So, you ran payroll and noticed a big oops. You overpaid an employee. What can you do? You can start by learning how to correct a payroll overpayment.

What is a payroll overpayment?

A payroll overpayment is when an employer pays an employee more than the worker should have received in a pay period. This can lead to cash flow and payroll tax issues.

Overpaying an employee can be the result of:

Calculation errors: You’re old school when it comes to running payroll. Software? Calculators? Who needs it?! Unfortunately, you realize you do after miscalculating 80 hours X $22 in your head.

Entry errors: When entering hours worked, your fingers slipped. So, you ended up typing in 50 hours worked when the employee only worked 40 (whoops).

Inaccurate PTO payout: Your employee cashes out 80 hours of accrued PTO … but they only had 32 hours of accrued PTO left. Employers who don’t have up-to-date time off records could wind up paying more than they should when an employee cashes out their accrued PTO.

| Sick and tired of calculation errors? Let Patriot’s online payroll handle calculations so you don’t have to. And if you want to view your team’s used and unused time-off, try our time and attendance software add-on. Get your free trial of both today! |

How to correct a payroll overpayment

How you handle an overpayment depends on when you realize you incorrectly processed payroll:

- Before the employee receives their pay: You realize you overpaid the employee before they receive their direct deposit or cash their paycheck. You may have time to void the payroll and reverse the deposit.

- After the employee receives their pay: You realize you overpaid the employee after they already received their direct deposit or cashed their paycheck.

What can you do if you notice after the employee receives their pay?

As an employer, you have the right to recoup the money you overpaid an employee under federal law. In fact, the Department of Labor puts wage overpayments in the same category as salary advances. If you have an overpaid employee, you can deduct money to recoup the difference, even if the deductions cut into federal minimum wage or overtime pay laws. However, state laws may be different.

So, how can you recoup the money you overpaid? Do NOT temporarily decrease an employee’s pay to try to even it out. Instead, you can:

- Ask the employee to pay back the difference between the two net pays (i.e., what the employee received minus what they should have received)

- Deduct the amount from an employee’s future paycheck

- Spread the amount out evenly across several future paychecks and deduct

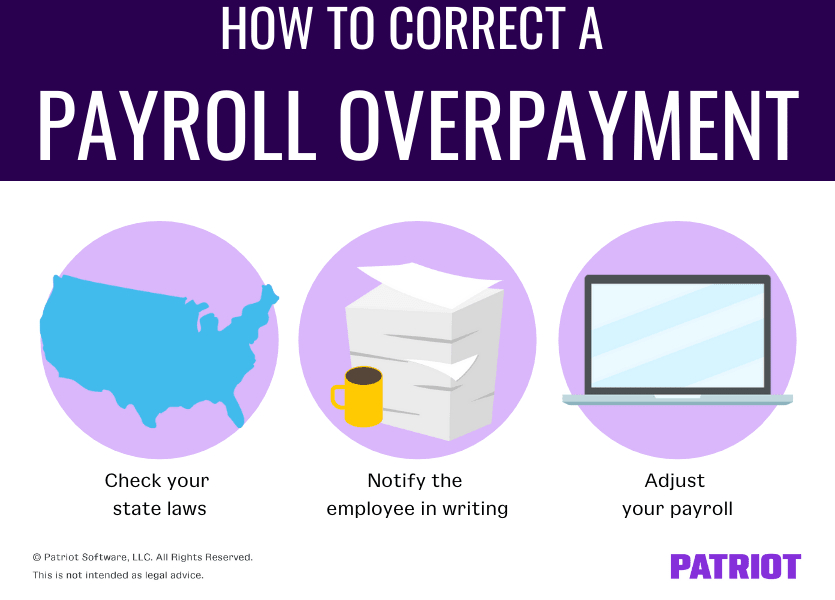

Decide to deduct the amount from an employee’s paycheck(s)? Here’s how to correct a payroll overpayment.

1. Check your state laws

Although employers get free rein under federal law, some states have stricter rules on correcting payroll overpayments.

Some states may require that you do one or more of the following:

- Notify the employee and get written authorization before deducting

- Example: Texas

- Catch the error and implement a plan within a certain time frame (e.g., 90 days)

- Example: Washington

- Avoid going below minimum wage

- Example: Ohio

- Avoid deducting more than a certain percentage of the employee’s earnings (e.g., no more than 15%)

- Example: Indiana

Be sure to check with your state for more information on overpayment recovery do’s and don’ts.

2. Notify the employee in writing

Whether your state requires it or not, notifying the employee in writing is a good rule of thumb. Letting your employee know can help avoid confusion and frustration. Not to mention, putting it in writing—and getting your employee’s authorization—can act as documentation.

To start, talk with your employee about the overpayment. Negotiate a plan that works for you and the employee, such as deducting a certain amount each paycheck. Make sure the final plan is in writing, and get the employee’s signature.

So, what should your payroll overpayment letter say? Detail the following:

- What date the overpayment occurred

- The total amount of the overpayment

- Deduction amount(s) per paycheck

- Time period of overpayment recovery (beginning and ending)

- What the employee can do to dispute the deduction procedure

3. Adjust your payroll

After you’ve checked your state laws and notified the employee, it’s time to adjust your future payroll(s) to recover the overpayment.

Set up the overpayment deductions like a post-tax deduction, not a pay decrease. This means that you’ll withhold the overpayment collection after withholding taxes from the employee’s pay.

Remember to update your records, including your accounting books, to reflect the overpayment and recovery.

Overpayment of wages tax implications

Here’s a brief overview of your payroll tax responsibilities as an employer. Withhold taxes from employee wages, contribute employer taxes, and report and remit taxes to the IRS quarterly (using Form 941) or annually (using Form 944). And, you must report each employee’s wages and tax withholdings on Form W-2.

If you overpay wages to an employee, chances are you overwithheld employee and overpaid employer taxes, too. So, what are the overpayment of wages tax implications you need to worry about?

Depending on when you recover the overpayment wages, you may need to file a Form 941-X or 944-X, an adjusted return:

- If you already deposited the taxes but realize your mistake before you file Form 941 or 944, report the amount you should have paid on the form (you should receive a credit).

- If you already deposited the taxes and don’t realize your mistake until after you file Form 941 or 944, file an adjusted return (e.g., Form 941-X).

Avoiding employee overpayment in the future

Recouping overpayment of wages can be stressful and confusing for all parties involved. To avoid going through it, there are a few steps you can take:

- Use payroll software to help you avoid calculation errors

- Easily view employees’ used and unused time-off hours with time and attendance software to avoid incorrect PTO payouts

- Review numbers before processing payroll to avoid overpayments due to entry errors