It’s easy to make mistakes, especially when you have a million and one things on your plate. One error you could make is deducting the wrong amount from employee wages. Correcting employment taxes is necessary if you withhold too much or too little from your employees’ paychecks.

This article provides an overview of employment taxes you need to withhold, mistakes you could make, and the steps to take if you make a withholding mistake.

Employment tax basics

There are two types of taxes you are responsible for withholding from your employees’ gross wages: income and payroll taxes.

There are federal, state, and local income taxes. Payroll taxes include Social Security and Medicare taxes, also known as FICA tax.

Income taxes

You must withhold federal income taxes from each employee’s wages, except for the rare cases when an employee is tax-exempt.

The amount you withhold for federal income taxes varies depending on each employee’s wages and their withholding information. You can gather withholding information from Form W-4, a document new hires fill out when they start at your business.

Use the IRS’s income tax withholding tables, along with each employee’s Form W-4, to determine how much to withhold for federal income tax.

Depending on where your employees work, you might also need to withhold state and local income taxes. Check with your state for more information.

Payroll taxes

Social Security and Medicare taxes are employer-employee taxes, meaning both you and your employees contribute to them.

Payroll taxes are percentages of an employee’s wages. Together, Social Security and Medicare taxes are 7.65%. You will withhold 7.65% of each employee’s paycheck and also contribute a matching 7.65% for each employee.

Let’s break payroll taxes down even further. Social Security tax is 6.2% of an employee’s wages until they earn the 2021 wage base of $142,800 ($147,000 in 2022). When an employee earns more than the Social Security wage base, you must stop withholding and contributing Social Security taxes.

Medicare tax is 1.45% of an employee’s wages. Instead of a wage base, there is an additional Medicare tax of 0.9% after an employee earns $200,000 (single), $250,000 (married filing jointly), or $125,000 (married filing separately). Remember to withhold 2.35% from an employee’s wages after they reach the threshold for additional tax. Because you are not responsible for the additional tax, you will continue contributing the Medicare tax rate of 1.45%.

Common tax errors

Taking too much out of an employee’s wages for taxes is known as overwithholding. Underwithheld taxes means you did not deduct enough to meet the employee’s tax liability. Both are caused by these common mistakes.

Failing to stop withholding Social Security taxes when an employee earns above the Social Security wage base can lead to excess Social Security tax withheld and FICA overpayment. On the other hand, not withholding the additional Medicare tax can lead to underwithheld taxes.

Calculating federal income taxes by hand can be tricky. You could miscalculate if you don’t know how to use the withholding tax tables. If you forget to look at the employee’s Form W-4, you could withhold too much or too little in taxes.

Taxes aren’t the only deductions you must withhold from employee wages. You also need to withhold deductions like health benefits. Some deductions are pre-tax while others are post-tax. When an employee has a pre-tax deduction, you withhold it before you take out taxes, which lowers their personal tax liability. Failing to take out pre-tax deductions before withholding taxes leads to tax overpayment. And, taking out post-tax deductions before taking out taxes leads to tax underpayment. Make sure you know whether the deductions are pre- or post-tax.

Another tax mistake is not knowing the current tax rules and rates for income and payroll taxes. For example, not knowing the current Social Security wage base will lead to incorrect withholding. To avoid overpayment of taxes by employer, stay up-to-date on tax rates and rules.

There are other reasons you might need to correct tax mistakes, like failing to withhold taxes on overtime, bonus, or commission wages. Learn what to do if you withhold the wrong amount below.

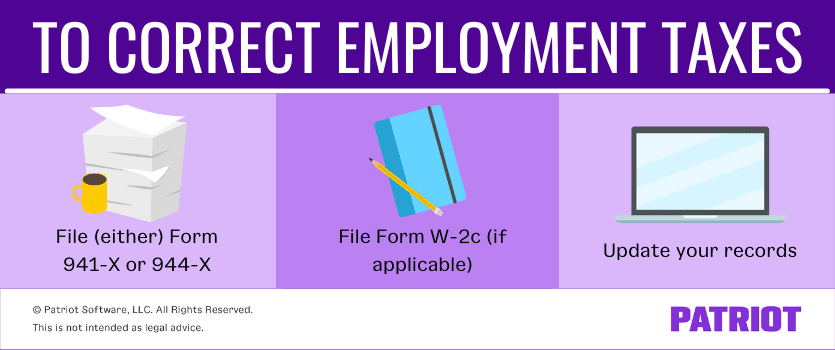

Correcting employment taxes

If you make a mistake on tax withholding, you need to correct it. Correcting employment taxes might sound daunting, but it doesn’t have to be.

First, you need to assess the problem. Is there a mistake due to overwithholding or underwithholding?

If you withhold too much from an employee’s wages, you must refund the employee. You can withhold less from future paychecks until the employee’s tax contributions are corrected, or you can refund the employee. Another alternative is to do nothing and let the employee handle it when they file their tax return. Or, you can file a claim with the IRS, explained later in this section.

If you withhold too little from an employee’s wages, you can withhold more money from the following paychecks until you have withheld enough. Or, you can pay the difference. Again, you can also let the responsibility rest on your employee’s shoulders and let them deal with it when they file their tax return.

Next, you must fix reporting forms if you already filed them with the IRS and update your records. When you withhold taxes from employee wages, you report them on Form 941, Employer’s Quarterly Federal Tax Return, or Form 944, Employer’s Annual Federal Tax Return. For correcting employment taxes, file the matching “X” form.

Form 941-X

Most employers must file Form 941. If you file Form 941 and make a mistake on tax withholding, file Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

You can either use this form to report overreporting and underreporting and pursue the adjustment process, or you can claim a refund from the IRS. You cannot do both.

If you simply report your overreporting mistake, you can withhold less from your employee. If you report your underreporting mistake, you can withhold more from your employee. The IRS does not refund you money through this method.

On Form 941-X, you must enter the corrections you need to make, the amount you originally reported, and the difference. And, you also need to explain how you determined your corrections, along with information about your business.

Form 944-X

The IRS notifies some employers that you must file Form 944. If you file Form 944 and must correct a tax error, you must file Form 944-X, Adjusted Employer’s Annual Federal Tax Return or Claim for Refund.

Correcting employment taxes on Form 944-X works similarly to Form 941-X. You can choose between the adjusted employment tax return and claim process.

You will enter the corrections you need to make, the amount you originally reported, the difference, how you determined our corrections, and business information.

Updating records and Form W-2c

Don’t forget to update your payroll records for each employee you over or underwithheld taxes from. If you don’t update your records, you will have inaccurate information for creating Form W-2, Wage and Tax Statement.

Let’s say you withheld taxes from an employee’s wages even after they reached the Social Security wage base. As a result, the information on the employee’s Form W-2 is incorrect. You already sent Form W-2 to the Social Security Administration and need to fix your mistake.

File Form W-2c, Corrected Wage and Tax Statement to fix reporting errors on Form W-2 if you already sent it to the SSA. On Form W-2c, you must enter previously reported information and the correct information.

Don’t make things difficult for yourself. Get guaranteed payroll calculations by using Patriot’s online payroll software. After you enter employee information, we’ll calculate payroll and income taxes. Want to eliminate your depositing and filing responsibilities? Opt for Full Service Payroll and give our payroll services a go. Get your free trial now.

This article has been updated from its original publication date of February 28, 2018.

This is not intended as legal advice; for more information, please click here.