Do employers have to offer health insurance? Under the Affordable Care Act, you must provide health insurance if you have 50 or more full-time equivalent employees. If this requirement doesn’t apply to you, you might decide to establish a QSEHRA plan.

What is a QSEHRA plan?

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a tax-free employee benefit. QSEHRAs reimburse employees for individually-obtained health insurance premiums and eligible medical expenses. Employers fund QSEHRAs—up to the contribution limit—and can deduct their reimbursement expenses from their taxes. Employers with fewer than 50 full-time equivalent employees can offer QSEHRAs.

The 21st Century Cures Act established the small business HRA in 2016. QSEHRA is not considered a traditional group health insurance plan. Rather, this health reimbursement arrangement is a group health plan alternative small employers can pursue.

Employers who do not have to offer health insurance to their employees can choose to offer a standalone Qualified Small Employer Health Reimbursement Arrangement. If you provide a QSEHRA plan, you cannot offer another type of health insurance.

Employees do not contribute to health reimbursement arrangements. And, eligible employees cannot opt out of employer-provided QSEHRA plans.

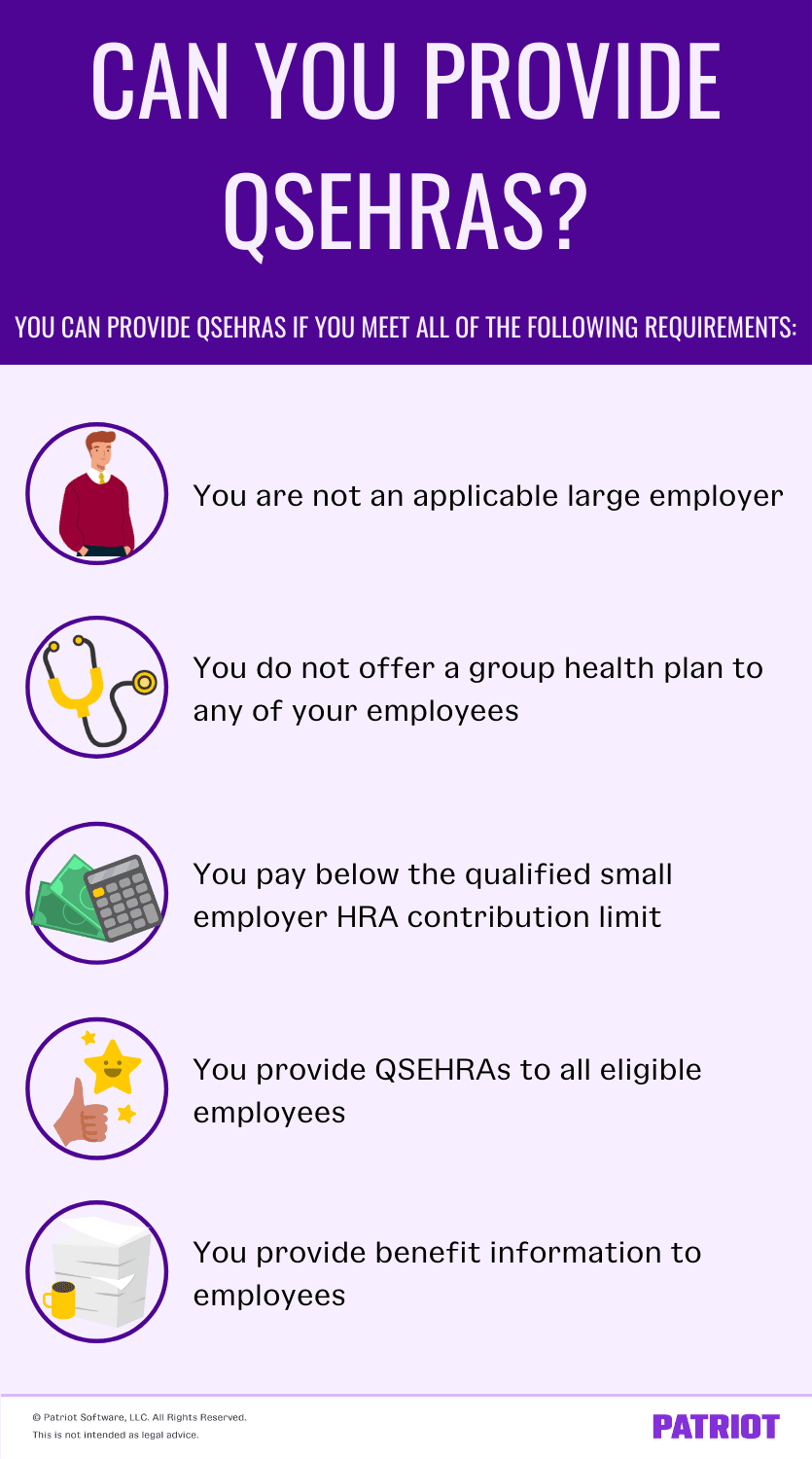

Can you provide QSEHRAs?

