You’re doing a bank statement reconciliation (aka the process of comparing your bank statement to books) like normal. But, things don’t add up. Suddenly, you realize the discrepancy is because there’s a large charge on your statement … but not in your books. Where’d this come from? I never spent this! And indeed, you haven’t—you’ve fallen victim to bank account fraud.

Bank account scams are expensive for businesses. According to one report, every $1.00 of fraud costs merchants $3.60 (and no business wants to spend their money like that!).

To help you prevent and respond to business bank scams, read on to learn:

- What is bank fraud

- Types of bank account scams

- Small business fraud prevention tips

- What to do if you notice bank account fraud

What is bank fraud?

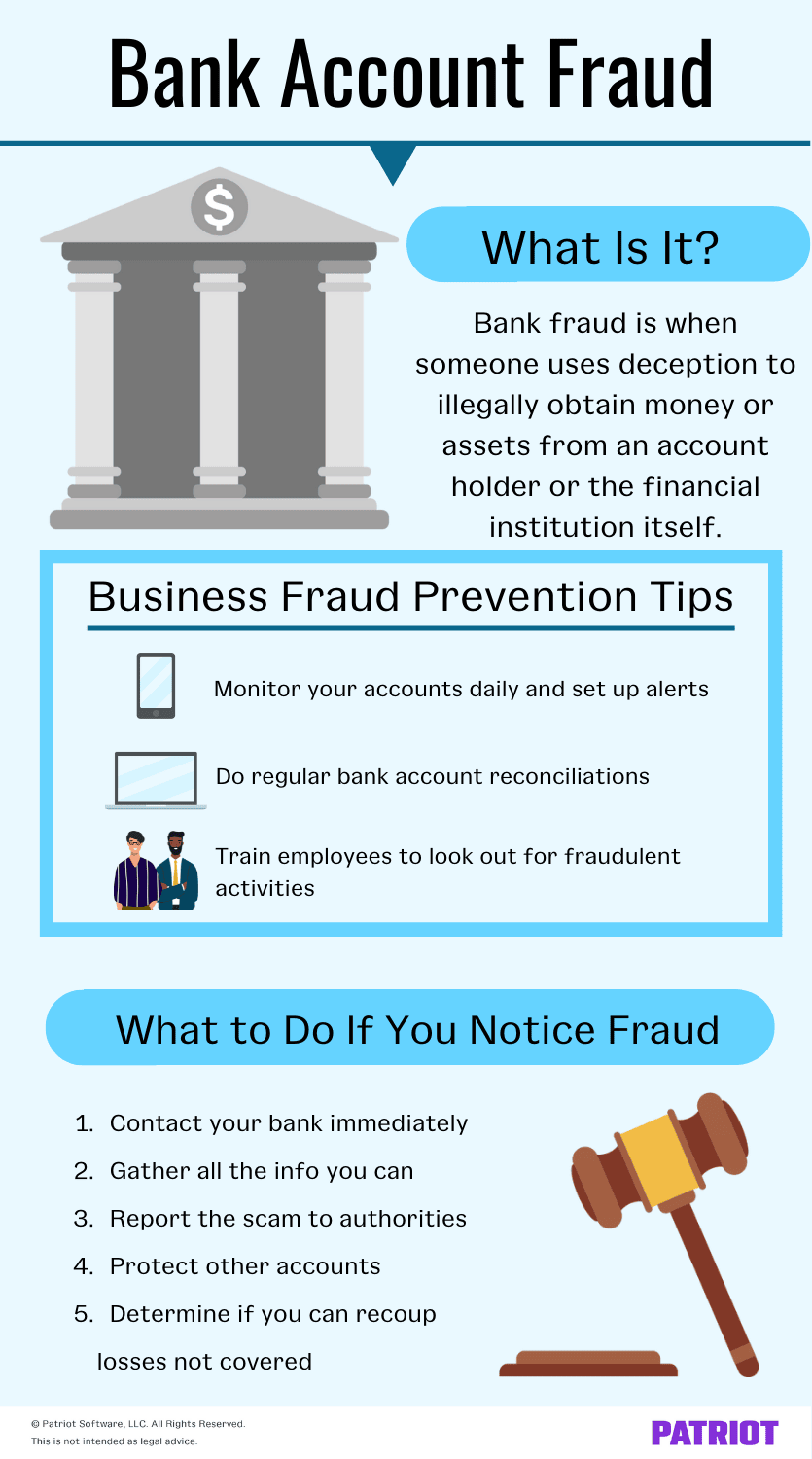

Bank fraud is when someone illegally obtains money or assets from an account holder or the financial institution itself. The scammer uses deception to obtain the illegal funds.

In 2021, consumers reported to the Federal Trade Commission that they lost over $5.8 billion to fraud. And, it’s not just a few businesses experiencing big losses—33% of businesses experience unauthorized ACH transfer transactions from their business account.

Types of bank account scams

For many businesses, unauthorized transactions and monetary losses all start with a scam. Be on the lookout for common scams that could cost you personal bank information (e.g., account number) and money.

