In 2020, the IRS released the long-awaited new federal W-4 form, shaking up how employers handle income tax withholding. Because the IRS only made the new form mandatory for new hires and employees making Form W-4 changes, some employers might be unfamiliar with it.

Other employers are a little too familiar with both the new IRS W-4 form and the old version. It can be difficult juggling both 2019 and earlier Forms W-4 with 2020 and later forms. To combat this, the IRS released a new, optional computational bridge for 2021.

You probably have questions. What is the IRS new W-4? How does it differ from previous versions of Form W-4? What is the computational bridge, and do I need to use it? If you need to be caught up to speed on the latest W-4 news, read on for the new W-4 form, explained.

New W-4 form recap

The “new” Form W-4, Employee’s Withholding Certificate, is an updated version of the previous Form W-4, Employee’s Withholding Allowance Certificate. The IRS launched this form in 2020, removing withholding allowances. The new IRS W-4 complements the changes to the tax law that took effect in 2018. This new design aims to simplify the process of filling out Form W-4 for employees and improve tax withholding accuracy.

Here’s a quick rundown of the two significantly different versions of the form:

- 2020 and later Forms W-4: “New version” without withholding allowances

- 2019 and earlier Forms W-4: “Old version” with withholding allowances

New hires who receive their first paycheck after 2019 must use the 2020 and later versions of Form W-4 when they begin working at a business. On the form, employees enter their contact information and Social Security number, report their filing status, and claim dependents.

Your other employees don’t need to fill out the new form. However, employees who want to update their withholdings and need to change W-4 forms must use the 2020 and later versions.

Use Form W-4 to determine how much to withhold from an employee’s gross wages for federal income tax. You need the employee’s completed Form W-4 to use the withholding tables in IRS Publication 15-T.

Maybe you have both the “old” and “new” versions of the W-4 on file. If you don’t like using two separate sets of rules (and income tax withholding tables), you might be interested in the IRS’s computational bridge released in 2021.

Ready to dive in?

New IRS W-4 form vs. old: What’s the difference?

There are a few changes with the Form W-4 2020 and later versions that go beyond having a new name and layout. You and your employees should understand how to fill out a Form W-4 2022.

The 2022 W-4 form, is divided into five steps:

- Enter Personal Information

- Multiple Jobs or Spouse Works

- Claim Dependents

- Other Adjustments

- Sign Here

The IRS only requires that employees complete Steps 1 and 5. Steps 2 – 4 are reserved for applicable employees.

Like previous versions of the form, there is a multiple jobs worksheet and deductions worksheet on the new form.

But unlike previous versions, the new form did away with withholding allowances. Employees can no longer claim withholding allowances.

In the past, employees could claim withholding allowances to lower the amount of federal income tax withheld from their wages. The more withholding allowances an employee claimed, the less you would withhold in federal income tax.

Not anymore.

So, how does the new W-4 withholding work? Now, employees who want to lower their tax withholding must claim dependents (Step 3) or use the deductions worksheet and enter the amount in Step 4(b).

Employees can also request employers withhold more in taxes in Step 4(a) and 4(c). If an employee requests extra withholding each pay period, make sure to account for that amount.

Checking the box in Step 2 also increases the amount of federal income tax withholding. Employees check this box if they work two jobs at the same time or if both they and their spouse work.

What these changes mean for employers: Q&A

Have questions about the new W-4 form 2022? Want to make income tax withholding consistent in your workplace? Take a look at our Q&A section below.

1. What is the purpose of the redesign?

The purpose of the updated form is to better match the changes to the Tax Cuts and Jobs Act. The new form supports the withholding table bracket updates.

Another reason for the redesigned form is ease-of-use. The IRS hopes that the new form will be easier for employees (and employers) to understand. And, the form is supposed to boost tax withholding accuracy.

2. Are withholding allowances gone?

Yes, withholding allowances are gone. Employees filling out the 2022 Form W-4 can no longer claim withholding allowances.

