School closings. Remote schooling. Daycare labor shortages. COVID ushered in a new era of problems for parents requiring new solutions, like employees working flexible or fewer hours. Another solution that’s gained new ground? Employer-provided childcare benefits (aka a dependent care assistance plan).

Read on to learn more about childcare as a new addition to your benefits package. Find out what employer-provided childcare looks like, the advantages of offering this benefit, and whether it’s taxable.

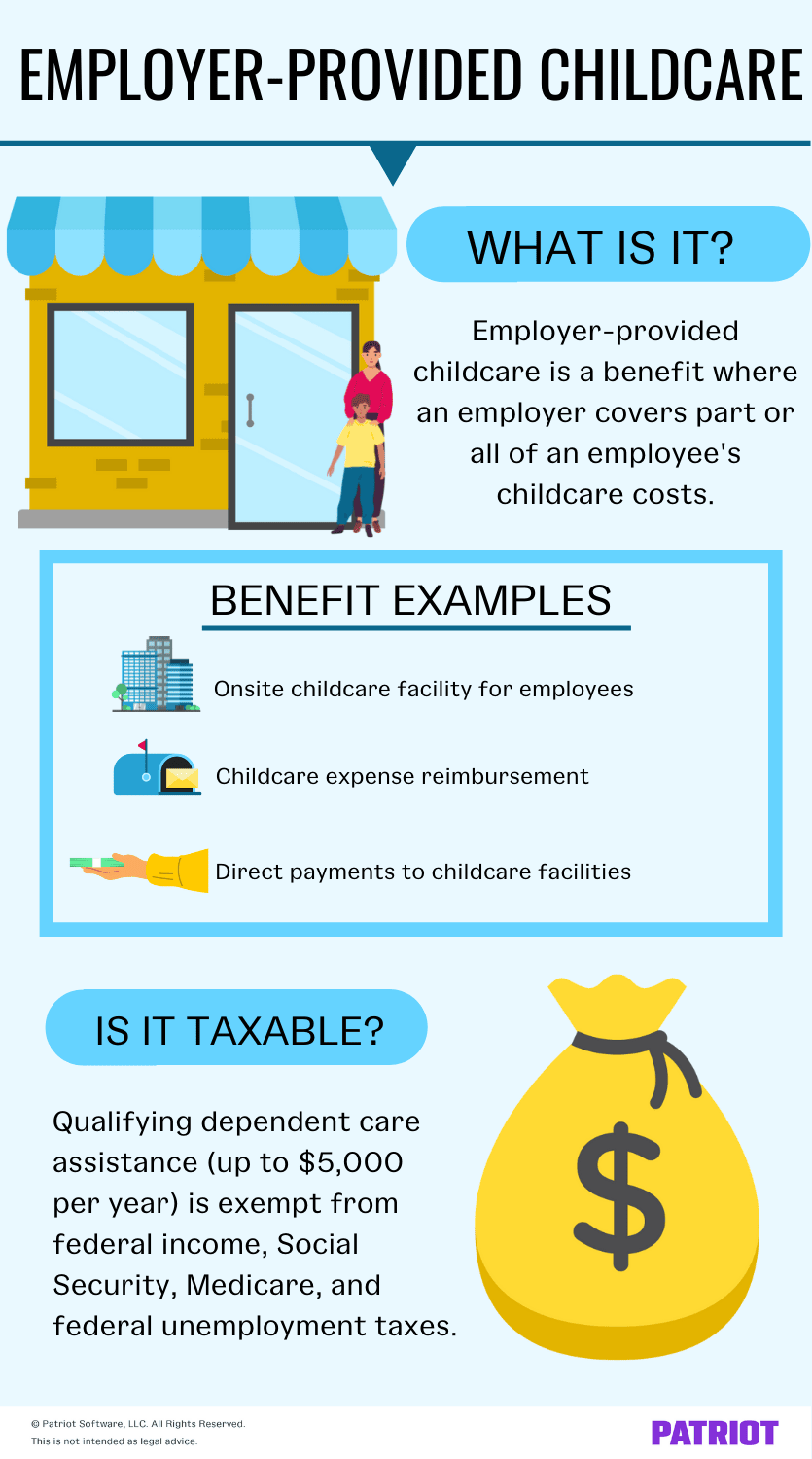

What is employer-provided childcare?

