If your business has been devastated by the impact of the coronavirus, you might be interested in new ways to cut back expenses. Instead of laying off or furloughing employees as a way to decrease costs, you might benefit from a work share program. What is worksharing?

What is worksharing?

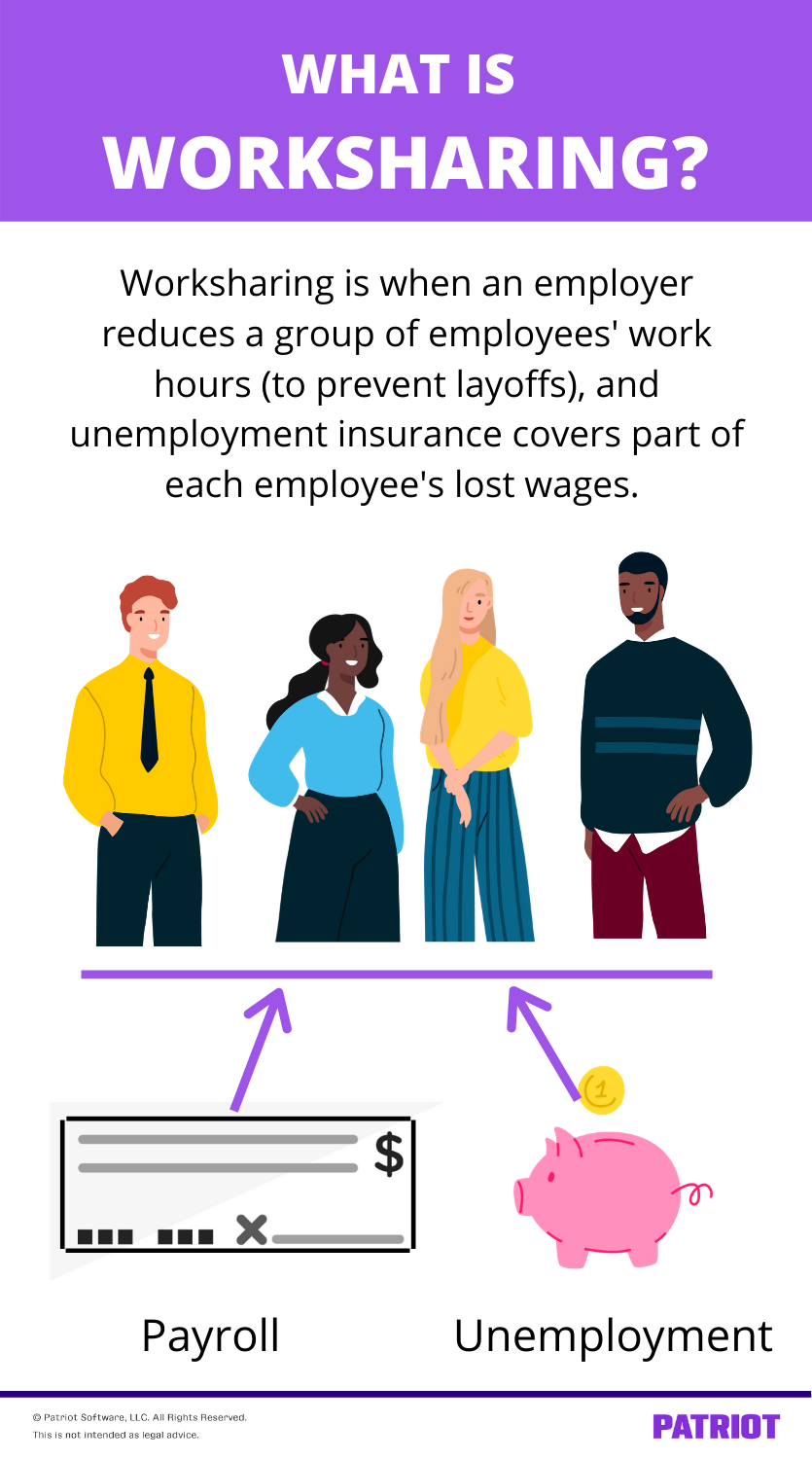

Worksharing, also known as short-time compensation (STC) or shared work, is a joint program between an employer and their state unemployment insurance office. In economic downturns, a participating employer can reduce a group of employees’ work hours rather than laying off or furloughing a few workers. Unemployment insurance then partially replaces the employees’ lost wages associated with their reduced hours.

Say you reduce your employees’ work hours from 40 to 30. If you participate in your state’s voluntary program, the workshare unemployment would cover a portion of the wages associated with the lost 10 hours per week.