Offering standalone health reimbursement arrangements are beneficial to both you and your employees.

Employees receive help paying for health insurance premiums. And, you can deduct QSEHRA contributions from your small business taxes.

But before you decide to provide a Qualified Small Employer Health Reimbursement Arrangement, check to ensure you’re eligible.

1. You are not an applicable large employer

If you want to provide a QSEHRA, you must meet small business size standards. You cannot provide a small business HRA if you are an applicable large employer (ALE).

Applicable large employers are businesses that employ at least 50 full-time equivalent employees.

You cannot provide a QSEHRA plan if you were an ALE in the previous calendar year. If your workforce increases to more than 50 full-time equivalent employees, you can continue your QSEHRA plan until January 1 of the next calendar year.

2. You do not offer a group health plan to any of your employees

Although small employers aren’t required to offer health insurance to their employees, you can. But if you do offer group health insurance, you cannot provide QSEHRA plans.

For example, you may opt for the Small Business Health Options Program (SHOP) rather than providing a QSEHRA plan. SHOP is an affordable health insurance option that qualifying small businesses can offer employees.

If you offer group health plans for part of the year, you cannot offer QSEHRA plans during those months.

3. You pay below the qualified small employer HRA contribution limit

Each year, the QSEHRA contribution limit is subject to change.

In 2022, the reimbursements limit for single coverage is $5,450 per year. The annual contribution limit for family coverage is $11,050.

You must fund your employees’ arrangements on your own. Do not withhold money from employees’ wages to fund the QSEHRA plan.

Keep in mind that you do not need to pay the maximum amount for your QSEHRA plan. Be sure to set a QSEHRA limit. Your limit might vary depending on whether the employee elects single or family coverage, as well as how many family members it covers.

4. You provide QSEHRAs to all eligible employees

If you want to establish a QSEHRA plan in your small business, you must offer it to all eligible employees. So, who is not an eligible employee?

You do not need to offer health reimbursement arrangements to the following:

- Part-time employees who work less than 35 hours per week

- Seasonal employees whose annual employment is less than nine months

- New employees who have not yet completed 90 days of service

- Employees under the age of 25 at the start of the plan year

- Nonresident aliens with no earned income from sources within the U.S.

- Employees covered by a health benefit-centric collective bargaining agreement

If you own an S corporation, 2% shareholder-employees are not eligible for QSEHRAs.

When you reimburse employees for their health insurance premiums or medical expenses, your contributions must be equal and proportional. Again, contributions should be equivalent to the number of family members covered under the plan.

According to the IRS, you can limit the scope of your QSEHRA. You may narrow down which medical expenses are eligible for reimbursement. But, you must make this widespread among all eligible employees.

5. You provide benefits information to employees

If you establish a QSEHRA plan in your small business, you need to notify your workforce. Distribute written notices to your eligible employees at least 90 days before the QSEHRA goes into effect.

| Want an easier way to distribute written notices? Upload electronic notices with Patriot’s online HR Software add-on. Share important documents with employees, organize employee records, and more. Plus, it integrates with our online payroll. Try both for free today! |

What should your written QSEHRA notices say? According to the IRS, each notice should include the following:

- The reimbursement amount the employee is eligible to receive

- A statement that the employee needs to inform the Healthcare Marketplace of the amount of the benefit if they apply for advance payments of the premium tax credit

- A statement that the employee might be liable for an individual shared responsibility payment if they are not covered under minimum essential coverage for any month

- The date that the plan takes effect

Failing to provide a written QSEHRA notice could result in penalties. You might be required to pay $50 per employee, up to a maximum of $2,500, if you do not provide written notices.

What if you don’t qualify to provide a QSEHRA?

If you don’t meet the above requirements, you cannot provide a standalone QSEHRA. However, nonqualifying employers of all sizes can offer a health reimbursement arrangement (HRA) in addition to group health insurance coverage.

This article has been updated from its original publication date of March 11, 2019.

This is not intended as legal advice; for more information, please click here.