Voiding a Contractor Payment

If you have paid a contractor through payroll and need to void the contractor’s check, here is how. You can void one contractor check at a time.

Find the contractor check that you want to void.

Go to either Reports > 1099 Contractors Reports and Forms > Contractor Payment History

Or the individual contractor’s record:

Payroll > 1099 Contractors > Contractor List > Contractor Name > Payments

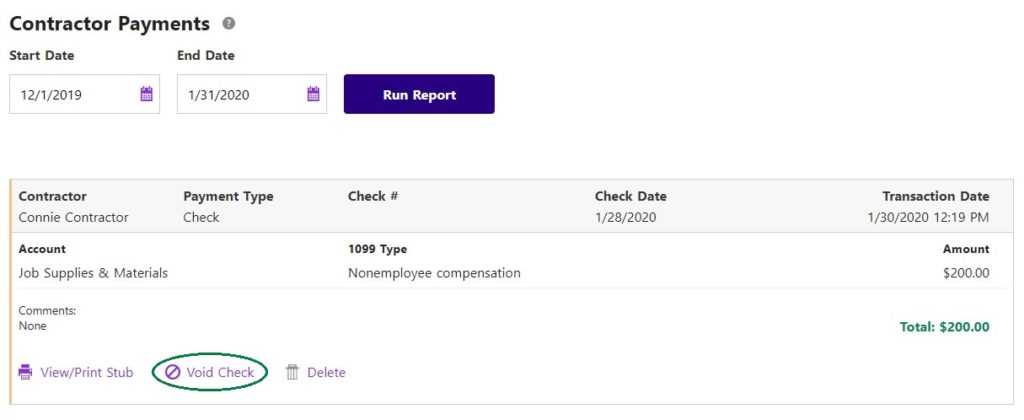

Enter the check date range and click Run Report to find the check you want to void. Click “Void Check.”

If this contractor was paid with direct deposit, you may stop the direct deposit depending on the timing of when you void the check(s). You will see a message at the top of the page to let you know how the direct deposit will be handled. For more details about the direct deposit deadline, see Direct Deposit Funding and Timing Options.

If you also have Accounting, your “Bills” report will show the bill that was originally created with the payment will change from “Paid” to “Open.” If needed, you can delete the bill.

Voiding Before the Direct Deposit Deadline

If you void the contractor check before the deadline, Patriot will not make a collection from your business bank account, and the contractor(s) will not get paid.

Voiding After the Direct Deposit Deadline

If you void a check after the deadline, but before 8:00 pm Eastern the day before the check date, Patriot will refund your collection, and the contractor(s) will not get paid.

Voiding After the Check Date

If you void the check after the 8:00 pm Eastern deadline the day before the pay date, the direct deposit cannot be stopped. You will need to arrange for repayment directly from the contractor.