount the employee received:

- (Self) Sick leave:

- “Sick leave wages subject to the $511 per day limit paid for leave taken after December 31, 2020, and before April 1, 2021, because of care you required.”

- “Sick leave wages subject to the $511 per day limit paid for leave taken after March 31, 2021, and before October 1, 2021 because of care you required.”

- (Other) Sick leave:

- “Sick leave wages subject to the $200 per day limit paid for leave taken after December 31, 2020, and before April 1, 2021 because of care you provided to another.”

- “Sick leave wages subject to the $200 per day limit paid for leave taken after March 31, 2021, and before October 1, 2021 because of care you provided to another.”

- Family leave:

- “Emergency family leave wages paid for leave taken after December 31, 2020, and before April 1, 2021.”

- “Emergency family leave wages paid for leave taken after March 31, 2021, and before October 1, 2021.”

You might need to report anywhere from one to six different types of leave on an employee’s Form W-2, depending on their COVID leave usage.

Reporting deferred Social Security tax you’ve collected

Employers could defer eligible employees’ Social Security tax obligations between September 1, 2020 – December 31, 2020.

Sure, that all might be 2020 news. But in 2021, employers were responsible for collecting the deferred Social Security tax.

Background

Under the employee Social Security tax deferral, employers could defer collecting the employee Social Security tax portion for employees earning less than:

- $2,000 weekly

- $4,000 biweekly

- $4,333.33 semimonthly

- $8,666.67 monthly

If you deferred an employee’s Social Security tax, you are responsible for collecting the deferred tax amount between January 1, 2021 – December 31, 2021.

And, you must report the deferred amount you collected on Form W-2c. That’s right: You do not report the collected deferred tax on Form W-2.

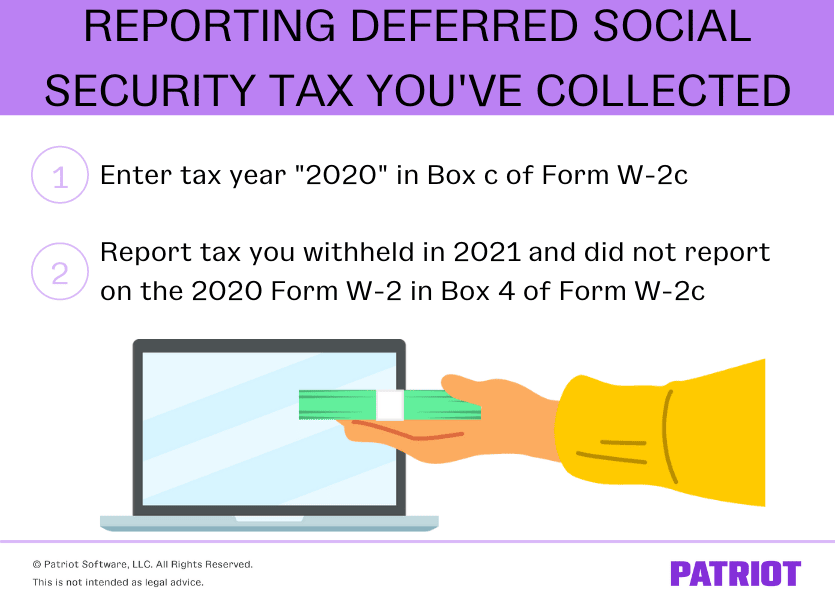

Where to report deferred Social Security tax you’ve collected on Form W-2c

According to the IRS, you must fill out Form W-2c, Corrected Wage and Tax Statement, as soon as you finish withholding the deferred taxes in 2021.

Take a look at what you need to do with the corrected W-2:

- Enter tax year “2020” in box c

- Report deferred Social Security tax you withheld in 2021 and did not report on the 2020 Form W-2 in box 4 on Form W-2c

Send Forms W-2c, along with Form W-3c, to the Social Security Administration (SSA) as soon as possible. Also, distribute Forms W-2c to your employees.

Still haven’t repaid the deferred taxes?

Remember, reporting is just one part of the equation. You also have to repay the employee’s portion of the deferral period by January 3, 2022.

Employers can make deferral payments via one of the following methods:

- Electronic Federal Tax Payment System (EFTPS)

- Debit or credit card

- Money order

- Check

Separate your deferred employee Social Security tax repayments from other tax payments. If you make the payment via EFTPS, select “deferral payment.” You can learn more about repaying deferred Social Security taxes on the IRS’s website.

This article has been updated from its original publication date of November 23, 2020.

This is not intended as legal advice; for more information, please click here.