Oregon employers have a new tax to add to their payroll radar: the Metro Supportive Housing Services (SHS) tax. So, what is the Metro Supportive Housing Services tax? Who must pay the tax? And, what does it fund?

The basics of the Metro Supportive Housing tax

Voters passed the Metro Supportive Housing Services income tax in May 2020. The tax aims to reduce homelessness through services that will help homeless individuals find and keep housing.

Services include:

- Emergency services (e.g., shelter)

- Placement into housing

- Help with paying rent

- Advocacy and case management

- Mental health

- Physical health

- Language and culture assistance

- Employment

- Addiction and recovery

- Tenant rights

…And other services. The Metro SHS tax will also expand and strengthen existing programs and systems that provide these services.

When did the tax go into effect?

The tax went into effect on January 1, 2021. In April 2021, employers could begin registering for the tax.

Employers could voluntarily withhold Metro SHS tax beginning January 1, 2021. But, you must offer to withhold the tax in writing (and we’ll get to that in a minute).

On January 1, 2022, withholding is required for all employees who work in the Metro District and earn $200,000 or more in the calendar year. And, employers must offer to withhold the tax for all employees who are not required to pay the tax.

For 2021, Metro will not assess penalties for tax payments not made for the 2021 tax year. Annual tax returns are due beginning April 15, 2022. Fiscal year filers have due dates later than April 15, 2022.

The tax is currently set to expire in 2031.

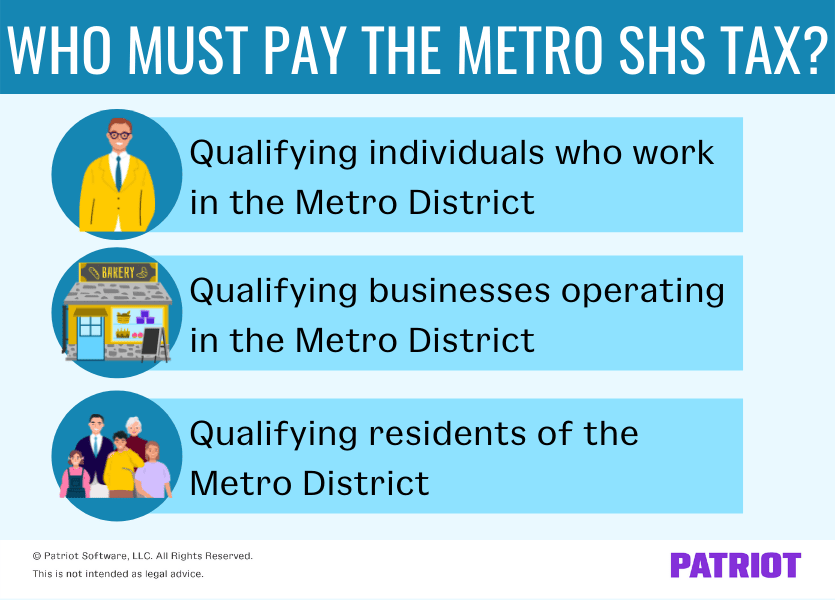

Who must pay the Metro SHS tax?

The Metro Supportive Housing Services tax is an employee and business income tax paid by qualifying individuals and companies.

The Metro district encompasses three counties:

- Clackamas

- Multnomah

- Washington

Individual income tax

Individuals (e.g., employees) must pay the Metro SHS tax if they are residents of or perform work in the Metro District of Oregon and earn above the income threshold.

Non-residents of the Metro District who perform work in the district must pay taxes only on income from the district. Part-year residents must prorate their income based on their residency and pay the tax, too (if applicable).

Employers outside of the Metro District who employ district residents are not required to withhold the tax. But, they may do so voluntarily.

Individuals who earn above the following income thresholds must pay SHS tax:

- Filing single: More than $125,000

- Filing jointly: More than $200,000

Business income tax

Businesses with locations in the Metro District must also pay the Metro SHS income tax if they meet the minimum criteria. If the business earns at least $5 million in gross receipts from all sources (both inside and outside the Metro district), the business must pay the tax.

