Easy and Affordable Payroll Software

Run quick, seamless payroll—and save money along the way—with Patriot's Payroll Software.

Choose Between Basic Payroll or Full Service.

Basic Payroll

Full Service Payroll

Payroll can be tricky, but we simplify it by offering free, USA-based support via phone, email, or chat. Contact us 9 AM - 7 PM, Monday - Friday. Our support is the best! (And we aren't biased at all).

We know that starting payroll or switching providers can be time consuming, so we offer free payroll setup. No tricks or gimmicks. Provide us with your information, and we'll take care of the rest. Or, just use our payroll startup wizard and do it yourself.

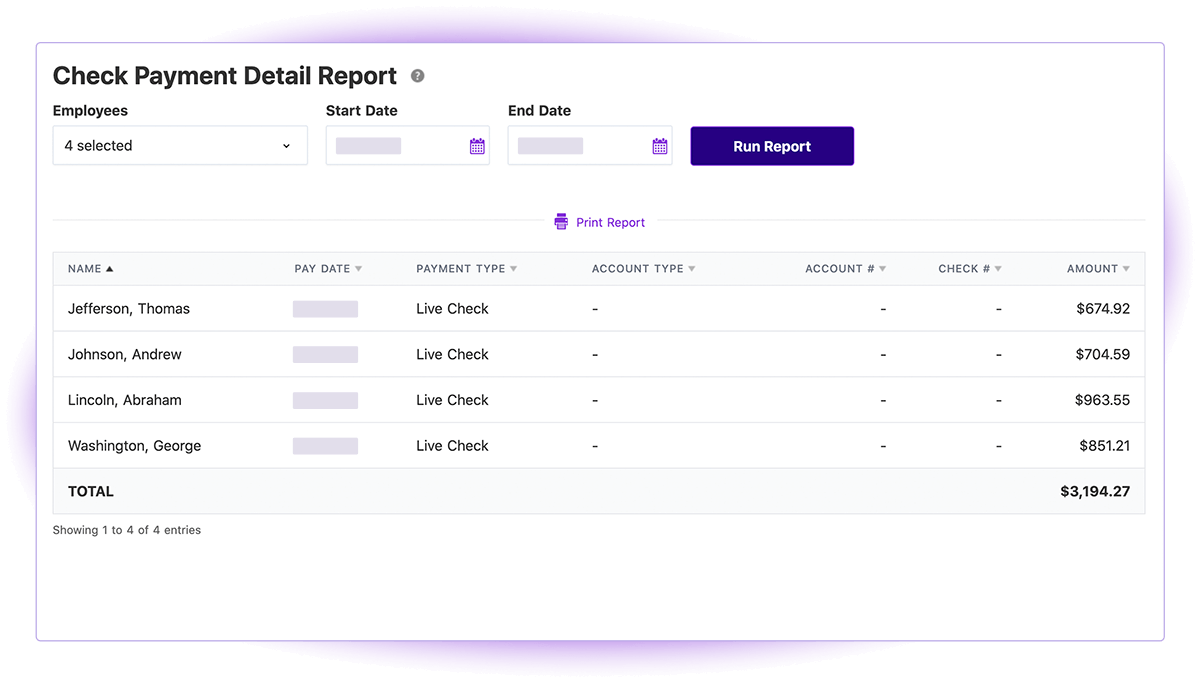

We offer free 4-day and 2-day direct direct deposit (for qualifying customers), so you can pay your employees with no extra fuss. Have an employee who wants to be paid by check instead? No problem! Handwrite or print checks right from the software.

