As employees head back into the workplace, you may be asking yourself what to do to keep your employees safe. Between mask rules, social distancing, and vaccines, you have a lot to consider. But when it comes to new requirements you set, can employers require COVID vaccines for their employees?

Can an employer require COVID vaccine?

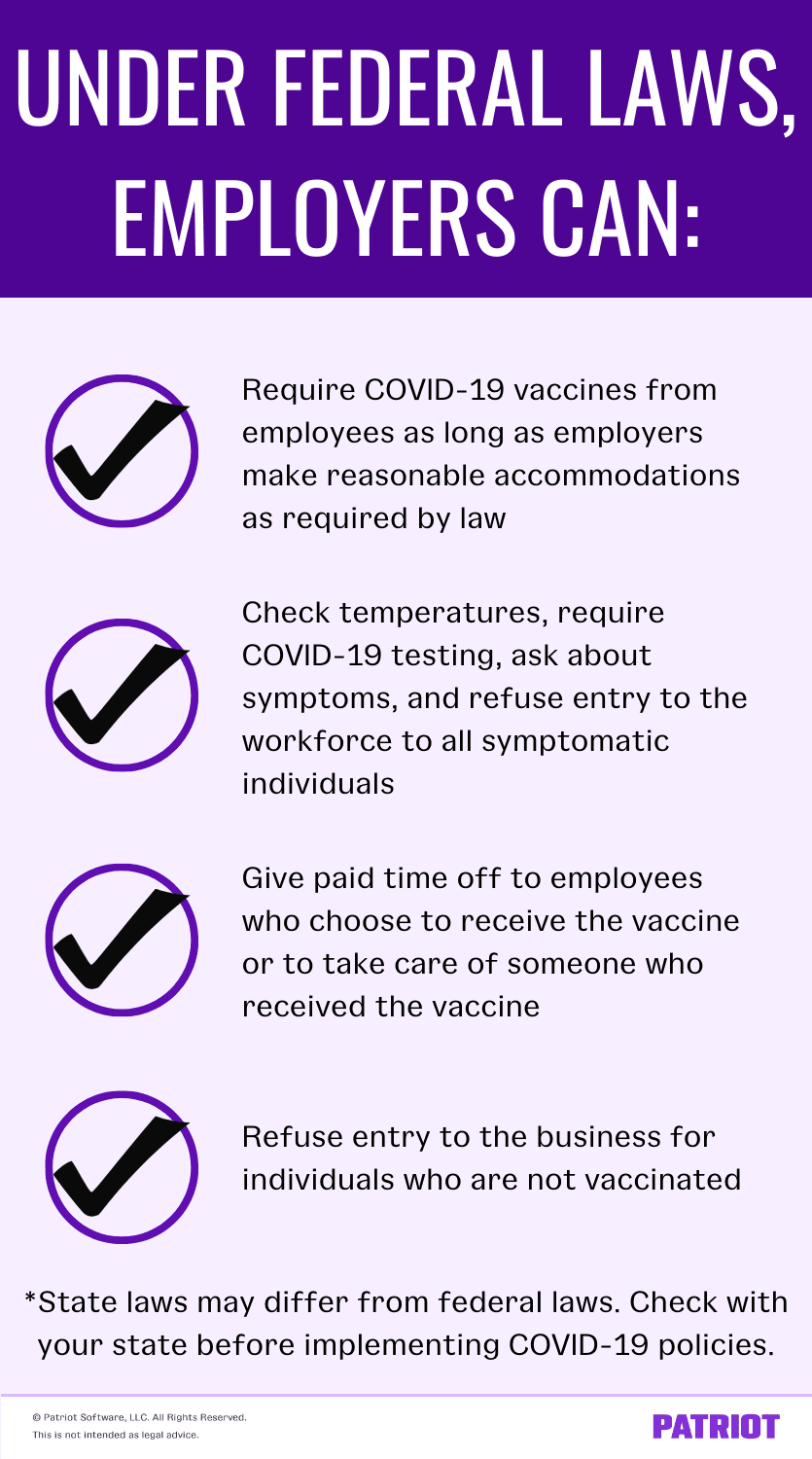

One survey found that 63% of employers will require proof of vaccination from their employees. But just because more than half of employers are requiring proof of vaccination does not answer the question Can you require a COVID vaccine? According to the Equal Employment Opportunity Commission (EEOC), the answer is yes, you can require your employees to get vaccinated—at the federal level.

However, there is a catch to requiring this of employees, per the EEOC. If you require employees to receive the vaccine, you must comply with reasonable accommodation laws from the following:

- Americans with Disabilities Act (ADA)

- Title VII of the Civil Rights Act of 1964

- Other EEO considerations

Some states may have stricter laws regarding reasonable accommodations. Check with your state to determine what accommodations you must make for employees who object to your vaccine requirements.

