Creating and Printing Modified 1099/1096 Forms

Background

There may be a time when you need to pay a contractor after you have already created and printed the 1099s.

If you already have given the contractor the 1099 and filed with the IRS, you will need to print a modified form.

If you have printed the forms, but have NOT yet sent them to the contractors or the IRS, you have the option to create all of the forms again using the most recent information.

To create your modified Forms 1099 and 1096

When you make a payment to a contractor after you have created all of your 1099s, you can create your modified Forms 1099 and 1096 by going to:

Reports > 1099 Contractor Forms > Create and View 1099/1096 Forms

Once on this page, there will be a button at the top that says “Create Modified Forms.” Again, this button will only show up if you make a contractor payment after creating your 1099s. Clicking this button will recreate only the 1099s that have been updated since your last creation.

Modified 1099/1096 forms will only report the difference in dollars paid since the most recent time you created your original 1099s/1096. When you file these with the IRS, they will be added to the original amounts paid that you’ve already filed.

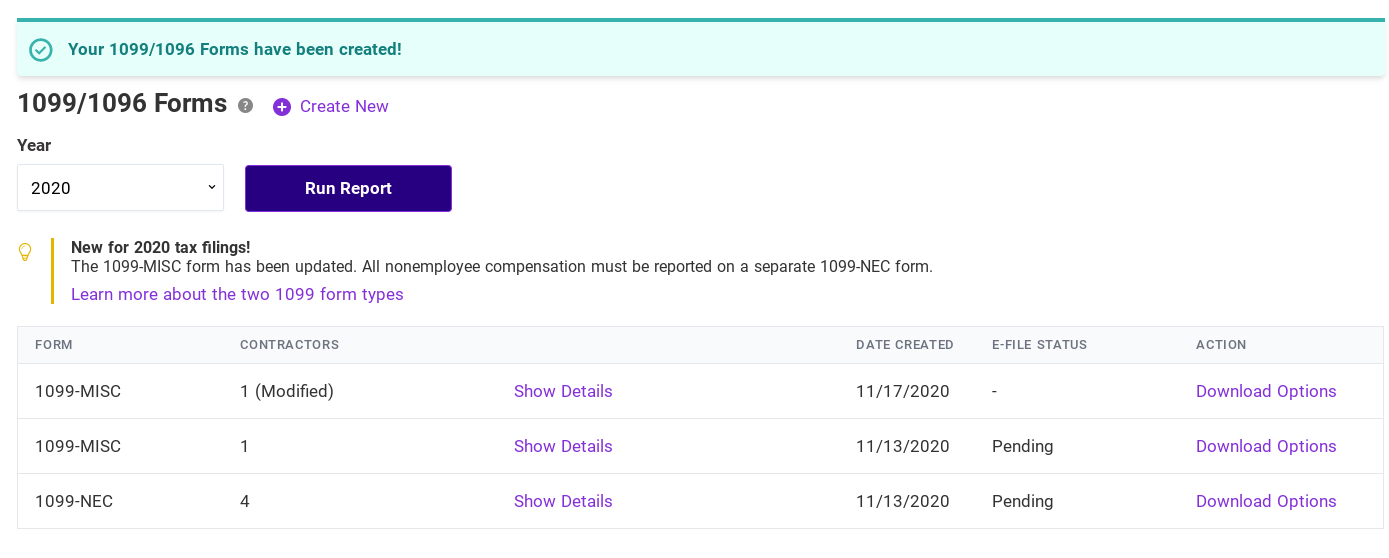

When you create a modified 1099/1096, it will appear in your list of 1099/1096 forms along with the rest of your created forms. It will appear in the list as “[number] Modified” next to the type of 1099 (MISC or NEC) that was modified.

To print your modified Forms 1099 and 1096

- Under the “Action” column, click the “Download Options” link in the row with your modified form.

- Load your IRS-approved 1099 Copy A forms (pre-printed in red) in your printer and print all pages except the last page of the PDF, which is the 1096.

- Load the same number of 1099 Copy B forms (pre-printed in black) in your printer and repeat the print step above.

- Once you’re done printing the 1099, click the 1096 button. A PDF will download.

- Load your pre-printed IRS-approved 1096 form in your printer and print only the last page of the PDF. You only need to file one copy of the 1096 with the IRS.