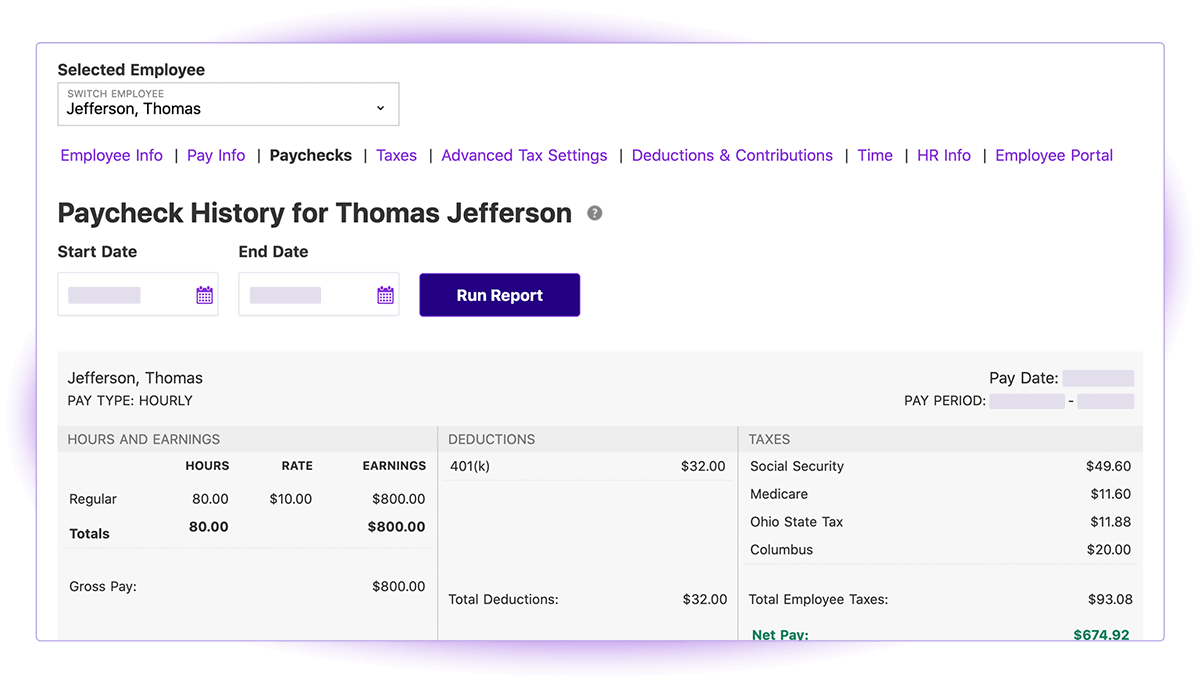

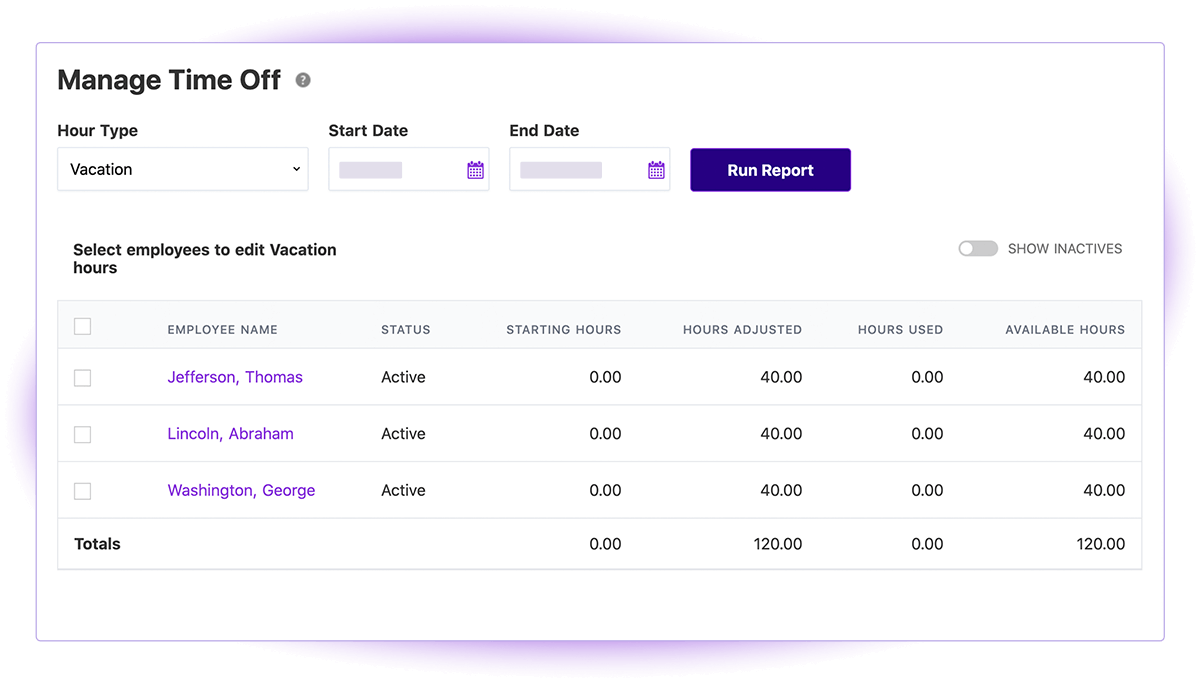

Give your employees secure access to their pay stubs, pay history, time off balances, and electronic W-2s.

