As a small business owner, you have to hope for the best and prepare for the worst. One of the worst things that can happen to your small business is a natural disaster.

You may be required to pay employees even if they aren’t working during or after a disaster. Learn more about disaster recovery payroll, laws to follow, and natural disasters employer obligations below.

Disaster recovery payroll planning

Natural disasters like earthquakes, hurricanes, and tornadoes can affect how and when you pay your employees. It’s crucial to have a plan for disaster recovery payroll in case a disaster happens.

Planning ahead

Your business should have a disaster plan in place long before disaster hits. Disaster recovery plans cover important aspects like backing up data, how to pay employees, and who will handle the payroll.

Consider creating a payroll disaster recovery plan checklist to start building your emergency preparedness plan. Outline what you want your business and employees to do during or after a disaster.

Backing up information

Disasters can take down your computer system and may prevent you from running payroll. You may have to back up payroll information if you have desktop software downloaded to a specific computer. Make sure you back up payroll information and have access to your software on more than one computer in case data is lost.

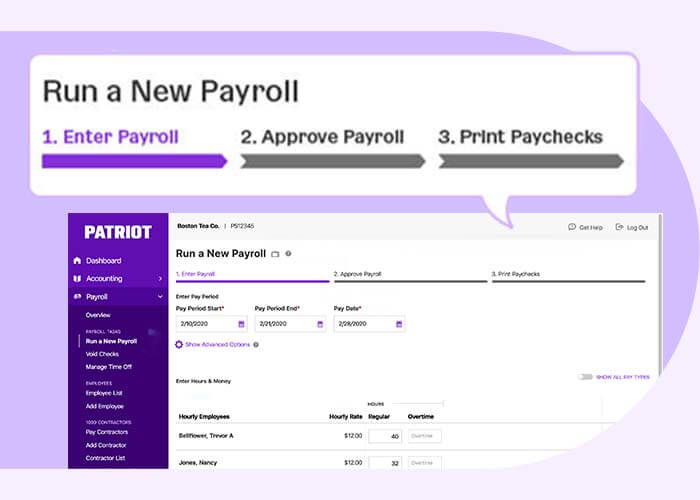

Consider using an online payroll software that allows you to access your payroll information anywhere. This also allows you to access your payroll information from multiple devices at any given time. And, online software is backed up in the cloud. The cloud stores data and protects your payroll information if your computer system crashes.

Paying employees

You should have alternative types of payment methods if your direct deposit option falls through during disasters. You may have forgotten to back up your computer. Or, you may not have access to the program you use to pay employees with direct deposit. Be sure to come up with other payment options like cash or checks to pay employees.

You must also prepare additional payment methods if you use checks to pay employees. Your supplies may get destroyed in the disaster. Or, you may not be able to access the supplies in the office. List your alternative payment methods for employees in your disaster recovery payroll plan.

Informing employees

After creating a disaster recovery payroll plan, be sure to educate employees on what will happen during a disaster. Tell employees the procedures they should follow and what you expect them to do if a disaster occurs.

Consider also creating a disaster pay policy for employees. Be sure to cover if they will get paid during a natural disaster and how much they get paid (if applicable). Include this information in your employee handbook.

Laws for paying employees during a disaster

Even though employees might not be working during disaster recovery, you still have to know employees’ compensation rights during natural disasters. Laws for paying employees during a disaster can vary depending on how you categorize an employee (e.g., exempt or nonexempt).

The Fair Labor Standards Act (FLSA) requires employers to pay nonexempt employees for hours worked during a disaster. You aren’t required to compensate a nonexempt employee if they are unable to work due to a natural disaster.

You might be required to pay an exempt employee their full salary if the worksite closes due to a natural disaster. Paying exempt employees during a disaster recovery period depends on how long the business closes.

You must pay exempt employees their entire salary if your business closes less than one full work week, according to the Department of Labor. You are not obligated to pay exempt employees if your business closes for the whole work week.

Laws can also vary by state on whether or not you are required to pay exempt or nonexempt employees during a disaster. Check with your state for additional information.

Need an efficient way to store your payroll information? Patriot’s payroll software is stored in the cloud, keeping your information safe and easily accessible during natural disasters. Try it for free today!

This article has been updated from its original publication date of January 7, 2019.

This is not intended as legal advice; for more information, please click here.