3. Which withholding table should you use?

Like previous income tax withholding tables, there are two methods for calculating federal income tax withholding—percentage and wage bracket methods.

But because of the two versions of Form W-4, there are even more income tax withholding tables to choose from. IRS Publication 15-T has tables that work with withholding allowances for pre-2020 W-4 forms. There are also tables that correspond with the 2020 and later Forms W-4. And, there is a table for automated payroll systems.

So, which do you pick? The table (or tables) you use may depend on:

- Whether you use a manual or automated payroll system

- Which form version you have in your records

- Whether you prefer the wage bracket or percentage method

If you use an automated payroll system, you must use the following table, regardless of which version of Form W-4 you have on file:

- Percentage method tables for automated payroll systems

If you use a manual payroll system and have 2020 and later W-4 forms on file, choose between the following tables:

- Wage bracket method tables for manual payroll systems with Forms W-4 from 2020 or later (cannot use this method if the employee earns over $100,100)

- Percentage method tables for manual payroll systems with Forms W-4 from 2020 or later

If you use a manual payroll system and have 2019 and earlier W-4 forms on file, choose between the following tables:

- Wage bracket method tables for manual payroll systems with Forms W-4 from 2019 or earlier (cannot use this method if the employee earns over $100,100 or claims more than 10 allowances)

- Percentage method tables for manual payroll systems with Forms W-4 from 2019 or earlier

4. What’s the difference between Standard vs. Checkbox rates?

When using the 2020 and later income tax withholding tables, you’ll see two rate schedules: 1) “Standard Withholding” rate and 2) “Form W-4, Step 2, Checkbox Withholding” rate.

Use the Standard rate if employees only fill out Steps 1 (Enter Personal Information) and 5 (Sign Here).

Use the Checkbox rate if the employee checks the box in Step 2 (Multiple Jobs or Spouse Works).

5. Do all employees need to fill out a new form?

No. An employee must fill out the form if they:

- Are a new hire whose first paycheck is in 2020 or later OR

- Decide to change their withholdings (applies to employees with 2019 and earlier forms)

6. What is the computational bridge?

The computational bridge is a four-step method employers can use to “convert” 2019 and earlier forms to 2020 and later forms for income tax withholding consistency. The IRS released the computational bridge in 2021. It is completely optional.

Use the computational bridge to treat all Forms W-4 like the 2020 and later versions. This option lets employers who use manual payroll systems stick to one income tax withholding table.

If you decide to use the computational bridge, gather the 2019 and earlier W-4 form and a fresh 2020 and later form. Then, make the following four adjustments:

- Find the employee’s checked marital status on Line 3 (2019 and earlier Form W-4). Then, choose a filing status in Step 1(c) (2020 and later Form W-4) that reflects this marital status:

- “Single” >> “Single”

- “Married, but withhold at higher single rate” >> “Married, filing separately”

- “Married” >> “Married filing jointly”

- Enter an amount in Step 4(a) (2020 and later Form W-4) based on the filing status you selected:

- $8,600: “Single or “Married filing separately”

- $12,900: “Married filing jointly”

- Multiply the number of withholding allowances claimed on Line 5 (2019 and earlier Form W-4) by $4,300. Enter the total into Step 4(b) (2020 and later Form W-4)

- Enter any additional withholding amounts the employee requested on Line 6 (2019 and earlier Form W-4) into Step 4(c) (2020 and later Form W-4)