Automatically pay your workers' comp insurance premium with each payroll through our partner, AP Intego. All of the compliance and none of the fuss.

Pay your employees as often as you want without being charged for extra payroll runs!

Pay different groups of employees weekly, biweekly, semi-monthly, or monthly as needed.

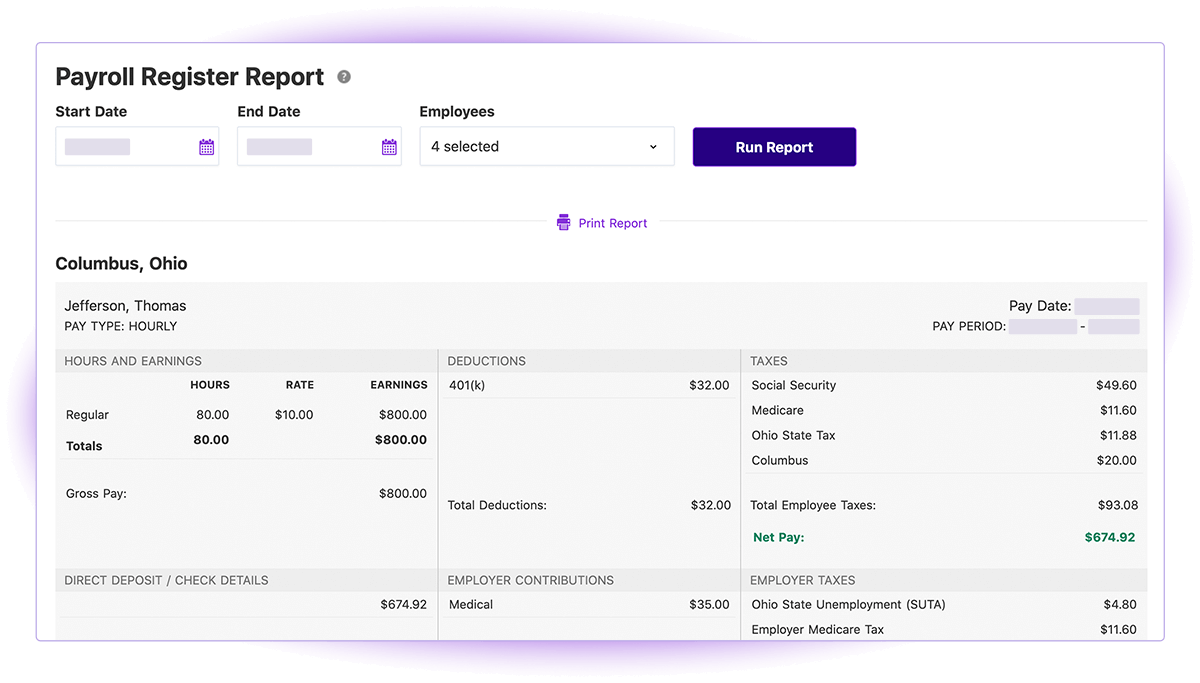

If your business has more than one physical location, assign the employee's primary work location (including working from home). The proper payroll taxes will be calculated based on where the employee works.