Basically, in a worksharing situation, you don’t have to lay off a couple of employees to stay afloat. Instead, your team (or a portion of your team) collectively has their hours cut. The employees remain on your payroll and receive partial unemployment benefits.

So, why worksharing? Here are a few reasons why employers and states think it’s a win-win:

- Employers can retain talented employees while also cutting costs during tough economic times

- State unemployment insurance offices are only responsible for paying partial unemployment benefits

- Employees get to keep their jobs; their hours are simply reduced

- Employees don’t need to look for a new job while receiving unemployment benefits

Employers who are interested in participating in their state’s work share program must submit a plan and get it approved by the state first.

Here’s a common question you might be itching to ask: If I enroll employees in the work share program, will my SUTA tax rate increase? Most likely, yes. Anytime your state doles out unemployment benefits, the employer foots the bill (exception: coronavirus-related furloughs and layoffs). This rule applies even if the employees are still on your payroll (i.e., in a shared work program).

Not all states have a work share program: just over half of the states have one. Work share program rules vary by state, too. Most states set hour reduction ranges for employees to be eligible. And, states may require employers to add a certain number of employees to the program.

Worksharing and COVID-19

According to the Department of Labor, the CARES Act gave states and thus employers more work share options.

Here’s what the CARES Act provides for states when it comes to short-time compensation:

- States with new or pre-existing shared work programs: The federal government is 100% financing STC payments temporarily

- States without a qualifying work share program: The state can enter into an agreement with the Secretary of Labor and temporarily operate a federal STC program

Work share programs by state

If you want to participate, understand your state work share program rules before trying to get employees on partial unemployment.

So, what are the states where you can do state-level worksharing? To start, these states currently do not have worksharing:

| Alabama | Louisiana | South Carolina |

| Alaska | Mississippi | South Dakota |

| Delaware | Montana | Tennessee |

| Georgia | Nebraska | Utah |

| Hawaii | Nevada | Vermont* (as of 7/1/2020) |

| Idaho | New Mexico | Virginia |

| Illinois | North Carolina | West Virginia |

| Indiana | North Dakota | Wyoming |

| Kentucky | Oklahoma |

If your state is not listed, you have a state-level work share program.

Again, state STC program eligibility may vary based on:

- Hour reduction

- Number of employees you must enroll

So, what are your state’s requirements? Take a look at our chart to find out. Use the links to learn more and apply through your state.

| State | Hour Reduction | Number or Percentage of Employees for Enrollment (in an Affected Unit) |

| Arizona | 40% – 60% | At least 2 |

| Arkansas | At least 10% | At least 10% |

| California | 10% – 60% | At least 2 and at least 10% of regular workforce |

| Colorado | 10% – 40% | At least 2 |

| D.C. | 20% – 40% | At least 10% |

| Florida | 10% – 40% | At least 10% |

| Iowa | 20% – 50% | At least 5 |

| Kansas | 20% – 40% | At least 10% |

| Maine | 10% – 50% | At least 2 |

| Maryland | N/A | At least 2 |

| Massachusetts | 10% – 60% | At least 2 |

| Michigan | 10% – 60% | All; at least 2 |

| Minnesota | 20% – 50% | N/A |

| Missouri | 20% – 40% | At least 10% |

| Nebraska | 10% – 60% | At least 2 |

| New Hampshire | 10% – 50% | All |

| New Jersey | 10% – 60% | At least 10 |

| New York | 20% – 60% | At least 2 |

| Ohio | 10% – 50% | At least 2 |

| Oregon | 20% – 40% | At least 3 |

| Pennsylvania | 20% – 40% | At least 2 |

| Rhode Island | 10% – 50% | At least 10% |

| Texas | 10% – 40% | At least 10% |

| Virginia* (beginning 7/1/2020)) | 10% – 60% | N/A |

| Washington | Up to 50% | At least 2 |

| Wisconsin | 10% – 60% | At least 2 |

Your state may also require the employees you enroll to work for you a certain length of time before enrolling. And, you may have to be in good standing with your state unemployment tax account to qualify.

What does your work share plan application entail?

When creating your work share program plan to submit to the state, you need to include substantial information to get approved.

Some of the things you might have to report include:

- Employee hour reductions

- Names and Social Security numbers of impacted employees

- The number of employees facing layoffs

- Starting date

- Certified statements signifying your application complies with state law

- Signature

Questions? Consult your state unemployment insurance office for more information.

Looking for an easier way to manage payroll? Patriot’s payroll software comes with free setup, expert (and friendly!) support, and more. Get your free trial now.

This is not intended as legal advice; for more information, please click here.