Some small businesses only operate during parts of the year, such as snow plow and lawn care services. These types of businesses are usually considered seasonal employers. The idea of hiring seasonal employees may sound appealing. But, you should weigh your pros and cons before becoming a seasonal employer.

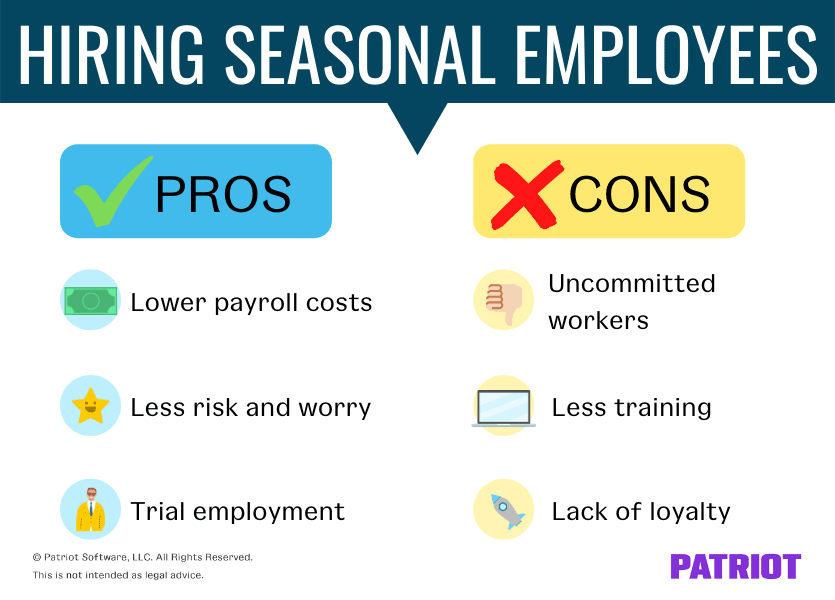

Pros of hiring seasonal employees

Being a seasonal employer has its advantages. Check out some pros of hiring seasonal employees below.

Lower payroll costs

Payroll can be a costly business expense, especially for businesses that operate year-round. As a seasonal employer, you can reduce payroll-related business expenses.

Seasonal employers typically operate for a few months at a time (e.g., four months during the summer). As a result, your business only incurs payroll expenses when you have employees.

When hiring seasonal help, seasonal employers may offer lower pay rates, as long as they meet minimum wage requirements and follow seasonal employment laws. And because seasonal workers are typically part-time employees, they may not work enough hours to receive overtime pay, cutting down on additional payroll costs.

Less risk and worry

Hiring new employees is always risky. Will they be hard workers? Are they reliable? Being a seasonal employer allows you to stress less about risky hiring decisions.

If you hire a seasonal employee and they aren’t a good fit, you don’t have to worry. Seasonal employees leave at the end of your business season. And, you have no obligation to rehire them.

You also don’t need to spend as much time stressing about the hiring process because seasonal employees are temporary.

Trial employment

If your business is open during peak seasons or on and off year-round, consider trial employment. Because seasonal workers are employed for a short period of time, use your peak season to test out employees.

If you like an employee during your busy months, you can offer them extended employment for off seasons. And for employees who don’t work out, let them go at the end of the season.

If your business only operates part of the year, you can see which employees you want to rehire the following season.

Cons of hiring seasonal employees

Before hiring seasonal employees, consider the following.

Uncommitted workers

Because seasonal workers are only at your business for a short amount of time, they may not take their job as seriously as other types of employees (e.g., full-time workers).

Seasonal hiring may result in unreliable, less motivated, and uncommitted employees.

You can avoid this disadvantage early on by clearly stating your expectations, rehiring reliable employees from previous seasons, and creating a fun work environment.

Less training

Training seasonal employees is usually a quick process. Due to little training, employees may be unprepared, stressed, or unable to keep up with the workload. And, less training may result in higher turnover rates.

Lack of loyalty

Many seasonal workers don’t have the same level of loyalty as employees with permanent types of employment. Nothing stops seasonal employees from switching to a different job with better pay, benefits for employees, and flexibility.

You cannot control how loyal a seasonal employee is to your business. However, taking measures such as offering competitive pay or flexible hours can prevent employees from leaving to work for another business.

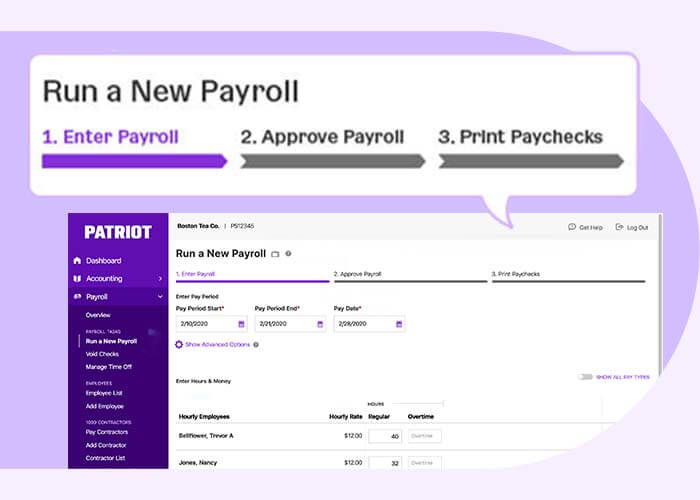

Are you a seasonal employer who needs a simplified payroll process? Patriot’s online payroll software lets you run payroll using an easy three-step process. Opt for our Full Service payroll services, and we will take care of withholding and depositing taxes for you. Get your free trial today!

This article is updated from its original publication date of 5/13/2011.

This is not intended as legal advice; for more information, please click here.