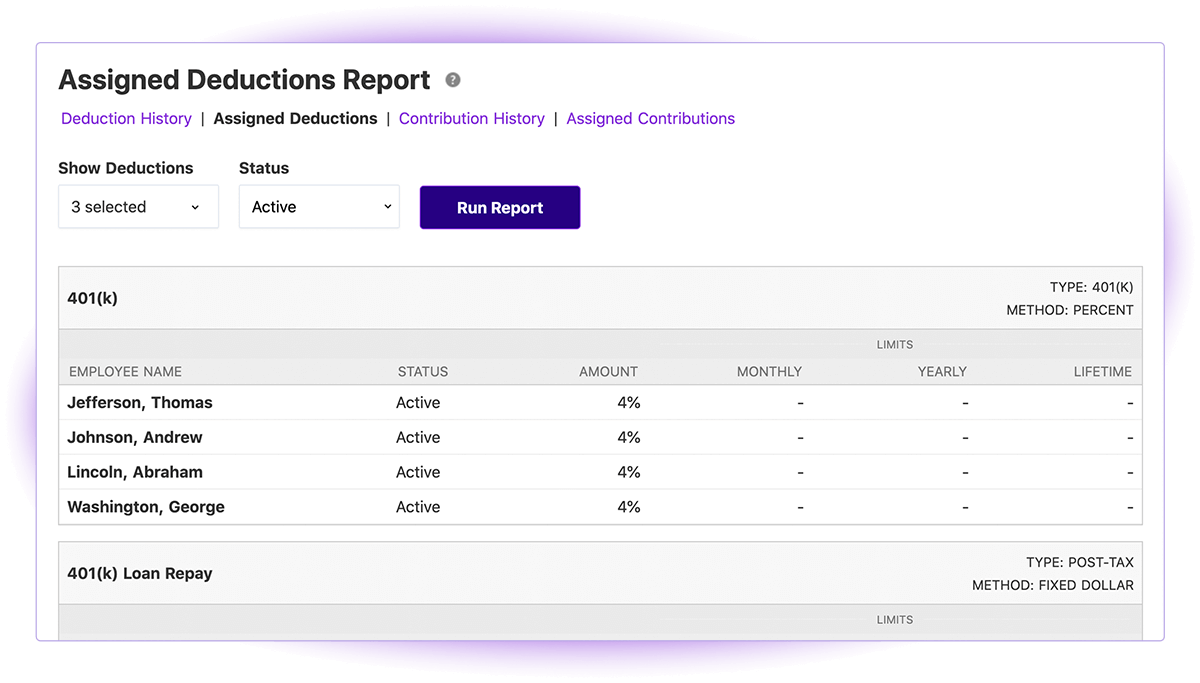

Use our standard hours and money types or add your own, plus add your own employee deductionsand company-paid contributions.

Our software is 100% mobile friendly. You can run your accounting or payroll directly from your smartphone or tablet. There is no need to download an app onto your mobile device or waste precious storage space.

Payroll information is imported seamlessly to Patriot's Accounting software. We also integrate with QuickBooks Desktop or QuickBooks Online.

Post electronic W-2 forms for employees in their portal, or print paper W-2 forms. The choice is yours!

Have a PTO policy you want to automate? You can easily set up and customize time-off accrual rules. Time-off hours will automatically be added to each employee's payroll.

Add up to five pay rates for each hourly employee. You can differentiate pay rates for employees by adding a description to each rate.

Do any of your employees need a repeating money type such as car allowance, cell phone allowance, housing allowance, etc.? No problem! Create as many different repeating money types as you'd like.

Pay your independent contractors with your employees in the same payroll. If you have direct deposit, you can pay contractors with direct deposit, too.

When it comes to your business, it's good to know where your payroll budget is being spent. With departments, you will be able to use reports to find payroll costs for each of your teams.

Automate your payroll even more by integrating with Patriot Time and Attendance software or QuickBooks Time to import employees hours to payroll effortlessly.

