As a business owner, you’re bound to reimburse employees for business expenses at some point, especially if they’re traveling for business purposes. If you reimburse employees for costs while traveling, you might consider creating a travel reimbursement policy.

Read on to learn more about travel reimbursement and what sections to include in your travel reimbursement policy.

What is a travel reimbursement policy?

Travel reimbursement is when you pay employees back for expenses they incur while traveling for business. The expenses you reimburse employees for depend on your business and reimbursement policies.

A travel reimbursement policy specifies your procedures and rules regarding travel expense reimbursement. Typically, policies cover things like:

- Which travel expenses you cover

- The travel expenses you won’t cover

- How employees report travel expenses

- How quickly you reimburse employees

Policies might also include information about overnight trips as well as traveling to meet clients during the workday.

What to include in your travel reimbursement policy

You must outline many details in your travel reimbursement policy, including types of expenses you’ll cover, which expenses are excluded, and your employees’ responsibilities.

Dive into what sections you should cover in your travel expense reimbursement policy below.

Travel expenses

Your travel reimbursement policy should specifically state which expenses your business is willing to reimburse employees for.

Some travel-related expenses you might cover include:

- Airfare

- Car rental

- Lodging

- Meals

- Tolls

- Parking

Under your travel expenses section, clarify which travel expenses you’re willing to cover. Include whether you have spending limits.

For example, you might indicate employees can only spend X dollars on meals. Your policy might state employees can spend up to $75 on meals per travel day. Setting limits prevents employees from splurging on expensive meals.

You can also give a breakdown of how much employees can spend per meal:

- Employees can spend no more than $15 each travel day for breakfast

- Lunches can be no more than $20

- Dinners have a maximum reimbursement of $25

Include what occurs if an employee goes over the limits for expenses (if applicable) in your business travel policy. Are employees responsible for covering the difference?

Level of the employee

For some businesses, employee status might impact which travel expenses are covered. Businesses that break travel reimbursements down by employee level should include this information in their policy.

Clearly state what you will cover for different employees (e.g., senior manager vs. junior sales rep).

Family members

Sometimes, businesses allow employees to bring their spouses or family members along on business trips.

If spouses or family members can go on a business trip with an employee, list whether or not non-employees can be reimbursed, and for which expenses (if applicable).

Exclusions

Along with stating which expenses you plan to cover, lay out what is not included in your policy.

In most cases, businesses only reimburse travel expenses that are business-related and priorities.

Create a list of things you do not reimburse employees for. List them in a separate section of your policy.

Some things you might not reimburse employees for when traveling include:

- Alcoholic beverages with meals

- Upgrades (e.g., first class seats)

- Activities that aren’t considered business-related (e.g., going to a movie or show)

Employee responsibilities

In your policy, state the steps employees need to follow to receive their travel reimbursement.

Some businesses might require employees to turn in a travel reimbursement form along with their travel receipts. Other companies might require that employees submit a digital form online.

If your business opts to use forms, you can create your own template and distribute the forms to employees. While creating your template, include spaces for the employee’s name, title, travel dates, expenses, and signature.

Employees can either fill out the form while they’re traveling or when they get back from their trip.

Some steps you can list in your policy for employees include:

- Save all business-related receipts

- Fill out your travel reimbursement form

- Turn in your receipts and form to the HR department for reimbursement

State what department or individual (e.g., HR Manager) your employees need to turn their travel expense information into.

Time frame for reimbursement

List out how long it takes to reimburse employees for travel expenses. That way, employees know when to expect their reimbursement.

Most businesses strive to reimburse employees as soon as possible. However, it takes time to review receipts and paperwork.

Give employees an idea of the time frame for the reimbursement process. For example, your policy might state employees should expect their reimbursement one week after submitting their paperwork.

Per diem pay

Per diem is a daily allowance employees receive to cover business travel-related expenses. Per diem only covers meals, lodging, and incidental expenses (e.g., dry cleaning).

If you offer employees per diem pay, include per diem rates and information in your travel and reimbursement policy.

Updating your travel policy

Review your travel reimbursement policy from time to time. Look at your policy regularly and make adjustments if needed.

You will likely need to make a change to your policy if you add or change procedures (e.g., reimbursement forms). Or, you might need to adjust your policy if new reimbursement laws go into effect.

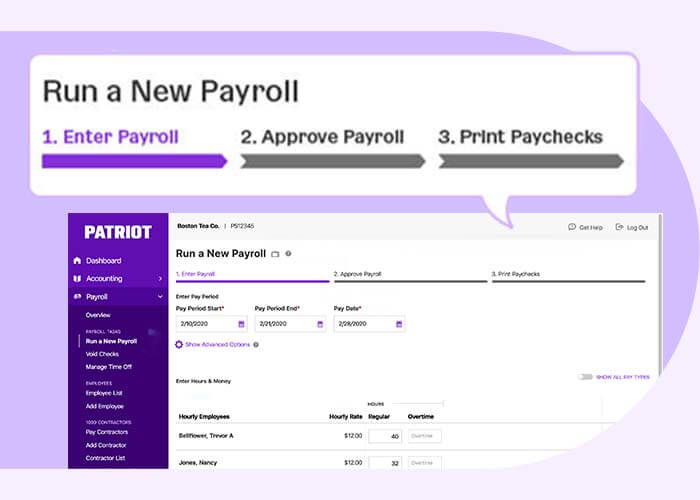

Need a quick way to reimburse your employees for travel expenses? Patriot’s payroll software lets you easily reimburse employees for expenses while running payroll. And, our free, expert support is only a phone call, email, or chat away. Get started with your free trial today!

This article has been updated from its original publication date of July 17, 2019.

This is not intended as legal advice; for more information, please click here.