And, other states are hearing cases regarding vaccine mandates and their legalities due to the experimental nature of the vaccine. For example, Montana has laws protecting employees’ vaccination status. In May 2021, Montana prohibited employers from requiring employees to disclose their vaccination status, and the state does not allow employers to mandate vaccines with emergency use authorization.

Other states may follow suit. Check your state laws requiring vaccination disclosure.

Can employers ask about an employee’s vaccination status?

During periods of lockdown for COVID-19, employers could require employees to notify their employers of symptoms consistent with the virus.

The EEOC and ADA guidelines also permit employers to:

- Check temperatures of all employees entering the workplace

- Administer or require COVID-19 testing

- Ask if employees have been exposed to the virus or anyone experiencing symptoms

- Refuse an employee from entering the workplace if they do not comply with temperature checks, testing, or disclosure of potential exposure

All of the information employers gathered during checks before employees entered the workplace must be kept separate from the employee’s personnel file. And, you must keep the information confidential.

| Looking for an easy-to-use, all-in-one solution for storing your employees’ confidential information? Patriot’s HR software add-on integrates seamlessly with our payroll software so you can access information with ease. Try it free for 30 days! |

Can employers require proof of COVID vaccine and disclose their vaccination status? Yes, employers may ask employees to disclose their vaccination status under EEOC and ADA guidelines. Employers must also keep vaccine disclosure records in a separate confidential file and not with the employee’s personnel file. Per the EEOC, disclosure of vaccination status does not fall under ADA rules about disability-related inquiries.

Can employers give time off to employees for COVID vaccination?

The federal government signed the Families First Coronavirus Act (FFCRA) into law on March 18, 2020 and required certain businesses to provide paid leave for COVID-19 related reasons. The paid leave came with a tax credit for employers who provided COVID-19 paid leave.

The Consolidated Appropriations Act (CAA) extended paid leave and the associated tax credit under the FFCRA until March 31, 2021. The American Rescue Plan (ARP) extended both the paid leave and the tax credit until September 30, 2021.

Under the ARP, paid time off expanded to include individuals who:

- Receive the vaccine

- Need to take time off to recover from vaccine complications

- Accompany an individual who is obtaining the vaccine

- Care for an individual who is recovering from the vaccine

Keep in mind that offering paid time off for employees receiving the vaccine is optional. Employers who do offer paid leave receive a tax credit of 100% of the paid leave wages and do not pay the employer portion of the Social Security tax on the leave wages.

Currently, the tax credits for COVID-19 paid leave expire on September 30, 2021.

How much should I pay employees if I give time off for COVID vaccination?

If you choose to give your employees time off for COVID vaccination, you may be wondering how much you have to pay for that time off. Under the FFCRA, CAA, and ARP, you must pay:

- The regular rate of pay for individuals who are taking time off to receive or recover from a vaccination themselves. The maximum daily rate is $511, or $5,110 over 10 days

- Two-thirds of the employee’s regular rate of pay if they accompany someone to a vaccine or provide care post-vaccination. The maximum daily rate is $200, or $2,000 over 10 days

So, if you give employees paid time off to receive or recover from a COVID vaccination, you must pay their regular rate unless their regular wages exceed the maximum rate. You may still pay their regular rate if it exceeds the maximum rate, but the tax credits do not apply past the maximum rate.

Can businesses require a COVID vaccine from customers?

Now that we’ve covered if you can require employees to receive the vaccine, it’s time to answer Can businesses require COVID vaccines? The popularity of what is known as “vaccine passports” is up for debate. Vaccine documentation for customers and patrons may be different than the requirements for employees.

So far, businesses may be allowed to require vaccine documentation from anyone visiting their business. But, it largely depends on the type of business and which state your business is in.

Vaccine mandate restrictions may fall under one of three categories:

- Businesses cannot require vaccine documentation from customers or patrons

- If the business receives public funds, the business cannot require vaccine documentation

- Businesses can require vaccine documentation

Consult your state rules for more information.

Do employee and patron COVID vaccine documentation requirements differ?

Vaccine requirements for employees and customers can differ. In some cases, states have passed legislation specifically regarding customer or patron vaccination requirements but do not mention employee requirements. Other states have laws regarding employee vaccination but do not mention customer requirements.

For example, Florida bans businesses in the state from requiring vaccination documentation from customers and patrons but does not mention employees.

Counties and localities may have stricter requirements than the state regarding vaccine laws. Check with your local and state governments before requiring proof of vaccination from employees, patrons, or customers.

This is not intended as legal advice; for more information, please click here.