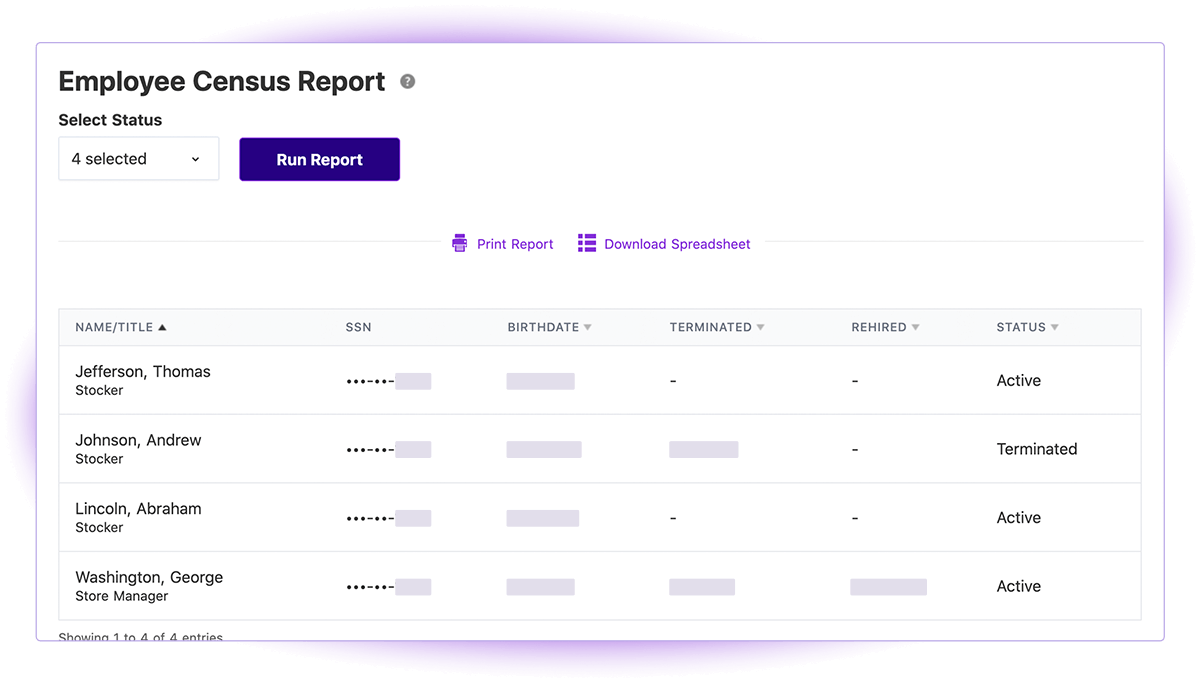

Having employees doesn't stop with payroll. Add Patriot HR for more employee status, position history & managers, notes, files and more.

Sick of paper 1099s? If you opt into 1099 e-Filing, you can file your forms in our software with just a few clicks (nominal fees apply for Basic Payroll customers). We'll shoot the 1099-NEC and 1099-MISC over to the IRS and send the 1099-MISC to states that participate in the combined federal/state e-Filing program for you!

So, you want to give your employees a bonus. What you don't want is to A) give a random take-home amount after taxes or B) do gross-up calculations yourself. With our Net to Gross Payroll tool, simply enter the amount you want employees to take home, and we'll gross it up for taxes.

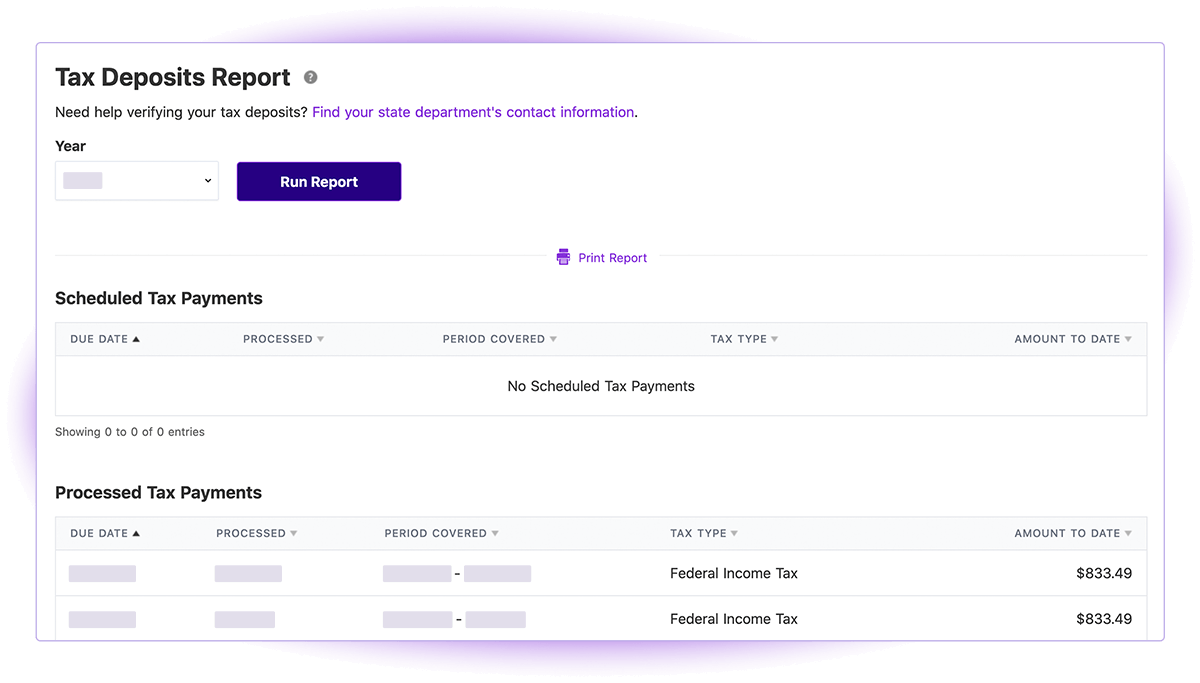

Patriot will begin collecting, depositing, and filing your federal payroll taxes based on the start date you select.

