As a small business owner, you’ve probably heard of cash and accrual accounting. But, you may not be as familiar with the hybrid accounting method. The hybrid method is a blend of the cash and accrual methods of accounting. Is the hybrid accounting system right for your small business?

Hybrid accounting: Combining bookkeeping methods

Usually, businesses use one of the two main methods of accounting: cash-basis or accrual. But, some small business owners choose to record transactions using the hybrid method of accounting.

Hybrid accounting combines aspects of cash-basis and accrual accounting. To understand the hybrid method of accounting, you need to know the differences between the cash and accrual methods.

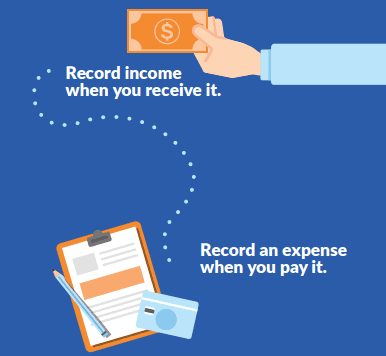

Cash-basis accounting

To use the cash method, record income and business expenses only when you receive or disburse cash. When you pay a supplier, vendor, or other entity, make a record. And when a customer gives you money for your goods or services, write down the transaction. You make records when actual cash is exchanged.

Cash-basis accounting is the simplest way to record transactions. The cash method results in fewer journal entries throughout the accounting cycle. The cash method is good for cash flow management and monitoring how much money you have on hand. However, cash accounting can make it difficult to see the big picture of your business’s finances over time.

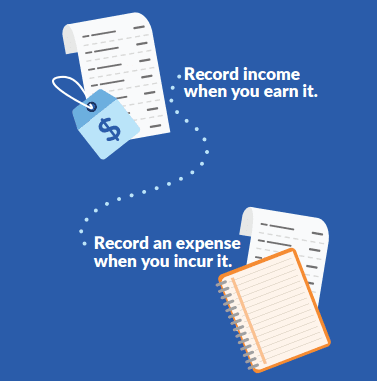

Accrual accounting

With the accrual accounting method, you record income when you earn it. You do not record cash when you receive it. For example, you record income when you give a customer an invoice.

Record expenses when you incur them, not when you pay them. For example, you record an expense when you receive an invoice.

Many larger businesses use the accrual method because it accurately tracks long-term performance. The method makes it easier to anticipate future income and expenses.

While accrual is beneficial in many ways, it doesn’t accurately represent cash flow. Your profits might look positive, but you could be headed for insolvency because you have no cash flow. Some companies conduct separate financial reporting and analysis for cash flow when using accrual accounting.

Want to learn more about how cash-basis and accrual accounting differ? Check out our FREE guide, A Basic Guide to Cash-basis vs. Accrual, to get more information.

Choosing the hybrid accounting method

When using the hybrid method, you use parts of cash-basis and accrual-basis accounting. The hybrid method makes it possible to track cash flow and see long-term financial health.

Some companies are required to use the hybrid method. These businesses include:

- Small mining operations

- Manufacturers

- Wholesalers

- Retailers

Even if your business is not required to use the hybrid accounting system, you can choose to do so. The hybrid method of accounting is a little tricky for those who don’t have much accounting or tax experience. You might have trouble knowing when to apply the cash and accrual methods.

Before selecting the hybrid method, find an accountant and consider the following factors:

- The size of your business

- The nature of your transactions

- Your potential tax deductions

- Your expertise in accounting and tax preparation

With hybrid accounting, you can use the cash method to account for most transactions. But, specific line items, such as inventory, require accrual accounting treatment. And, accrual entries are required if your company meets specific revenue thresholds.

Special IRS rules for hybrid accounting

You can use the hybrid method for income taxes, so long as you are consistent and clearly reflect income. You must follow special rules when using the hybrid method. You can find the full list of requirements in IRS Publication 538.

Special rules you must follow when using the hybrid method include:

- If you report income using the cash method, you must also report expenses using the cash method.

- If you report income using the accrual method, you must also report expenses using the accrual method.

- If you have inventory, you must use accrual accounting to record sales and purchases.

Bottom line: Income and expenses must be reported using the same method, whether it’s cash or accrual. And, if you have inventory, you need to report sales and purchases using the accrual method. You can record all other transactions with either cash or accrual accounting.

Your takeaway

- The hybrid method is a blend between the cash and accrual accounting methods.

- You must use the hybrid accounting method consistently to compute income.

- Before selecting the hybrid method, evaluate your operations to see if it’s the right fit.

Need help tracking your small business transactions? With Patriot’s online accounting software, you can complete your books with cash, accrual, or hybrid accounting. We offer free, U.S.-based support. Try it for free today.