As an employer, there may be times you need to find a way to boost employee morale or productivity. One idea that may come to mind is incentive pay. But, what is incentive pay? And, what are the types of incentive pay you should know?

What is incentive pay?

So, what exactly is incentive pay? Here is the incentive pay definition: A type of compensation given in addition to base wages that can help motivate employees to perform their best. In turn, the company boosts profit because employees have an extra incentive to work harder.

Incentive pay can be cash or non-cash payments to your employees. And, you can choose to give incentive pay individually or based on the company’s performance as a whole.

There are two structures for incentives: casual and structured.

Casual incentive pay is a payment type that you can give to an employee at any time to reward them for their work performance or to help retain an employee. For example, you have a member of your team who performs exceptionally well, so you decide to give the employee a gift card. The gift card is a casual incentive payment type.

Structured incentive pay is set by specific sales or production goals and paid to employees at a percentage or flat rate. For example, you set a goal for $50,000 in sales for the fiscal year. If you reach that goal, you give each employee a bonus equaling 2% of their annual salary. When you achieve the sales goal, the payments you give to your employees are structured incentive payments.

Merit pay vs. incentive pay

When you hear about incentive pay, you may also think about merit pay. After all, merit pay is very similar to incentive pay. With merit pay, you can also reward individual employees for their work performance. But, the big difference is that merit pay is a permanent increase to an employee’s wages while incentive pay is temporary.

For example, your employee consistently meets targets and completes tasks ahead of the deadline. As a result, you decide to reward the employee’s hard work by offering a 1% raise on the employee’s yearly salary. The pay increase is merit pay.

Incentive pay plans

How you distribute incentives to your employees can vary. But, you should have an incentive pay plan in place to ensure that employees clearly understand the process.

One type of incentive pay plan is having employee reviews. Have a staff member, such as a supervisor, subjectively review each employee’s work performance for a set period of time. Look at things such as teamwork, the ability to take initiative, work completed, etc., and rate the employee. You may choose to give incentive pay to employees with the highest overall performance rating.

Another type of plan is the group plan. The group plan allows you to look at the team’s overall performance to decide how much you pay the employees. Typically, you determine how much each individual team member receives based on the overall performance of every team member working together.

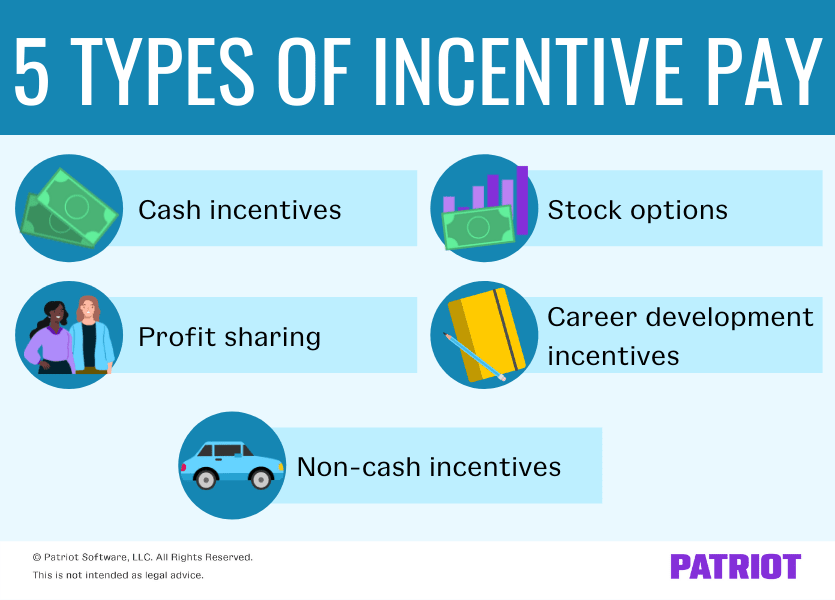

Types of incentive pay

Again, incentive based pay is temporary. Incentive pay does not permanently change the employee’s hourly or salary wages. Take a look at some incentive pay examples.

1. Cash incentives

Cash incentives include a variety of payments to employees based on their job performance, including commissions and bonuses.

Commission pay is a lump-sum payment made to employees when they complete a task. Typically, the task is selling a certain amount of goods or services. Employers may choose to have a commission-only payment system for employees. But generally, commissions are payments made in addition to hourly or salary wages.

Cash bonuses are lump sums of money given to employees occasionally or periodically for good performance. You may also choose to give bonuses to employees for joining or remaining with your company. Bonuses are typically not tied to sales.

Types of bonuses include:

- Signing

- Referral

- Performance

- Holiday

- Retention

- Annual

- Milestone (e.g., five years with the company)

Generally, only a non-discretionary bonus is considered incentive pay. A non-discretionary bonus is one where certain requirements must be met in order for the employee to receive the payment.

Cash incentive pay can be individual or group plans. For example, you may choose to give a group plan bonus for a holiday but give performance bonuses only to those employees who perform exceptionally well.

2. Profit sharing

Profit sharing is the sharing of the company’s annual profits with employees. Most profit-sharing plans have yearly payouts to employees, and employees receive payments in the form of cash or stocks.

Typically, this type of incentive pay has a detailed plan and formula for how much of the profits the business will set aside and distribute. And, the plans are designed to assist employees with saving and investing for retirement.

3. Stock options

Employee stock options allow employees to purchase shares of the company’s stock at a discount and see possible tax breaks on profits.

Employers also benefit with stock options because it gives employees a true stake in the future of the company. Employees have the incentive to see the company succeed when they have a financial stake in the business beyond a paycheck.

4. Career development incentives

Do you offer your employees opportunities to learn and grow to further develop their career? If so, you probably offer a career development incentive. Examples of career development incentives include:

- Tuition reimbursement

- Networking opportunities (e.g., conference attendance)

- Training courses

- Job shadowing/mentorship opportunities

- Skill advancement certification training

If you pay for your employees to attend functions that allow for career development, you offer an incentive pay.

5. Non-cash incentives

When looking at incentive pay, you might be looking at all of the big things your company can do to incentivize employees to join or stay with your company. But, not all incentives have to be large undertakings, like stock options or profit sharing. Enter non-cash incentives.

With non-cash incentives, employees do not receive money for their work, but they do receive some type of reward.

Non-cash incentives can be things like personal use of company car (PUCC), gifts, vouchers, or memberships to clubs (e.g., health clubs). In other words, non-cash incentives can be rewards employees would not purchase for themselves. Employees may have to pay income taxes on some non-cash incentives (e.g., PUCC).

Other non-cash incentives that can help you recruit and retain employees can be things like:

- Periodic company lunches

- A snack bar

- Employee recognition programs (e.g., employee of the month)

- Flexible work arrangements

Non-cash incentives are unique because they can be physical items or experiences employees receive. And, this type of incentive can encompass other types of incentives. For example, career development opportunities are also a non-cash incentive for employees.

This article has been updated from its original publication date of June 5, 2012.

This is not intended as legal advice; for more information, please click here.