Patriot is compliant in all 50 states and will keep you up-to-date on your state payroll tax filing obligations. (Each additional state filing is $12 per month, per state.)

Have local payroll taxes? Patriot will deposit and file all of your local and city taxes, too!

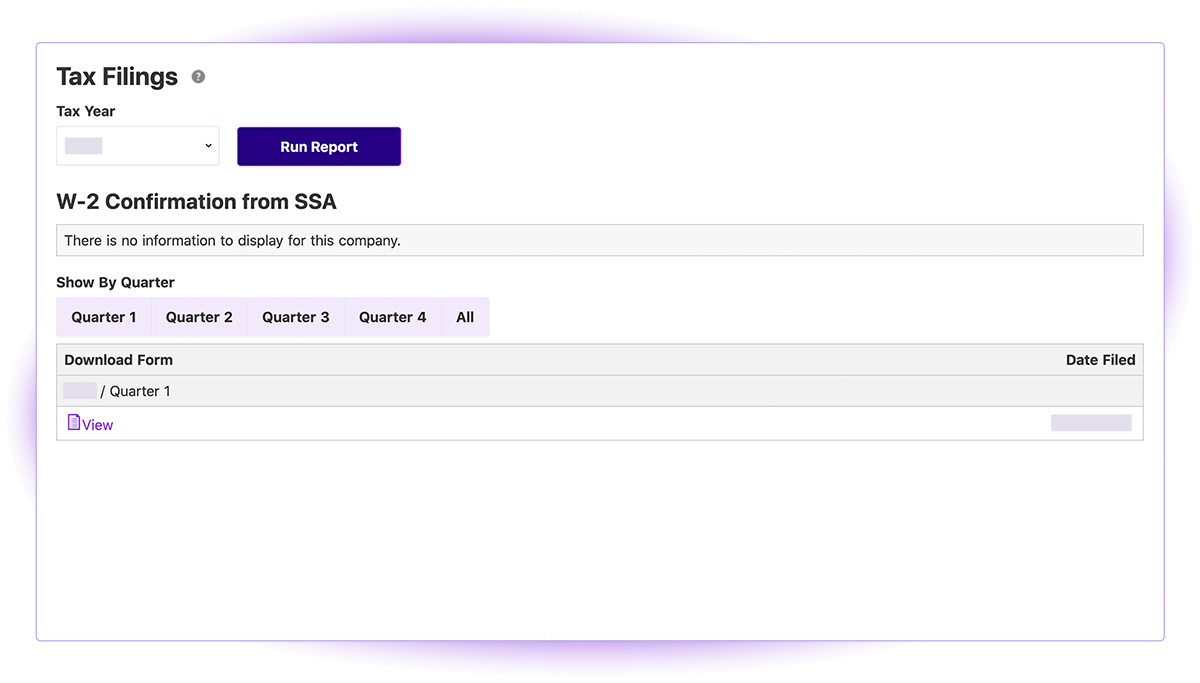

Patriot will submit your 940, 941, W-2, and W-3 data to the proper tax agencies each quarter or at year-end, for no additional fee.

Rest assured that Patriot will deposit and file your tax obligations on-time and accurately. If we make a mistake, then we'll cover all the penalties and interest.