Several types of bank frauds to watch out for include:

- Unsolicited checks: Scammers send checks. When you cash the checks, you make a commitment (e.g., authorize a membership or loan), losing money in the process.

- Overpayment scams: Scammers purchase a good but send you a fake check for more than they owe. You send them money for the difference between what they paid and what was owed. In addition to losing this money (because the check is fake!), you lose the product’s value and may owe returned check fees.

- Phishing scams: Scammers may pose as your bank, the IRS, or another agency and use emails and texts to get you to share personal information (e.g., password) or click malicious links. They can then use that information to access your bank account.

Keep in mind that this isn’t an all-inclusive list. There are seemingly countless creative ways scammers get bank account information or pull funds from accounts.

Small business fraud prevention tips

With online banking scams on the rise, you may be wondering what types of bank account fraud protection are available. After all, knowing how to prevent fraud could help you and your employees avoid potential losses.

Take a look at the following business fraud protection tips to help safeguard your business bank account(s):

- Monitor your accounts daily

- Set up fraud alerts via email and/or text message

- Use two-factor authentication (if your bank offers it!)

- Do regular bank account reconciliations

- Add liability insurance coverage for account fraud losses

- Look out for fraudulent activities (e.g., phishing emails)

- Train employees to look out for fraudulent activities

Follow business fraud prevention best practices to help you avoid and quickly catch fraudulent transactions. So, what happens if there is fraud on your bank account?

What to do if you notice bank account fraud (5 steps)

Great—despite your best efforts, you notice banking fraud. Now what? Now, it’s time for bank account fraud reporting. Take a look at the following five steps to help you address fraud activity on bank account.

Pro Tip: Report bank account fraud ASAP to increase your chances of recouping your losses and preventing further damage.

1. Contact your bank immediately

As soon as you spot fraud activity on bank account, call your bank. Your window to catch the fraud, report it to your bank, and prevent damages is typically limited. And unfortunately, the clock starts when the fraudulent transaction takes place.

Although the extent of your bank’s protection may vary, businesses generally have less time to spot and report suspicious activity. For example,

- Personal account holders generally have up to 60 days to report electronic payment fraud

- Business account holders generally have 24 hours to report electronic payment fraud

Why is the timeline so much shorter for banks? According to First Business Bank:

Business clients do not have the protections of Regulation E. Federal protection for businesses that experience ACH fraud falls under the Uniform Commercial Code (“UCC”). The burden is on the business to notify the financial institution immediately if there is a disputed transaction. Within 24 hours, all the liability for fraudulent transactions shifts from the financial institution to the business.”

You should be transferred to a fraud department when you contact your bank to report fraudulent transactions. There, they can instruct you on next steps, such as:

- Canceling your business debit card and ordering a new one

- Setting new online passwords for your banking app or website login

- Freezing your bank account to prevent additional fraudulent transactions

2. Gather all the information you can

Being an amateur sleuth can come in handy if you’re the victim of bank account fraud. Gather all the information you can about the incident for your bank and other authorities.

Ask yourself questions like:

- Who contacted me that may have led to the fraud?

- What could have caused the fraudulent activity? (Did I click a link to a fake website?)

- Where did this communication take place? (e.g., over email, over the phone, etc.)

- When did this happen?

Write down any information you have of the possible scammer, including the name or position they gave you, how they contacted you, what they asked you to do, and how much you lost. Consider taking screenshots or pulling payment records (e.g., wire transfers), if applicable.

3. Report the scam to the proper authorities

After you contact your bank and gather more information, take the time to spread the word about the scam to the proper authorities.

Report the scam to:

- Your local police

- Federal Trade Commission (if you’re able to identify the scam or scammer)

- Internet Crime Complaint Center IC3 (if the scammer contacted you via email)

Reporting bank account fraud can help investigators identify and stop fraudulent activity.

4. Take action to protect other accounts

Are you worried the fraudster could access your identity (i.e., Social Security number) or other account information (e.g., business credit cards)? If so, take action to protect your credit.

Check your credit reports and notify credit card holders. You can also contact the three credit reporting bureaus:

Consider placing a fraud alert on your credit file with these bureaus. You can also ask for a free security freeze if you’re concerned someone has access to your identity.

5. Determine if you can recoup losses not covered by your bank

If you catch the fraud too late, you may be frustrated by your bank’s inability to remediate the fraud. In some cases, your insurance may help cover your loss.

So, will your insurance cover losses related to fraud? According to Lexology:

…Recent decisions have ordered insurance carriers to provide coverage … A common place for seeking coverage for these losses is under crime insurance policies. Many crime insurance policies include coverage for ‘computer fraud,’ ‘funds transfer fraud,’ or even ‘computer and funds transfer fraud.’”

Long story short, whether your insurance pays or not depends on your policy and provider (and whether you take them to court over a dispute). To stay ahead of insurance disputes, understand the ins and outs of what your insurance provider offers, including what your policy covers and limits.

Looking for an easier way to spot discrepancies between your books and statements? Patriot’s accounting software has account reconciliation, making it easy to compare your statements to your recorded software transactions and reconcile the differences. Try our Premium Accounting today!

This is not intended as legal advice; for more information, please click here.