Sole proprietorships and disregarded entities are not subject to the tax as a business. Instead, they pay the tax as individuals.

Can employees opt in or out of the tax?

Employees or residents who earn less than the required income threshold may choose to pay into the Metro SHS income tax with a designated withholding amount.

Additionally, employees who qualify to pay the tax may also opt out of payroll tax withholding. However, they are responsible for paying for the tax on their own. And, employees who opt out and have an annual Metro SHS tax liability of $1,000 or more must make estimated payments each quarter.

Again, you must communicate with your employees in writing once the tax is available in your payroll system. Employees can use the Metro Tax OPT Form or Metro/MultCo OPT Form to opt in or out of paying the tax (we’ll touch on these forms in a minute).

What is the tax rate?

The tax rate for individuals and businesses is the same. Both individuals and companies receive a tax rate of 1% (0.01).

Who collects the Metro SHS tax from employers?

The Metro District partnered with the City of Portland’s Revenue Division to collect and process the tax payments and filings.

Who oversees the tax program?

The Metro District created the Supportive Housing Services Regional Committee to oversee the program. The committee is made up of volunteers and must provide independent, transparent oversight of the program for the duration of the program.

Every three months, the committee must meet to review and evaluate if the Metro SHS program is fulfilling its goals. And, the committee must make annual reports and presentations to the Metro Council and the boards of commissioners for Clackamas, Multnomah, and Washington Counties.

Employers’ next steps for the Metro SHS tax

Again, the Metro District won’t assess penalties for late payments for tax year 2021 if a withholding system is not available. But, employers must still prepare for the tax. After all, withholding is mandatory for all qualifying employees beginning January 1, 2022.

1. Create a Portland Revenue Online account

Employers in Portland do not have to re-register for a Portland Revenue Online (PRO) account. But, employers in the Metro District who do not have a PRO account must create one.

Employers will use their PRO account to pay and file the tax.

2. Contact your payroll provider

If you use an accountant or payroll software, check if your provider is prepared to accommodate the new Metro SHS tax. If your payroll software is not yet ready, ask for an approximate time when the tax will be available in the software.

Verify that your provider can accommodate the new tax no later than January 1, 2022.

3. Communicate with your employees

As an employer, you only need to collect the tax from employees who earn over $200,000. Again, employees can opt out of the tax, even if they meet the threshold. But, employees who opt out must pay the tax on their own. And, employees can opt in to the tax even if they don’t meet the employer withholding threshold.

Regardless of who opts in or out, employers must communicate with their employees in writing once the Metro SHS withholding is available.

Provide all employees with a copy of one of two forms:

- Metro Tax OPT Form: Opt-in/opt-out form for the Metro Supportive Housing Services tax only

- Metro/MultCo OPT Form: Opt-in/opt-out form for both Metro Supportive Housing Services tax and the Multnomah County Preschool For All Tax

Choose the form based on your business’s location. Businesses in the Multnomah County section of the Metro District should use the Metro/MultCo OPT Form.

Collect the forms from all employees and update your payroll with the employees’ information. Employees who opt in should provide a designated withholding amount.

4. Remit and submit taxes

Again, mandatory withholding begins in 2022. Starting in 2022, all applicable employers must submit quarterly returns, annual reconciliations, and Forms W-2 through the PRO system. Employers can choose to use bulk filing or electronic data entry.

The due dates for withholding payments are the same as those for the employer’s Federal Income Tax and state income tax withholding. Employers may pay via ACH credit if filing in bulk. Employers with only one return and payment may use ACH debit.

If you use full-service payroll software, your provider may handle collecting, depositing, and filing the Metro SHS tax. Check with your provider for more information.

If an employer wishes to make a payment by check, the employer must request or petition.

This is not intended as legal advice; for more information, please click here.