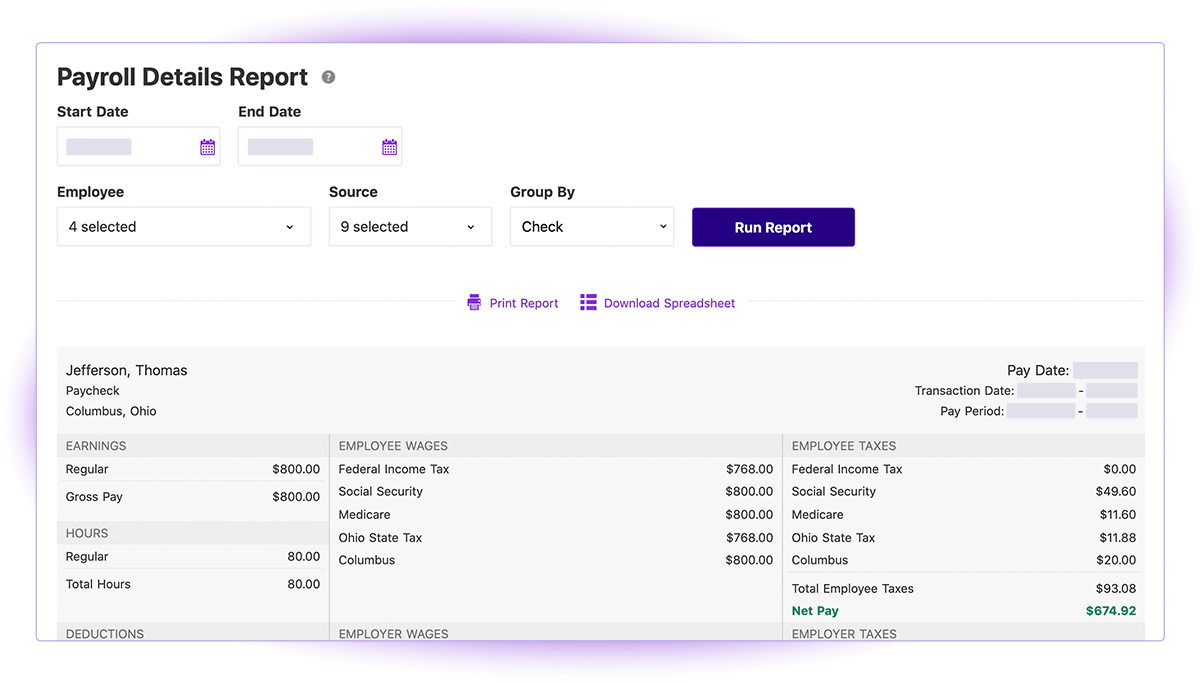

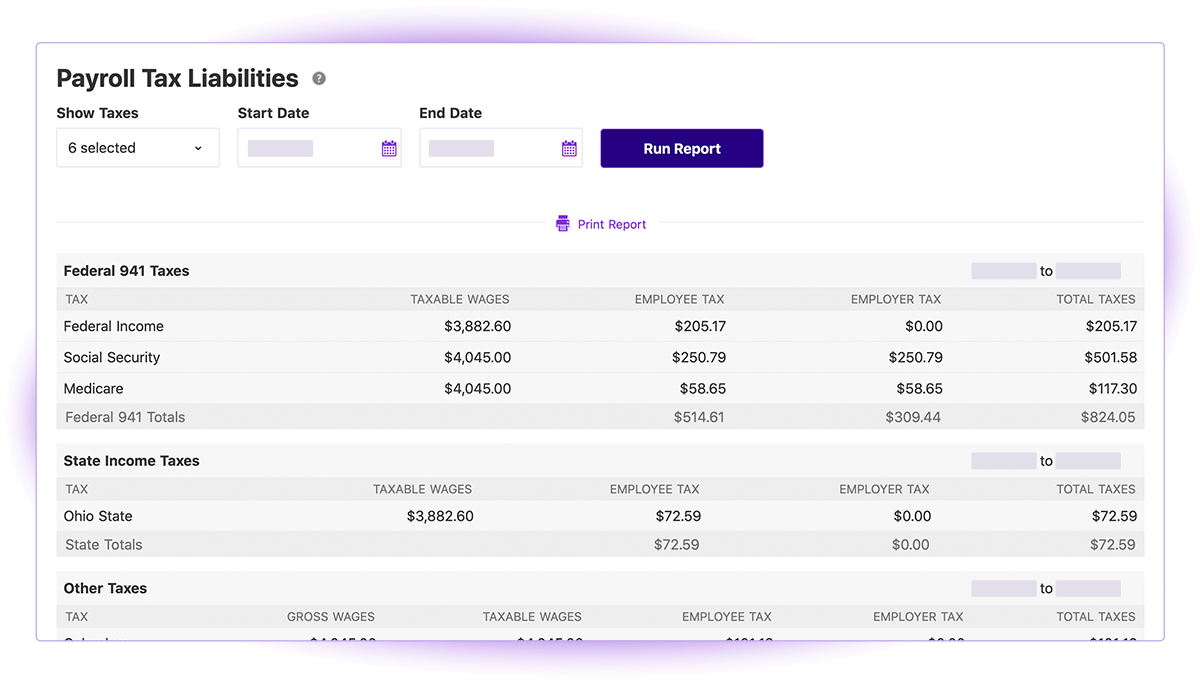

Get Quick and Accurate Payroll Reports

So many reports, so little time. Need to get year-to-date totals, tax filings, or contribution history? We got you.