Help! I need an example

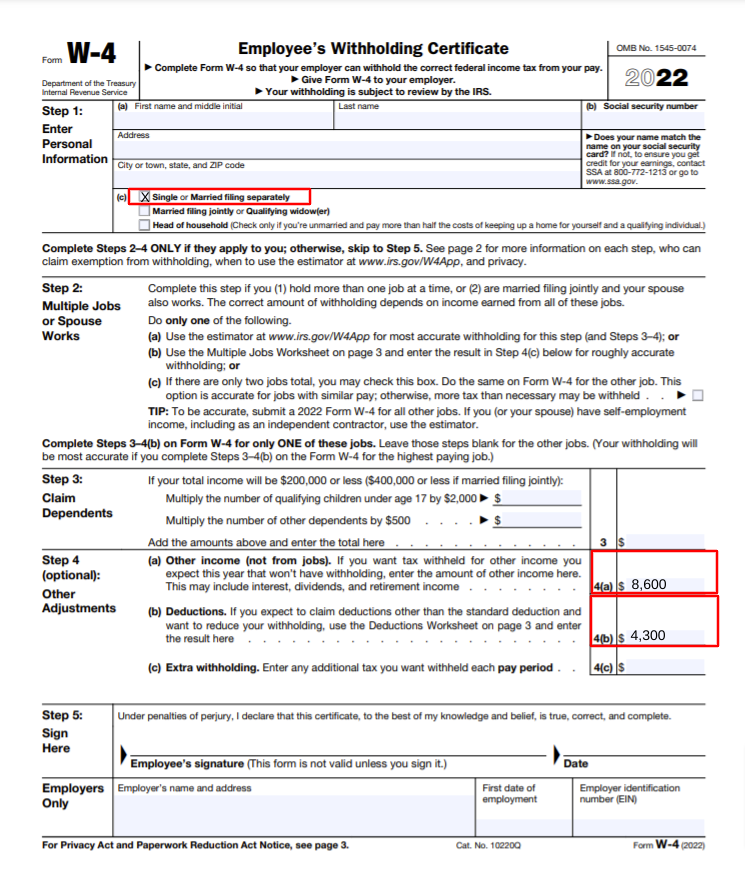

Let’s go through the computational bridge, step by step. Say the employee marked “Single” on the 2019 and earlier Form W-4, claimed 1 withholding allowance, and did not request any additional withholding amounts. Fill out the latest W-4 form, which is the 2022 Form W-4.

Here’s how the computational bridge would look in action:

- The employee’s filing status on the 2022 Form W-4 would be “Single”

- Enter $8,600 into Step 4(a) on the 2022 Form W-4

- Multiply the employee’s claimed withholding allowance (1) by $4,300 to get $4,300. Enter $4,300 into Step 4(b) on the 2022 Form W-4

- Because the employee did not claim any additional withholding amounts, you do not enter anything into Step 4(c)

Here’s an example of W-4 form filled out using the computational bridge:

Now, you can use either the wage bracket or percentage method income tax withholding table for Forms W-4 from 2020 or later. To do so, simply refer to the “converted” 2022 Form W-4.

Remember, this is only for the purpose of figuring federal income tax withholding. The new form you create does not replace the 2019 and earlier Form W-4 the employee completed. Keep both forms in your records.

If the employee ends up furnishing a new form, stop using the computational bridge for that employee.

7. What happens if a new hire doesn’t fill out the form?

Treat new hires who do not fill out the new form as single filers with no other adjustments. Use the standard withholding rate for these employees.

8. Can employers force employees to submit a new form?

Although you can ask your employees with 2019 and earlier W-4 forms to submit a new form, you cannot force them to.

If you ask your employees to fill out a new form and they are not required to, you must explain two things:

- They are not required to do so

- Their withholding will continue to be based on their previously submitted Form W-4 if they do not fill out the 2020 or later versions

Again, you cannot force employees first paid before 2020 to fill out a new form. And if these employees refuse to do so, you must continue using their previous form (but you can use the computational bridge, if desired!).

9. What does the IRS form look like?

You can view the full 2021 W-4, Employee’s Withholding Certificate, on the IRS’s website. And if you want to see the 2019 and earlier version, you can check it out here.

This article has been updated from its original publication date of December 18, 2019.

This is not intended as legal advice; for more information, please click here.