Employee Federal Tax Updates in Patriot’s Employee Portal

In the Patriot Software employee portal, your employees can update their own federal tax withholding by completing an electronic version of Form W-4.

When an employee makes an update to W4 federal tax withholding in their employee portal, you (the employer) will receive an email notification that a change has been made. The information automatically updates the employee’s “Taxes” page in Patriot Software, so there is nothing further you need to do.

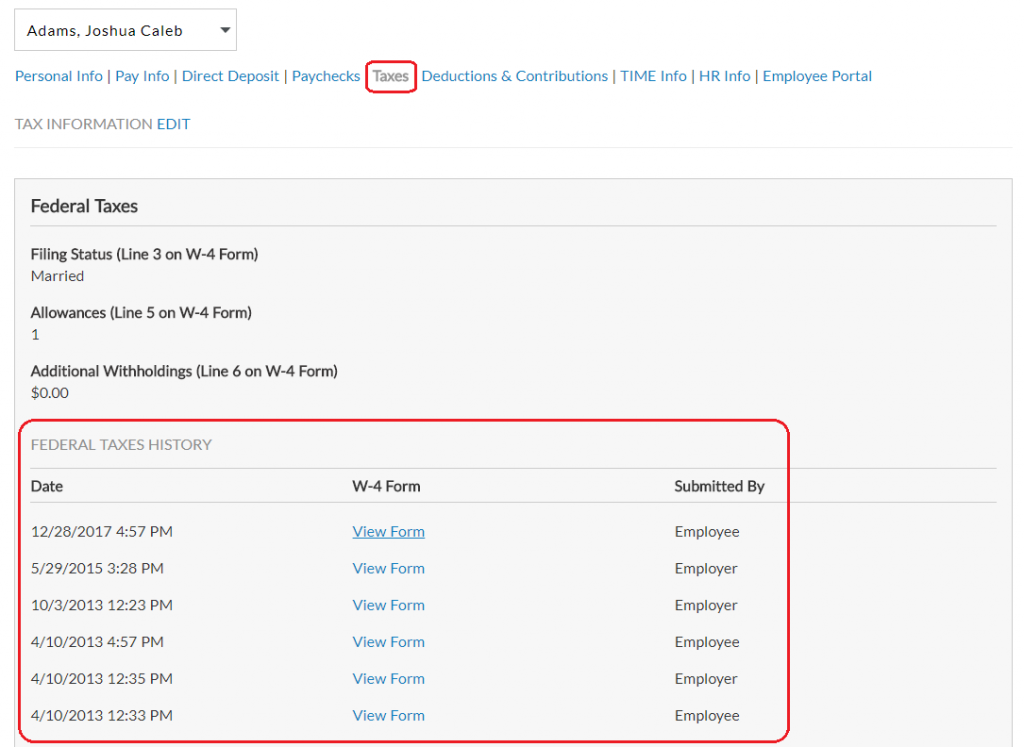

You can view a history of all federal withholding changes made by both the employee and employer on the employee’s “Taxes” page. The Federal Filing History section shows the date and time the change was made, a link to view the electronic version of the W-4 form, and whether the change was made by the employee or employer. The employee can also view this history in their portal.

Form W-4 Deadline for Exemptions

W-4 Exemption Deadline Can Affect Your Payroll