Do you use a personal checking account for your business transactions? If you do, you may want to open a business checking account. There are many benefits of a business checking account. As you continue to grow your company, keep these business bank account benefits in mind.

Benefits of a business checking account

You are not required to have a business bank account, but it is a good idea to use one. Take a look at these five benefits of a business checking account:

1. Your business records are organized

You can keep your small business accounting program records organized with a business checking account. A business checking account separates your personal and business transactions. All your business transactions are tracked on a separate statement.

Separating your business transactions from your personal transactions helps monitor your business’s profitability.For example, you look at your business checking account statement for the past month. From the statement, you see your business earned $10,000 and spent $2,000. You can subtract $10,000 in earnings by $2,000 in business expenses to get a net profit of $8,000. The net profit ($8,000) is the bottom line of your business checking account statement.

If you mixed personal and business transactions into one account, you might have a hard time trying to determine profit margin. To find your profitability, you must remember which expenses were personal and omit them.

2. Accurate taxes and deductions

Separating business transactions into a checking account doesn’t just help you organize financial records. A business checking account also helps you file taxes. To file business taxes, you need your business transactions separated from your personal transactions.

A business checking account helps to ensure you file taxes accurately. You look at your business account statement and record the figures on your tax return. Accurately filing taxes becomes harder when you mix personal expenses in the same account. If you do not file taxes accurately, you could face IRS penalties.

You can deduct business expenses from your tax return. Deducting business expenses may be easier if you use a business checking account. You must prove to the IRS that the expenses were for the business. The business account statement supports that you can deduct the expenses for your business.

3. You can accept credit cards

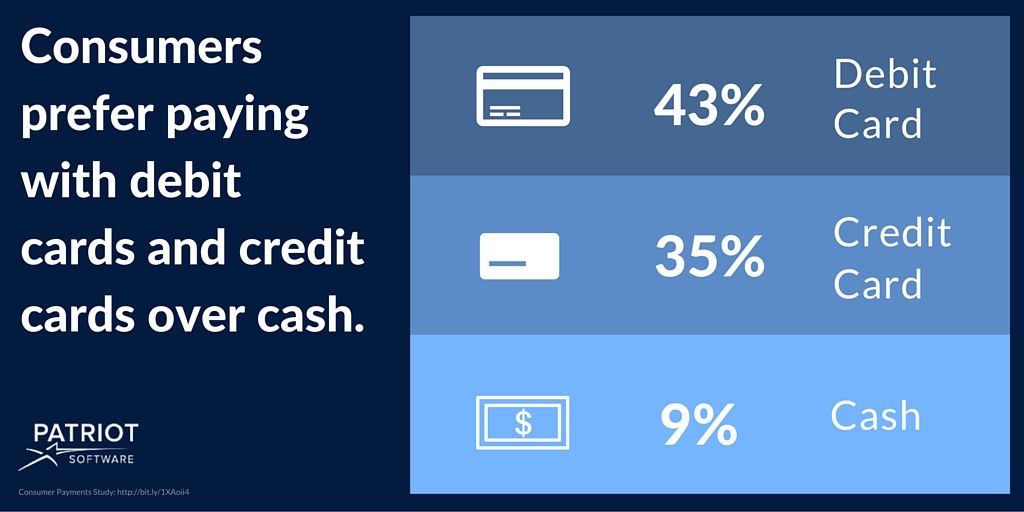

You limit your customer pool and potential sales when you only accept cash payments. Many consumers pay with credit cards over cash. Accepting credit cards helps you serve a larger number of customers.

You can set up a credit acceptance system through the bank with your business checking account. Or, you could set up a merchant account with your business checking account.

You may have to pay the bank extra to accept card payments. But, you might benefit from not running a cash-only business. Look into maintenance and transaction fees before signing up for credit processing services.

4. Multiple business account signers

You can have multiple signers on a business checking account. In other words, you can allow other people to use your business checking account.

While you run your business, an employee can do some administrative banking duties. This could allow you to focus more time on revenue-generating aspects of your business.

If you allow others to use your business checking account, be careful who you give access to. Be sure you trust each person who handles your business’s money.

Keep in mind that if you are a sole proprietor, you open the business checking account with your Social Security number. Whoever uses your business checking account has access to your Social Security number. Trust is essential for sole proprietors who give employees access to their checking accounts.

5. You look professional and gain bank relationships

Whether you are a startup or an established business, you want to look professional. Do you pay vendors with checks that have your personal information printed on them? Or, do you tell customers to issue payments to your personal name? A business bank account gives you a more qualified look.

Opening a business checking account can also help you form bank relationships. Relationships with your banking professionals can help you grow your business. For example, if you need financing, you may want a small business loan. A relationship with your bank representative might help you get better loan terms.

Do you need a simple way to record your business’s transactions? Patriot’s accounting software for small business is easy to use. We offer free support. Sign up for your free trial today!