Employer-provided childcare, or dependent care assistance, is a benefit where the employer covers part or all of an employee’s childcare costs. Childcare employee benefits include household and dependent care services that employers directly or indirectly pay for. Qualifying benefits under a dependent care assistance program (DCAP) are fringe benefits. A fringe benefit is an additional payment for an employee’s service.

Employer-sponsored childcare isn’t a one-size-fits-all benefit. Employers that provide child care can decide how to offer it to employees. Again, you can pay for these services directly or indirectly.

For example, you might:

- Provide an onsite childcare facility for employees

- Reimburse employees for childcare expenses they incur

- Pay childcare facilities directly on behalf of your employees

If you decide to implement employer-provided childcare, create a written plan for your employees that details the benefit.

Benefits of offering employer-sponsored daycare

For many parents, COVID’s impact on childcare worsened an already difficult situation. Between school and daycare closings due to the pandemic, some employees left the workforce entirely.

To combat these issues, businesses can join the list of companies that currently offer dependent care assistance, like Best Buy and Apple. And, doing so comes with a slew of benefits for both employers and employees. Brian Snedvig, CEO and founder of Jofibo, shares what offering childcare benefits for employees has done for his company’s team:

We see childcare as one of our most attractive perks for people who work for us. Our employees are happier and more productive because they know that their children are well cared for while they’re at work. This is a win-win for everyone involved.”

Here’s a breakdown of the benefits of employer-provided daycare:

- Attract new talent

- Retain employees

- Reduced absenteeism

- Improved engagement

- Tax benefits (see below)

- Employer tax credit

Before offering employer-sponsored daycare, keep in mind some cons. In addition to the added cost, providing childcare for employees could alienate employees without children or those whose children are grown.

Is dependent care assistance taxable?

So, how do you handle dependent care payments? Are they taxable? Again, a qualifying DCAP is a fringe benefit. Some fringe benefits are exempt from federal income, Social Security and Medicare, and/or federal unemployment taxes.

Qualifying DCAPs are exempt from federal income, Social Security and Medicare, and federal unemployment taxes—up to a certain amount. You can exclude up to $5,000 of dependent care assistance benefits per year ($2,500 for married employees filing separately) from an employee’s taxable wages.

So, what qualifies? Dependent care assistance is exempt from federal payroll taxes if all of the following conditions are met:

- The individual meets the definition of an employee

- Current employee

- Leased employee who provided services that were performed under your primary direction or control for at least a year on a substantially full-time basis

- Sole proprietor

- Partner who performs services for a partnership

- You directly or indirectly pay for or provide household and dependent care services under a written DCAP that covers only your employees

- The services allow the employee to work

- You reasonably believe that the employee can exclude the benefits from gross income

- The exclusion is not more than the smaller of the earned income of either the employee or the employee’s spouse

Keep in mind that any dependent care assistance benefits you provide an employee that exceed $5,000 per year are taxable.

Potential hazard ahead! The federal tax exemption for assistance doesn’t apply to certain highly compensated employees under a program that favors highly compensated employees.

For more information, check out Publication 15-B, Employer’s Tax Guide to Fringe Benefits.

Reporting dependent care assistance on Form W-2

Whether childcare benefits are excludable from taxes or not, you need to report them on Form W-2, Wage and Tax Statement.

On the W-2, report the value of dependent care assistance you provide in box 10, “Dependent care benefits.” If you can exclude the value from taxes (i.e., it meets all the qualifications and doesn’t exceed the annual limit), do not include it anywhere else.

Report any amounts that are taxable in boxes:

- 1 (“Wages, tips, other compensation”)

- 3 (“Social security wages”)

- 5 (“Medicare wages and tips”)

- 10 (“Dependent care benefits”)

If you exceed the annual dependent care assistance limit, report both the nontaxable portion and the excess in box 10.

This is not intended as legal advice; for more information, please click here.