All payroll reports are easy to create with a few clicks of a button. Plus, we give you easy ways to share and save your reports with either PDF or CSV files.

“Easy to sign up. Easy to use. Very accurate reports. Top notch customer service and all at a very reasonable price point.”

Barry (Courtesy of TrustPilot)

Get the Software That Tops the Charts for Best Customer Support, Ease of Use, and Value

Patriot Is Trusted by Tens of Thousands of Businesses to Streamline Their Payroll

You Got Questions? We Got Answers!

Since our payroll software is online, you only need access to a web browser and the Internet. There’s no software to download.

The software is designed for small- or medium-sized businesses with up to 100 employees.

Yes. You may run a payroll whenever you need to in the payroll software.

Yes. You may begin using the payroll application at any time during the year. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s are accurate. (We can help! We offer free payroll setup to help you get your account set up and can enter all payroll history for you.)

No–our software is only available to companies with employees working in the USA. It’s our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

Patriot will e-File 1099s for Full Service Payroll customers who are paying contractors through payroll at no additional cost for 2020 1099s and later years. If you have Accounting Premium, Accounting Basic, or Basic Payroll, here are the filing fees:

| Number of 1099s | Fee |

|---|---|

| 1 to 5 | $20.00 |

| 6 to 35 | Additional $2.00 per 1099 |

| 36+ | No additional charge |

For more information, check out our help article, Electronically Filing Your 1099s.

Payroll Overview

Yes. You may run a payroll whenever you need to in the payroll software.

No–our software is only available to companies with employees working in the USA. It’s our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

Patriot Software will not share your information with any outside party without your prior permission.

Yes. You may begin using the payroll application at any time during the year. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s are accurate. (We can help! We offer free payroll setup to help you get your account set up and can enter all payroll history for you.)

Pricing & Billing

In the months you don’t run payroll, you will only be charged the base price for the payroll.

There’s no additional software charge for providing direct deposit to your employees.

Patriot Software accepts credit or debit cards from Visa, Mastercard, American Express, and Discover for your software and service fees.

Direct Deposit

We will only accept applications from small business owners using a commercial/business bank account for their payroll.

Patriot offers a few direct deposit options to meet our customers' needs: free, expedited 2-day direct deposit for qualifying customers; standard 4-day direct deposit; and payroll prefunding. Your money will be ACH debited from your bank after you run payroll.

Technical

Since our payroll software is online, you only need access to a web browser and the Internet. There’s no software to download.

When building solutions, they are designed to be highly secure, performant, and scalable. Solutions are built on a cloud provider giving us the ability to quickly respond to outages and threats. Patriot Security & Systems Team is notified immediately when monitoring systems detect abnormal activity.

We utilize a diverse set of technologies to safeguard your data. Policies are implemented to ensure that these technologies are properly installed and maintained. Third-party audits are conducted to verify we meet industry standards.

Full Service Payroll

Our Full Service is perfect for small- and medium-sized businesses in the USA and handles all employee taxes and most employer taxes, including federal, state, and local taxes.

Patriot collects and files Workers’ Compensation Insurance for Washington and Wyoming. For other states, we do offer free integration with Next Insurance, who offers Pay-As-You-Go Workers’ Compensation Insurance.

Yes, we file in all 50 states. However, there is a $12 fee for each additional state that we file in.

Unfortunately, we don’t handle the IRS Form 943 at this time. However, it’s on our radar, and we look to offer this sometime in the near future!

No. While you can set up custom deductions and contributions, Patriot Software DOES NOT handle the remitting of these funds to the proper agencies at this time. However, it’s on our radar, and we look to offer this sometime in the near future!

After you have completed your tax filing setup, Patriot Software will collect payroll taxes on approved payrolls usually the first banking day before the pay date. If payroll is run on the same day as the pay date, payroll taxes will be collected on the next available banking day.

Run the Average Payroll in Under 3 Minutes With 3 Easy Steps

- Enter Hours

Plug in employee hours or use our Time and Attendance Software to automatically import the hours to payroll. Easy-peasy...

- Approve Payroll

After you see our instant payroll calculations, it’s one click to approve.

- Print Paychecks

Print checks, paystubs, or a combination of both. You decide how to pay your employees. The ball’s in your court.